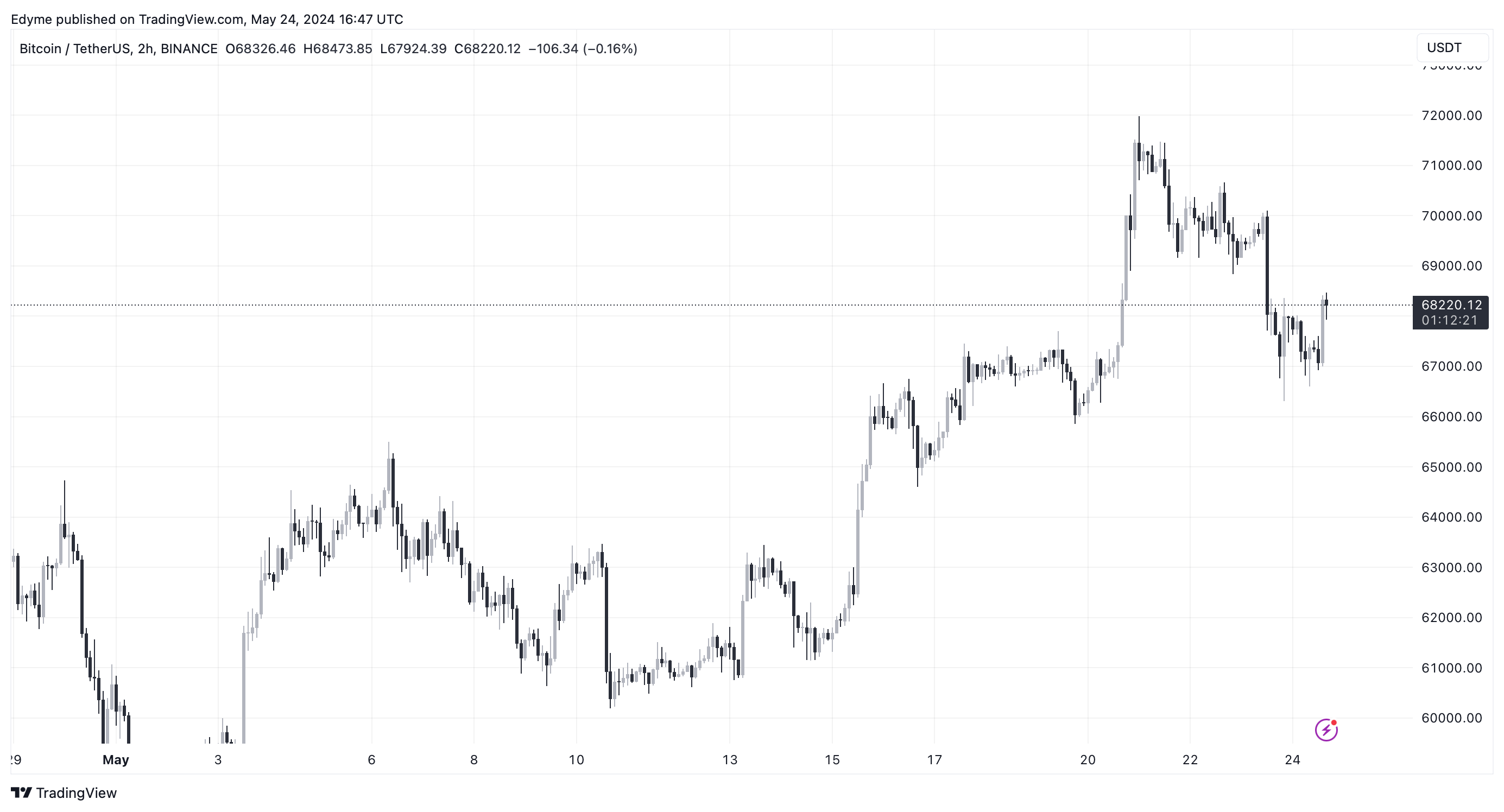

Bitcoin continues to dominate discussions, with its latest worth actions drawing specific consideration. Because the asset struggles to reclaim its March all-time excessive of over $73,000, with latest makes an attempt peaking above $71,000 earlier this week, the worth has since receded to roughly $68,231 on the time of writing.

This retracement marks a 7.3% drop from its March peak, signifying a unstable interval for the cryptocurrency, influenced by varied underlying market components.

Lengthy-Time period Holders Reduce Promoting, What This Spell For BTC

Glassnode, a famend market intelligence platform, highlights a major growth in Bitcoin’s market conduct. In line with a latest evaluation of the platform, there was a notable decline within the distribution strain from Bitcoin’s long-term holders (LTHs).

Glassnode’s “Lengthy-Time period Holder Binary Spending Indicator” tracks the sell-off exercise of long-standing Bitcoin holders, and its latest knowledge factors to a marked discount on this group’s promoting strain.

Traditionally, when long-term holders cut back their promoting, it alleviates downward strain on the worth, probably giving rise to extra bullish market circumstances.

Additional insights into Bitcoin’s worth conduct come from distinguished crypto analyst RektCapital, who famous on social media platform X that Bitcoin usually faces resistance on the vary excessive post-Halving and suggests a protracted re-accumulation section.

Because the crypto asset trades just under $69,000, RektCapital discloses that Bitcoin would possibly solely escape from its present re-accumulation vary round 160 days post-Halving, projecting a major breakout as late as September 2024. This evaluation is essential because it units expectations for traders searching for indicators of Bitcoin’s subsequent huge transfer.

#BTC

Traditionally, Bitcoin has all the time rejected from the Vary Excessive on the primary try at a breakout after the Halving

Furthermore, historical past suggests this Re-Accumulation ought to final for much longer

Bitcoin tends to breakout from these Re-Accumulation Ranges solely as much as 160 days after… https://t.co/Jw7FcQui2Q pic.twitter.com/beLdOPqZOi

— Rekt Capital (@rektcapital) Might 24, 2024

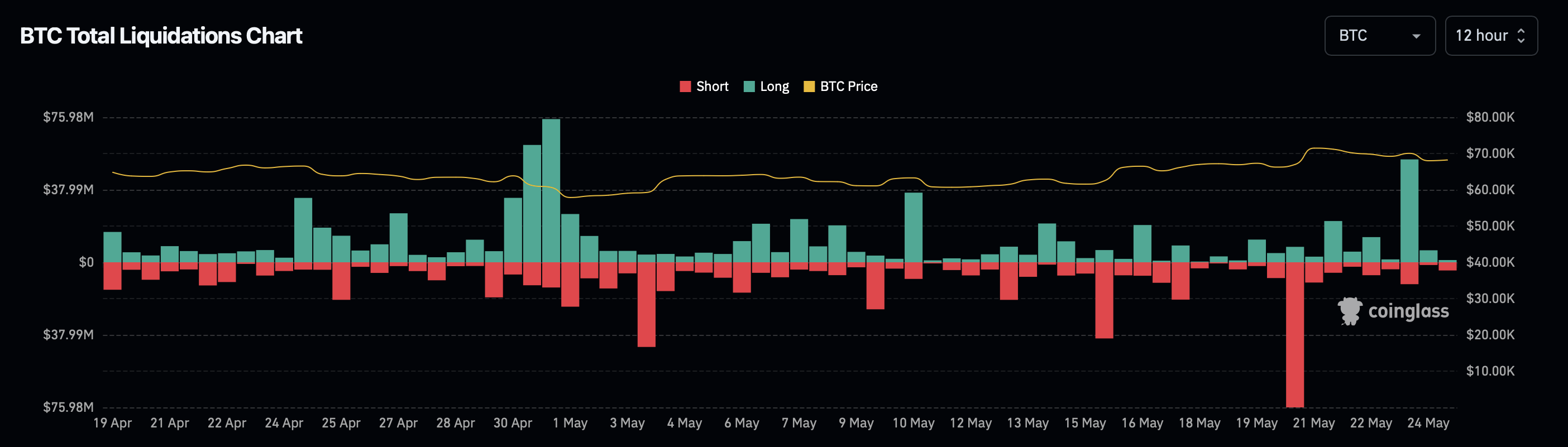

In the meantime, latest worth motion from Bitcoin has led to substantial losses for some merchants, with Coinglass knowledge displaying about $41.68 million in liquidations for Bitcoin lengthy merchants and $14.34 million for brief merchants over the previous 24 hours.

Total, the crypto market has seen complete liquidations amounting to $292.07 million throughout the identical interval, affecting 78,874 merchants.

Upcoming Challenges For The Bitcoin Market

In line with Greeks.Stay, the approaching expiry of a major quantity of Bitcoin and Ethereum choices provides one other layer of complexity to the market’s fast future. 21,000 BTC in choices are set to run out quickly, with a Put Name Ratio of 0.88 and a Maxpain level at $67,000, representing a notional worth of $1.4 billion.

Equally, 350,000 ETH choices are nearing expiration, and their dynamics may affect the broader market as a consequence of their $1.3 billion notional worth and a Put Name Ratio of 0.58.

Might 24 Choices Information

21,000 BTC choices are about to run out with a Put Name Ratio of 0.88, Maxpain level of $67,000 and notional worth of $1.4 billion.

350,000 ETH choices are about to run out with a Put Name Ratio of 0.58, Maxpain level of $3,200 and notional worth of $1.3… pic.twitter.com/rftA9kBm4q— Greeks.stay (@GreeksLive) Might 24, 2024

On this context, a put choice offers the holder the correct to promote an asset at a predetermined worth inside a particular timeframe, which is usually used as safety in opposition to a decline within the asset’s worth.

Conversely, a name choice presents the correct to purchase underneath related circumstances and is often utilized in anticipation of a worth enhance. The Put Name Ratio is a device that helps gauge market sentiment, with the next ratio indicating a bearish outlook and a decrease ratio suggesting bullish circumstances.

Featured picture created with DALL·E, Chart from TradingView