World liquidity has surged to just about $100 trillion, fueling bullish expectations for the Bitcoin (BTC) market.

This unprecedented degree of liquidity is seen as a big enhance to Bitcoin’s ongoing bullish rally, with the cryptocurrency now buying and selling at $71,000.

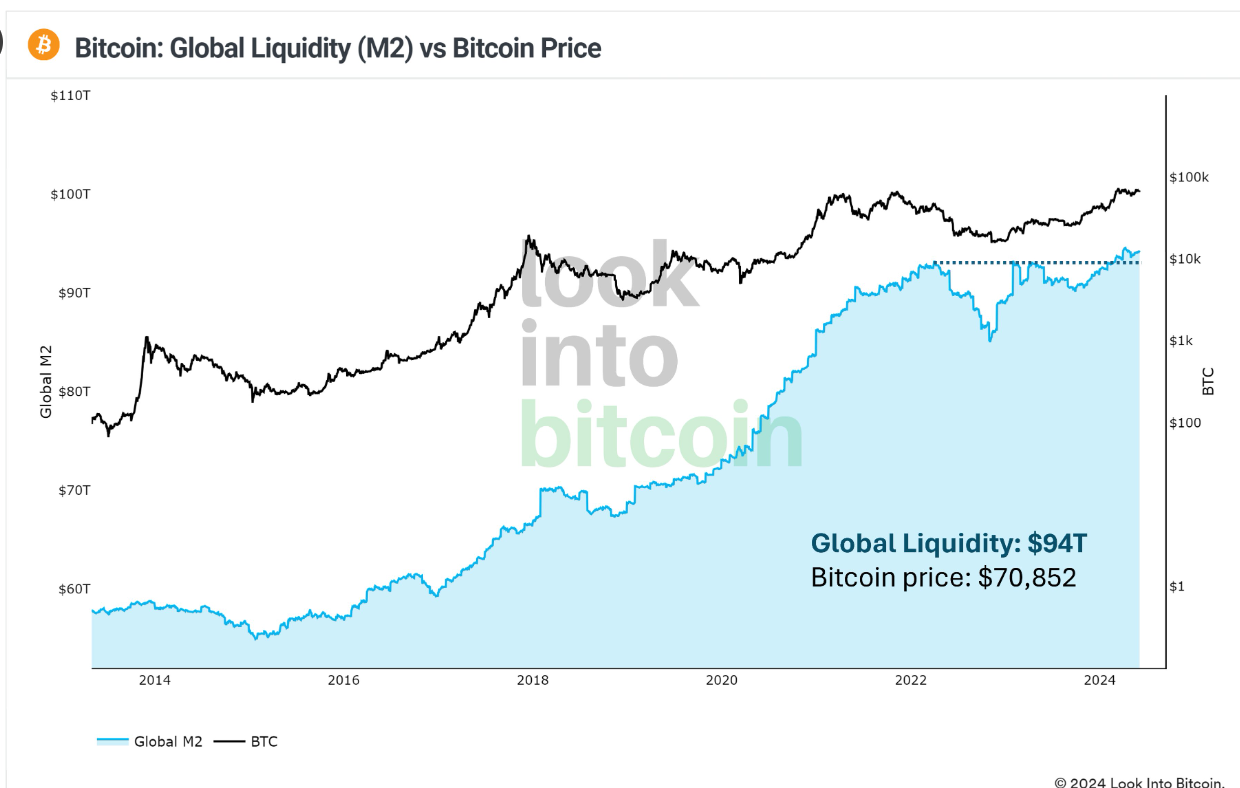

A current evaluation by Philip Swift, creator of the on-chain knowledge platform LookIntoBitcoin, reveals that the worldwide M2 cash provide stands at $94 trillion — the very best ever recorded.

This determine is $3 trillion greater than when Bitcoin hit its earlier all-time excessive of $69,000 in late 2021.

Since bottoming out at $85 trillion in late 2022, M2 has rebounded by 10%, marking a big restoration from the bottom level of the crypto bear market

Swift’s platform tracks the worldwide M2 cash provide and its relationship with Bitcoin value tendencies. He emphasised the significance of this milestone on X (previously Twitter), stating:

“Crucial chart for this bull run has simply made a brand new all-time excessive.”

This file in international liquidity suggests a powerful correlation between elevated liquidity and Bitcoin’s value trajectory, indicating that the surge in M2 cash provide might additional gasoline Bitcoin’s bullish momentum.

Bitcoin’s resilience and future prospects

Bitcoin has demonstrated notable resilience, revisiting the $70,000 value degree amid constructive macroeconomic indicators and heightened market optimism.

With $1 billion being added every day to new whale wallets, Bitcoin may very well be on the verge of one other important value motion.

Regardless of minor setbacks since Could 2021, Bitcoin’s general development stays bullish. CryptoQuant founder and CEO Ki Younger-Ju highlighted similarities to mid-2020, the place secure costs had been accompanied by excessive on-chain exercise, indicating strong market well being.

The BTC versus U.S. M1 cash provide metric can be within the technique of breaking out from a seven-year consolidation interval — the longest in Bitcoin’s historical past, as reported by Finbold.

This breakout is seen as a crucial improvement that would ignite a parabolic surge in Bitcoin’s value, much like previous bull markets.

Moreover, U.S. Bitcoin spot ETFs noticed their second-best-ever joint web influx day of $886.6 million on June 4, reflecting rising institutional curiosity and confidence in Bitcoin as a helpful asset class.

Moreover, the Puell A number of indicator, which assesses Bitcoin’s worth relative to mining exercise, has entered a “low cost vary,” suggesting that Bitcoin may be undervalued.

This typically alerts shopping for alternative for buyers anticipating future value positive factors. CryptoQuant researchers consider the market could also be getting into a brand new part of shortage, getting ready for a possible rally.

BTC value evaluation

With Bitcoin presently buying and selling at $71,284, up 0.7% for the day and advancing 14% on its month-to-month chart, market sentiment stays optimistic for potential future rallies.

The substantial international liquidity, mixed with rising whale exercise and institutional investments, units the stage for a possible surge in Bitcoin’s value.

Total, Bitcoin is getting inexperienced lights from all angles, indicating a strong and probably profitable interval forward for buyers.

Whereas the general sentiment leans bullish, you will need to train warning and contemplate different elements earlier than making funding choices in Bitcoin’s unstable market.

Disclaimer: The content material on this web site shouldn’t be thought-about funding recommendation. Investing is speculative. When investing, your capital is in danger.