- Bitcoin’s worth outlook stays strong as long-term holders’ promoting stress eases.

- Institutional buyers purchased Bitcoin throughout native worth bottoms at roughly $57,500.

- The Market Worth to Realized Worth indicator suggests additional upside forward.

Bitcoin’s (BTC) worth outlook stays constructive within the quick time period regardless of its latest stabilization, on-chain information suggests, propelled by easing promoting stress by long-term holders and exercise from large-wallet buyers.

Bitcoin whales evaluation signifies bullish sentiment

Bitcoin’s worth reached $71,979 on Could 21, practically matching its all-time excessive (ATH) of $73,777, nevertheless it retreated barely amid uneven buying and selling. An evaluation of the habits of large-wallet buyers, popularly often known as whales, supplies an image of the place Bitcoin’s worth would possibly head within the quick time period.

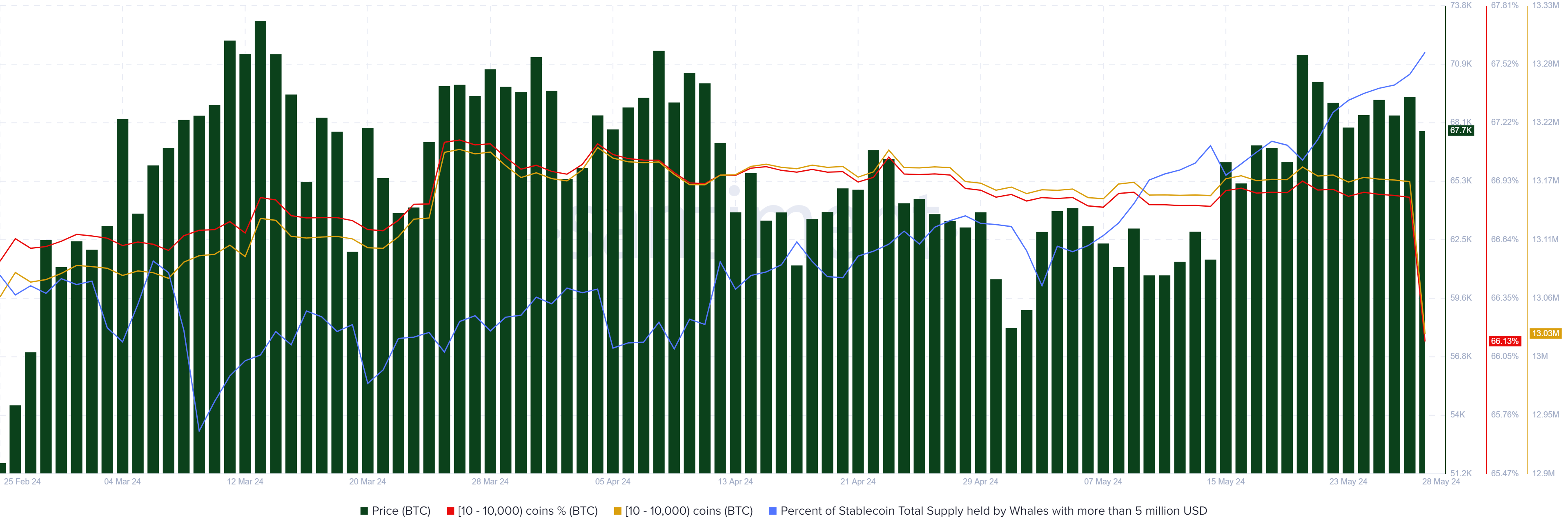

Santiment information about Bitcoin and the highest stablecoins supplies some clues about whales. Every of those three strains within the graph under signifies an vital facet of how nicely Bitcoin and the remainder of the cryptocurrency market are positioned for future worth will increase:

Bitcoin and prime Stablecoin chart

- The brilliant purple line, which represents the proportion of BTC held by wallets with 10 to 10,000 BTC, has declined by 0.76% within the final two months.

- The darkish yellow line, which reveals the overall collective BTC owned by wallets with 10 to 10,000 BTC, has decreased by 0.38% during the last two months.

- The blue line, representing the proportion of stablecoin complete provide held by whales with greater than $5 million, has elevated 5.49% during the last two months.

Two of the three strains are going downward (traditionally, these strains have led to Bitcoin worth corrections), indicating {that a} BTC correction is probably going. Nonetheless, giant buyers are growing their holdings in stablecoin, implying extra shopping for energy within the occasion of any dips.

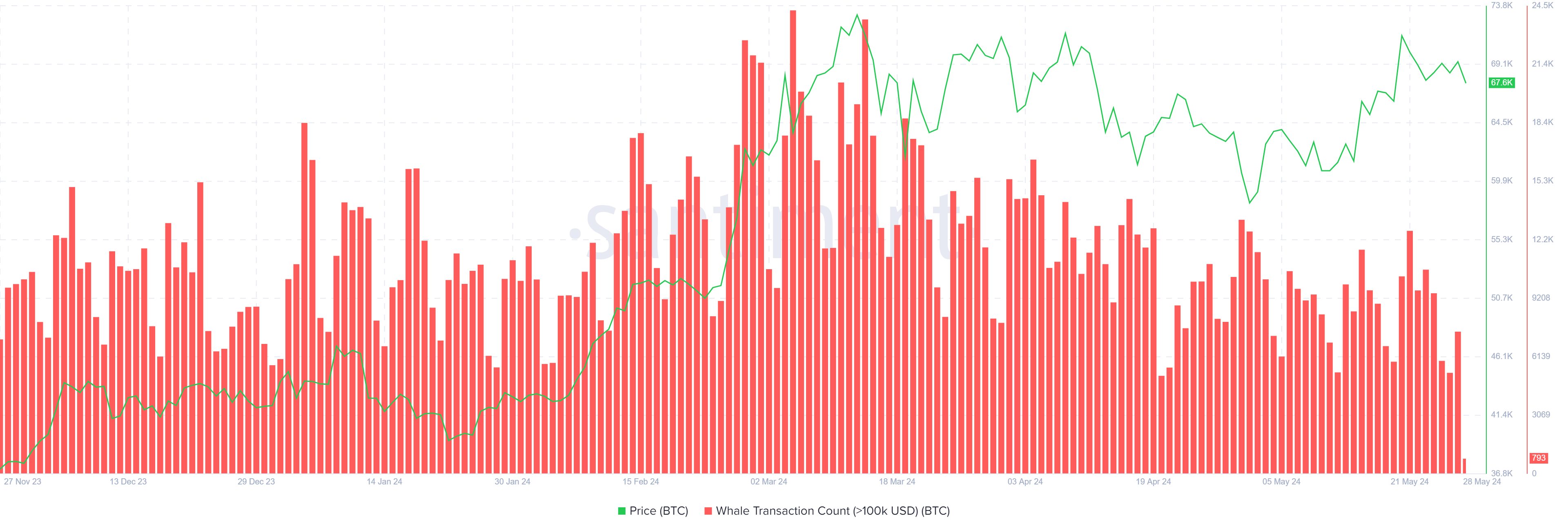

Santiment information of Whale Transaction Rely better than $100,000 for BTC day by day transfers present that whale exercise has declined for the final three months, other than when BTC reached its ATH on March 14. This means that enormous stakeholders are usually not discovering any alternatives to take a revenue or accumulate proper now.

BTC Whale Transaction Rely (>100k USD) chart

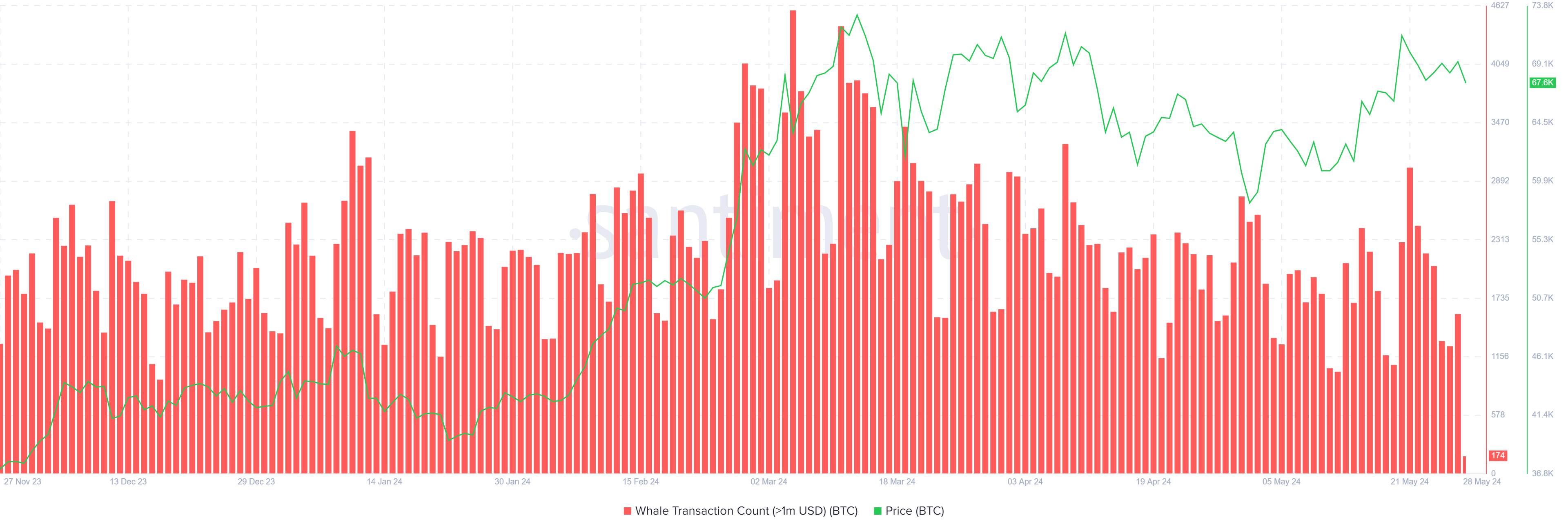

Whereas learning the Whale Transaction Rely better than $1 million for BTC day by day transfers, it additionally seems the identical: whale exercise has declined for the final three months. The one distinction is that on Could 20, there was a spike within the day by day switch when the value was operating towards its ATH, signaling that income have been booked and waving a worth prime.

BTC Whale Transaction Rely (>1m USD) chart

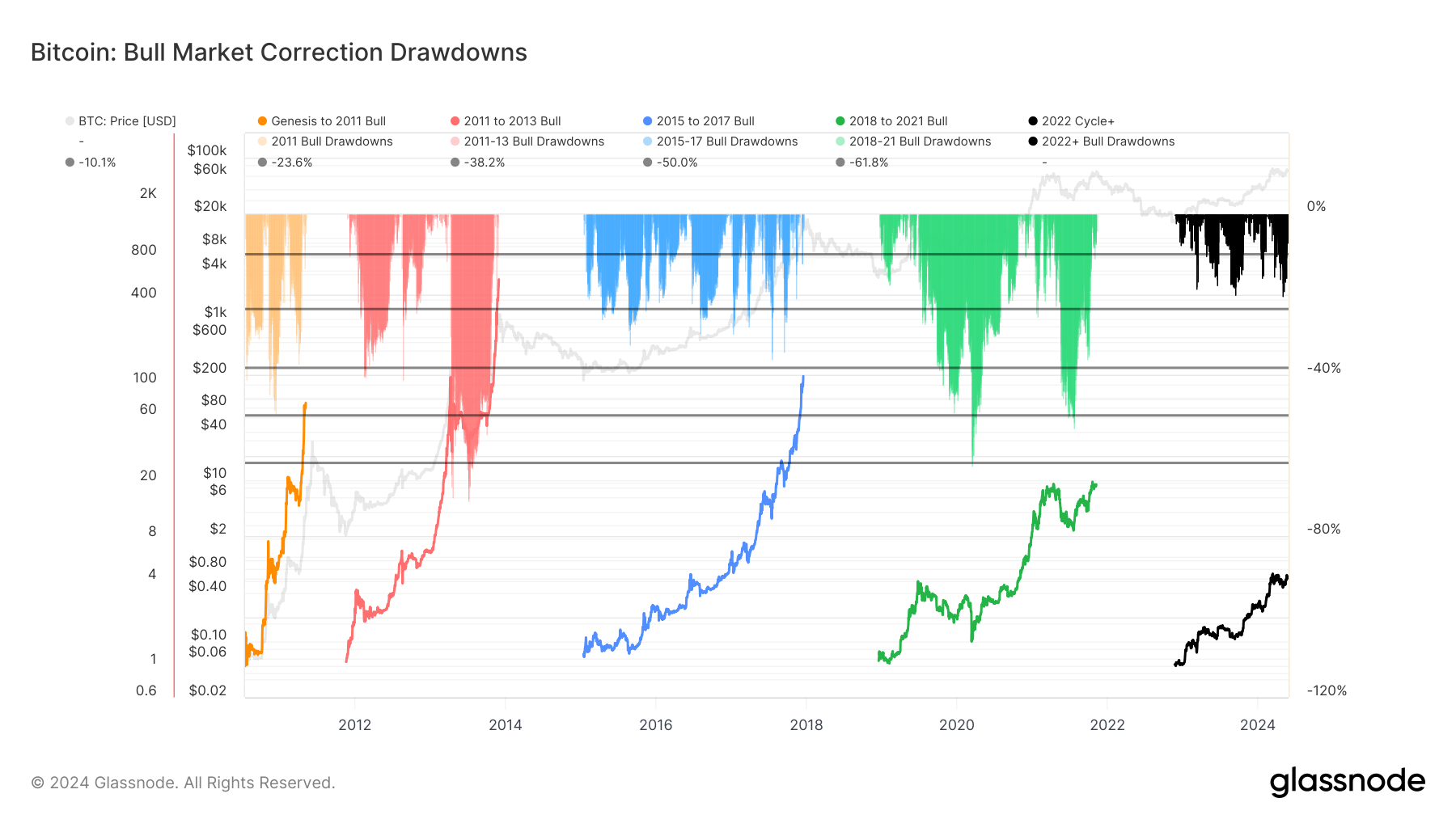

Once we evaluate Bitcoin Bull Market Correction Drawdowns information from Glassnode, we will see that the drawdown sample spanning the 2023-2024 uptrend is strikingly much like the 2015-2017 bull market.

Nevertheless, earlier than the 2015-2017 bull development started, Bitcoin had no spinoff devices accessible, versus now, when Bitcoin ETFs can be found.

BTC Bull Market Correction Drawdowns chart

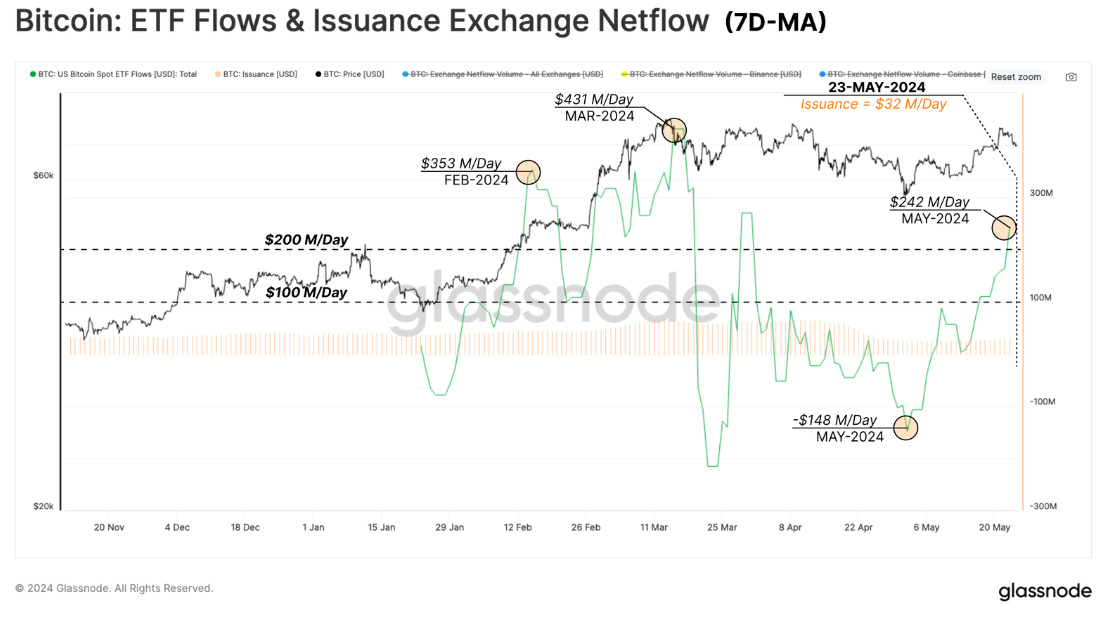

In response to Glassnode Bitcoin ETF Flows & Insurance coverage Trade Netflow (7-day Shifting Common), the ETFs had important web influx peaks of $353 and $431 million per day in February and March, respectively. As Bitcoin worth fell to a low of roughly $57,500, the ETFs skilled a major web outflow peak of $148 million per day. This transfer served as a type of micro-capitulation, and this tendency has reversed considerably.

Final week, we noticed a spectacular web influx of $242 million per day, indicating a resurgence of buy-side curiosity.

Since miners’ pure day by day promote stress has been $32 million per day because the halving, the ETFs’ shopping for stress is almost eight occasions extra. This means that growing demand and lowering insurance coverage for BTC would positively have an effect on its worth.

BTC ETF Flows & Issuance Trade Netflow (7-day MA) chart

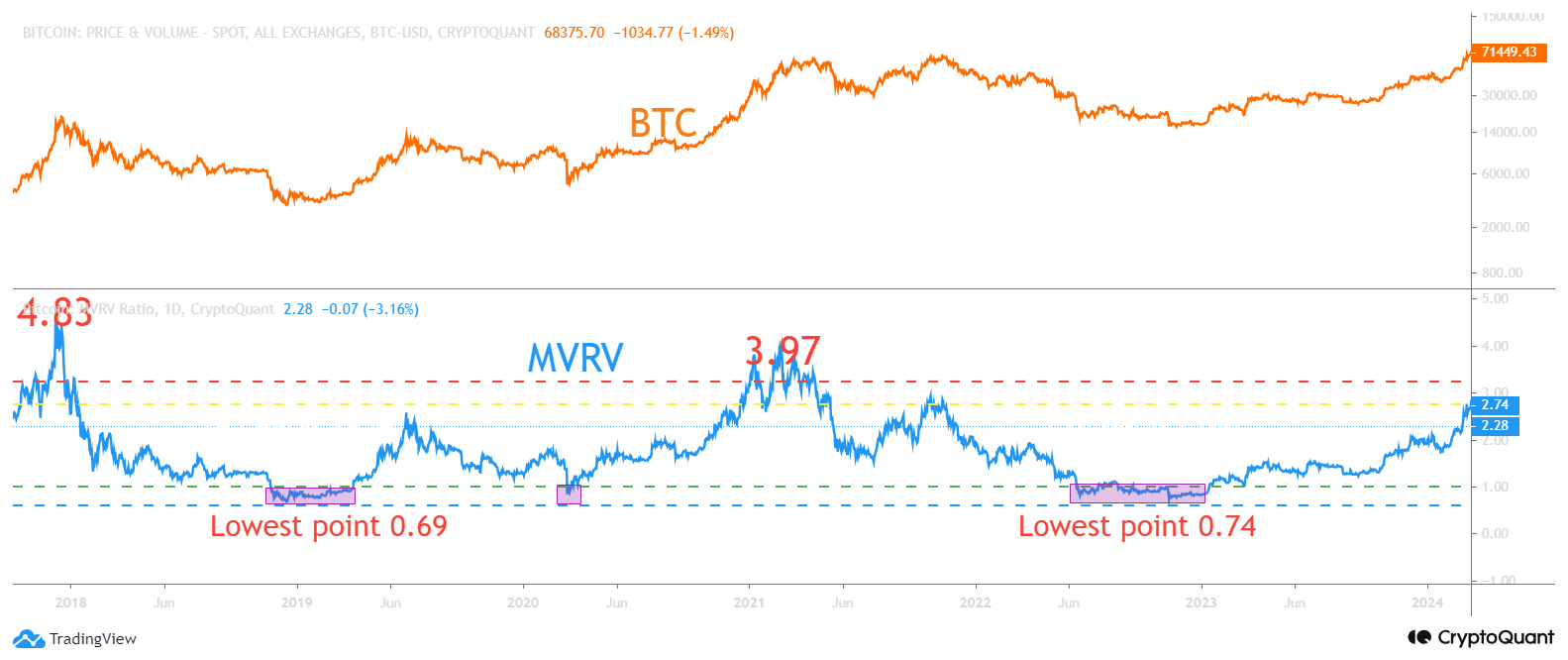

Check with Cryptoquant’s Market Worth to Realized Worth (MVRV) indicator, which reveals if the Bitcoin worth is overpriced or undervalued and will decide the height and backside of the bull and bear markets.

As witnessed within the 2019 and 2022 bear markets, the MVRV fell to 0.69 and 0.74, respectively, and signaled that the Bitcoin worth was undervalued and had achieved its bear market backside.

Equally, through the 2018 and 2021 bull markets, the worth of MVRV peaked at 4.83 and three.97, respectively, indicating that the Bitcoin worth was overvalued and the market had achieved its bull market prime.

The MVRV is at the moment hovering at 2.74 and has not reached the overvalued zone, indicating that bulls nonetheless have room to rally the Bitcoin worth.

BTC MVRV Ratio chart

As beforehand famous, MVRV statistics, constructive ETF inflows, and elevated stablecoin possession, all level to Bitcoin bulls being robust sufficient to drive the value increased within the ongoing bull market.

Share: Cryptos feed