Bitcoin (BTC) worth is up 3% within the final 24 hours. Nonetheless, the rally has been comparatively muted regardless of two main developments: the SEC revoking SAB 121 coverage, permitting banks to custody crypto, and Trump making a Digital Asset Stockpile by government order.

The 7-day MVRV Ratio signifies extra room for short-term progress, whereas whale exercise has dropped to its lowest stage in a 12 months, signaling a possible shift in large-holder conduct. With BTC’s EMA strains reflecting bullish sentiment however exhibiting indicators of consolidation, the market faces a decisive second between testing new highs or retreating to key help ranges.

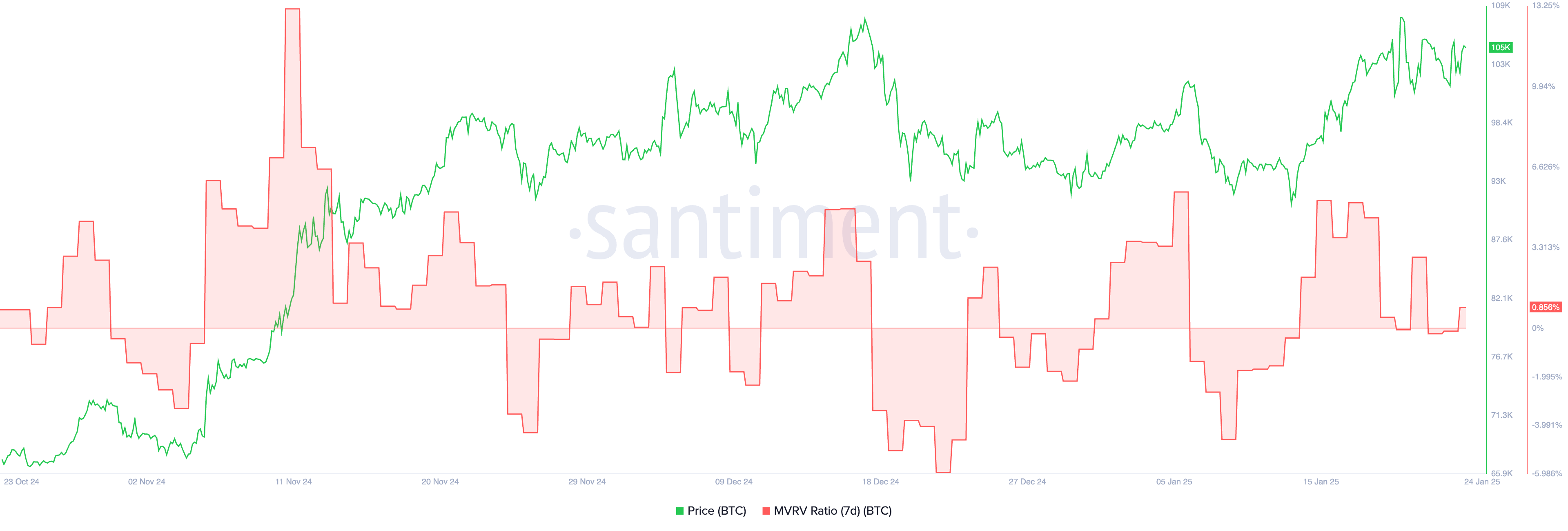

MVRV Ratio Exhibits Extra Room for Development

The 7-day MVRV (Market Worth to Realized Worth) Ratio for Bitcoin at present stands at 0.85%, following a interval of stability close to 0% over the previous two days. This metric measures the common revenue or lack of BTC holders who’ve acquired their cash inside the final seven days.

A constructive MVRV ratio signifies that current holders, on common, are in revenue, whereas a unfavourable ratio suggests unrealized losses. The current transfer into constructive territory means that market sentiment amongst short-term holders is shifting towards profitability, reflecting a possible uptick in momentum.

BTC 7D MVRV Ratio. Supply: Santiment

Historic traits present that Bitcoin’s 7D MVRV Ratio typically rises to ranges round 5-6% earlier than experiencing a major worth correction. This means that BTC has traditionally demonstrated extra room for short-term progress from present ranges earlier than encountering resistance or promoting stress.

On the present 0.85%, the metric means that the market is way from overextended, leaving ample house for added upside earlier than reaching typical profit-taking thresholds.

Bitcoin Whales Reached Its Lowest Stage In One Yr

The variety of Bitcoin whales – wallets holding not less than 1,000 BTC – dropped sharply from 2,067 on January 20 to 2,039 on January 23, reaching its lowest stage since January 30, 2024.

Whale exercise is a key metric to observe as these giant holders typically affect market traits by means of important purchase or promote selections. This current decline suggests a shift in technique amongst main BTC holders, probably signaling warning or reallocation of funds, even after SEC revoked SAB 121 coverage permitting banks to custody crypto.

Variety of addresses holding not less than 1,000 BTC. Supply: Glassnode

This drop may replicate whales awaiting additional particulars on Bitcoin-related government orders anticipated from the Trump administration. Alternatively, some whales may be rotating their capital into different belongings now that BTC has stabilized above the $100,000 mark.

“The quantity of Bitcoin held by long-term holders has decreased by 1.5 million BTC (roughly $150 billion) within the final 12 months. Their promoting accelerated since Trump’s election in November, with 500,000 BTC (round $50 billion) leaving long-term holder addresses since then. This pattern resembles a sample from earlier bull cycles, the place these holders began promoting after costs reached new all-time highs and collected following 50%+ retracements,” Lucas Outumuro, Head of Analysis at IntoTheBlock, instructed BInCrypto.

BTC Value Prediction: Will It Keep Above $100,000?

Bitcoin’s EMA strains are at present bullish, with short-term strains positioned above long-term strains, however their lack of upward motion suggests the market could also be getting into a consolidation section.

BTC Value Evaluation. Supply: TradingView

“There’s a mixture of establishments and short-term speculators driving the demand-side. Onchain information reveals that the quantity of Bitcoin held by addresses which have been holding for underneath 12 months is at its highest since early 2022. This implies excessive speculative exercise and merchants being in charge of market dynamics. From the institutional aspect, Trump’s DeFi protocol, World Liberty Monetary, purchased over $47 million of wrapped Bitcoin on Ethereum, together with ETH, AAVE, and different tokens. It’s unclear what the plan for these belongings is, however it seems that World Liberty Monetary may grow to be an more and more related participant within the house,” Outumuro added.

If Bitcoin regains its robust uptrend, it may check the resistance at $108,561, and a breakout above this stage may result in BTC reaching $110,000 for the primary time ever. This might be sparked as quickly as extra particulars in regards to the Digital Asset Stockpile are out.

Nonetheless, if the pattern reverses and Bitcoin worth enters a downtrend, it might check the help at $99,486, with a possible drop to round $95,800 if that help is damaged.