Bitcoin (BTC) has made a robust begin to the brand new month after the value fell wanting expectations for a big a part of 2024’s second quarter (Q2). Buying and selling at $63,255, the value elevated by 3.11% within the final 24 hours.

Buyers can be occupied with whether or not the coin will proceed its run or fare higher. This evaluation affirms the potential of the next worth by the top of July until one thing sudden occurs.

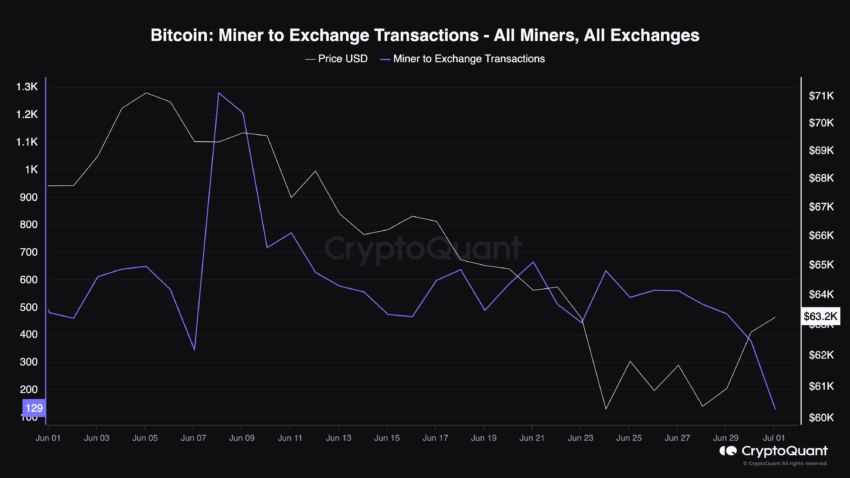

Bitcoin Miners Cut back Excessive Promoting Exercise

Miners had been one of many elements that grounded Bitcoin’s worth to a halt in the previous few months. In April, Bitcoin miners, who’re accountable for verifying transactions on the community, noticed their rewards halve.

Afterward, income dropped as they discovered it difficult to maintain up with working prices. Consequently, they offered a few of their BTC. In line with CryptoQuant, Miner-to-Trade Transactions jumped up till June 8.

The Miner-to-Trade Transactions metric measures the variety of Bitcoin cash despatched into exchanges from miners’ reserves. When it will increase, BTC drops. Nonetheless, a notable decline gives stability for Bitcoin’s worth — both it will increase or the worth trades sideways.

Learn Extra: 5 Platforms to Purchase Bitcoin Mining Shares After 2024 Halving

Bitcoin Miner-to-Trade Transactions. Supply: CryptoQuant

Hypothesis unfold that the metric would bounce once more, however that didn’t occur, because it appears miners are finished with distribution. As seen above, solely 129 BTC affiliated with miners had been despatched to exchanges.

That is an especially low determine in comparison with June 8, when the quantity was 1,279 BTC. Ought to the worth proceed to drop, Bitcoin may preserve its head above $60,000 via July. In a extremely bullish situation, the value can retest $65,000 to $67,000.

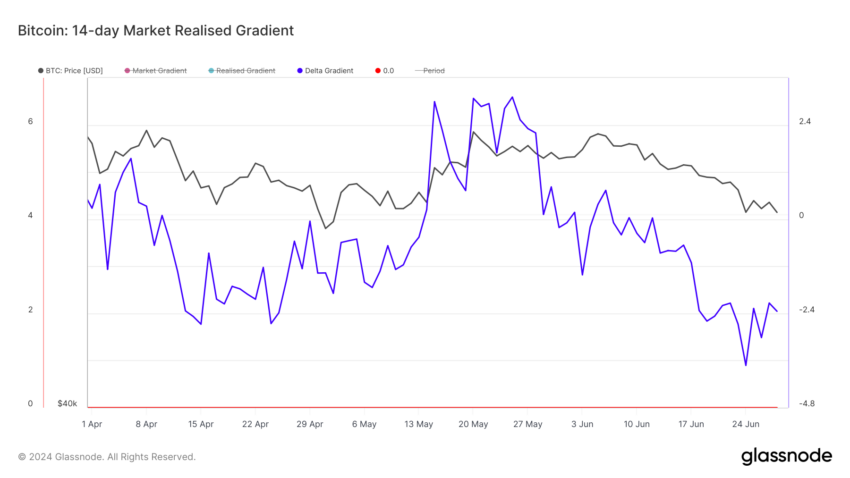

Historic Tendencies Elevate Eyebrows

One other metric supporting a worth improve is Bitcoin’s Delta Gradient. The Delta Gradient mannequin assesses the speed of worth change in comparison with the capital inflows into Bitcoin.

It additionally considers the gradient of the spot BTC worth and the realized worth. The distinction between these values is what provides the Delta Gradient.

If the metric is optimistic, it signifies that buyers ought to count on an uptrend inside a specified interval. Then again, a destructive gradient implies that returns could also be destructive.

At press time, utilizing Glassnode’s knowledge, the 28-day Bitcoin Delta Gradient is -1.62. Usually, that is speculated to drive a downtrend for BTC. Nonetheless, that is probably not the case, as it’s an enchancment from a number of days in the past when the studying was -2.90.

Bitcoin 28-Day Realized Gradient. Supply: Glassnode

Ought to the studying of the metric above proceed to rise, so will BTC. Moreover, a bounce into the optimistic area may affirm Bitcoin’s worth hike.

In the meantime, analysts on social media shared their views about this month’s efficiency. For instance, Ali Martinez wrote on X that BTC could bounce strongly in July.

Bitcoin Historic Month-to-month Returns. Supply: Ali Charts on X.

Referring to the coin’s earlier returns within the seventh month, he defined that:

“Traditionally, when Bitcoin has had a destructive June, it tends to bounce again strongly in July. Actually, BTC has proven a median return of seven.98% and a median return of 9.60% throughout this month.”

BTC Value Prediction: $67,000 or Nothing?

In line with the day by day BTC/USD chart, the coin had shaped a Cup and Deal with sample. This sample seems when the value types a rounded backside (cup) and later exams new lows to type the deal with.

The cup and deal with sample acts as a bullish sign, indicating that an upward breakout may have the energy to maintain shifting north. Wanting on the Fibonacci retracement to identify help and resistance ranges, BTC may hit $64,966 if the upswing continues.

Bitcoin Day by day Evaluation. Supply: TradingView

From a extra bullish perspective, the coin’s worth could attain $67,241 earlier than the month ends. As well as, the Relative Power Index (RSI) is beginning to transfer up. The rise within the RSI signifies that Bitcoin is leaving the bearish reigns.

Nonetheless, to validate the value prediction, the RSI studying must cross over the 50.00 impartial zone. If this occurs, BTC will proceed its upswing and doubtlessly surpass $64,000 in a number of days.

Learn Extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

Bitcoin RSI. Supply: TradingView

Failure to solidify the bullish momentum will invalidate the forecast. Merchants additionally have to be careful for the actions of establishments that maintain Bitcoin.

Just lately, Spot On Chain disclosed that the U.S. and German governments are promoting BTC once more. If this lingers, Bitcoin’s worth could lose maintain of $60,000 and drop to $59,795. In a extremely bearish case, the value could plunge to $56,599.