Bitcoin (BTC) miners have adopted a cautious strategy, offloading a few of their cash for revenue. On-chain information reveals a gentle decline in miner balances because the begin of September.

When miners start promoting, it’s sometimes considered as a bearish indicator. This raises the query: what do these cohort of coin holders know?

Bitcoin Miners Promote for Revenue

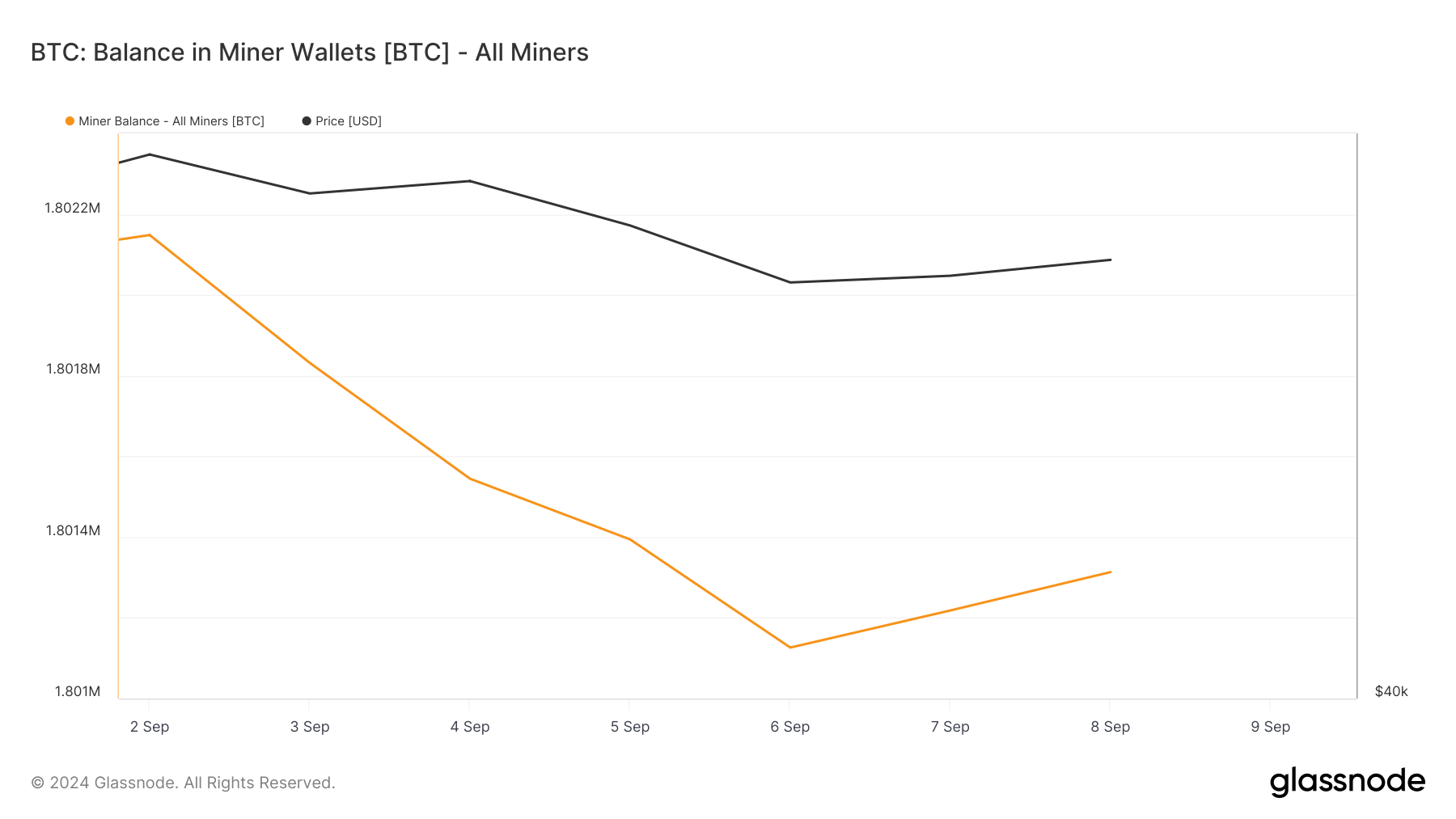

Glassnode information reveals a gradual decline in Bitcoin miner balances since September 2. This metric tracks the whole variety of cash held by miners on the BTC community. At present, 1.8 million BTC, valued at roughly $99 billion at present market costs, are held in miner addresses.

Bitcoin Miner Steadiness. Supply: Glassnode

A decline in miner balances sometimes signifies that miners are promoting their holdings, usually as a result of low profitability. Nevertheless, the continued selloff has occurred regardless of a spike in complete miner income from transaction charges and block rewards.

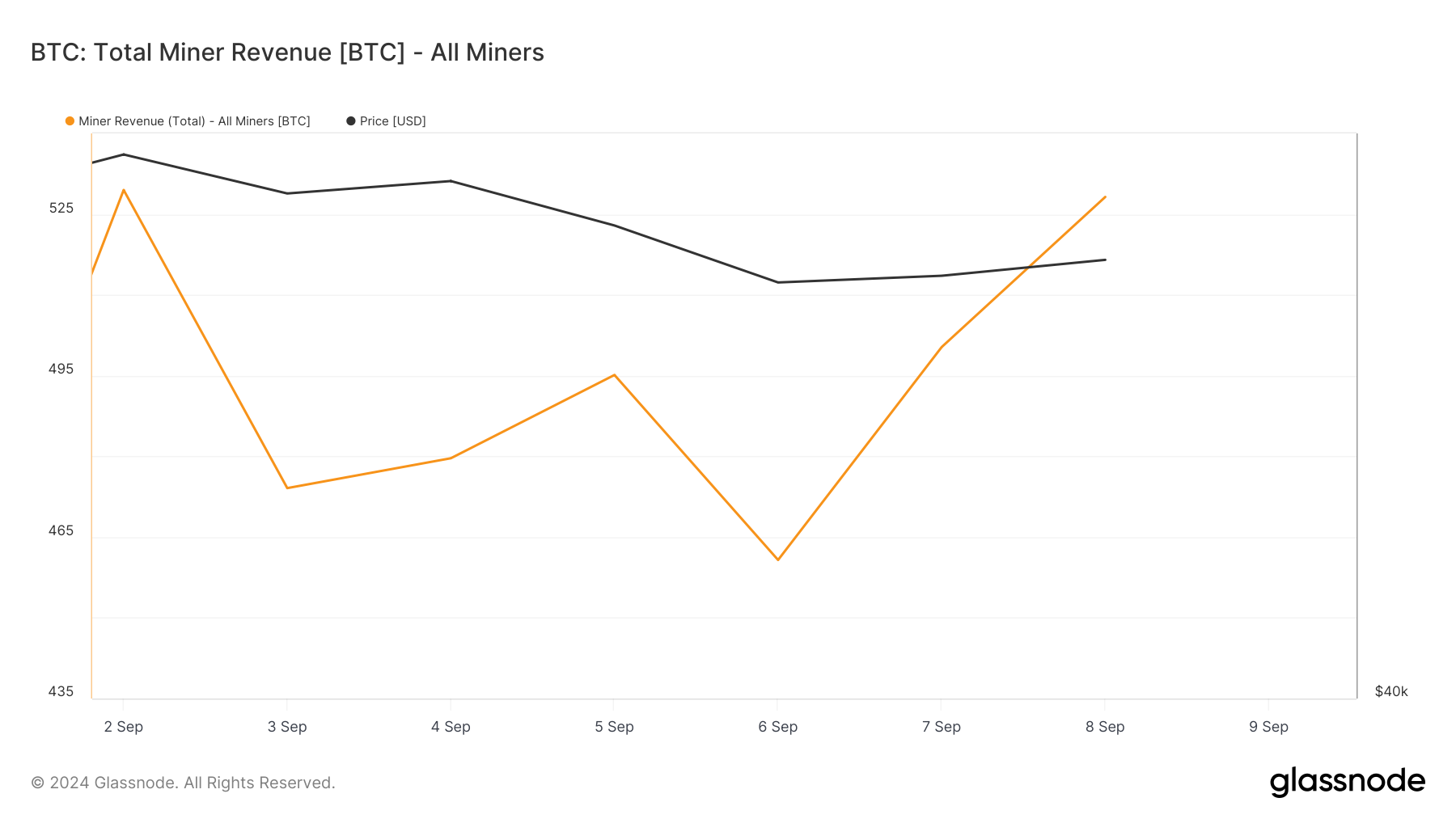

In response to Glassnode, complete miner income has elevated by 15% over the previous two days, whilst Bitcoin’s worth continues to fall. At present buying and selling at $55,659, BTC has misplaced almost 5% of its worth within the final seven days. This implies that whereas miners are incomes extra, they may be offloading their holdings as a result of broader market considerations.

Learn extra: 5 Finest Platforms To Purchase Bitcoin Mining Shares After 2024 Halving

Bitcoin Complete Miner Income. Supply: Glassnode

A easy rationalization for the uptick in coin distribution amongst BTC miners as their income surges is profit-taking. With BTC struggling to interrupt above the $60,000 mark, miners could also be promoting a few of their holdings to make sure liquidity or cowl operational bills.

BTC Value Prediction: Market Contributors Are Afraid

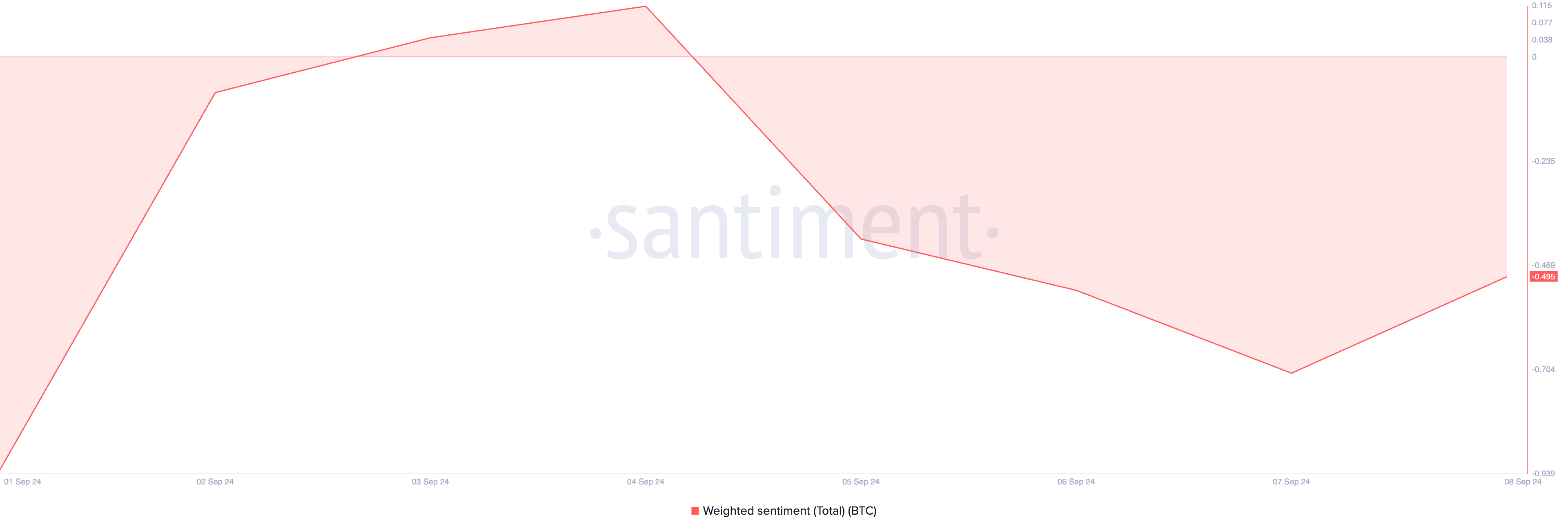

The unfavorable weighted sentiment surrounding Bitcoin because the miner selloffs started provides to market uncertainty. At present, this sentiment metric, which measures the general temper of the market, stands at -0.49.

Bitcoin Weighted Sentiment. Supply: Santiment

A worth beneath zero signifies that the majority social media discussions are pushed by unfavorable feelings, reminiscent of concern, uncertainty, and doubt (FUD).

That is additional supported by the Concern and Greed Index, which reveals that the market is in a state of concern. It means that BTC holders are risk-averse and could also be extra prone to promote their cash within the close to time period.

Bitcoin Concern and Greed Index. Supply: different.me

If promoting strain intensifies, Bitcoin (BTC) dangers falling to $55,246 within the quick time period. If this help degree fails to carry, the value may drop additional, probably slipping beneath $50,000 to commerce round $49,516.

This decline would mark a major downturn, heightening market considerations.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

Bitcoin Value Evaluation. Supply: TradingView

Nevertheless, a shift in market sentiment from unfavorable to constructive could trigger the coin to retest help at $58,790. If the retest succeeds, the coin’s subsequent worth goal is $61,655.