The rejection of decrease costs after the climactic drop in early August assuaged trades. Regardless of the welcomed restoration, Bitcoin bulls are but to construct on the momentum and break above the native resistance ranges. Even so, merchants are optimistic, anticipating consumers to take cost and resume the uptrend set in movement in Q1 2024.

Of their forecasts, extra analysts suppose any breakout above $72,000 and July highs may spark a wave of demand that will see Bitcoin report recent all-time highs above $73,800.

Bitcoin Breaking To All-Time Highs Will Take Time

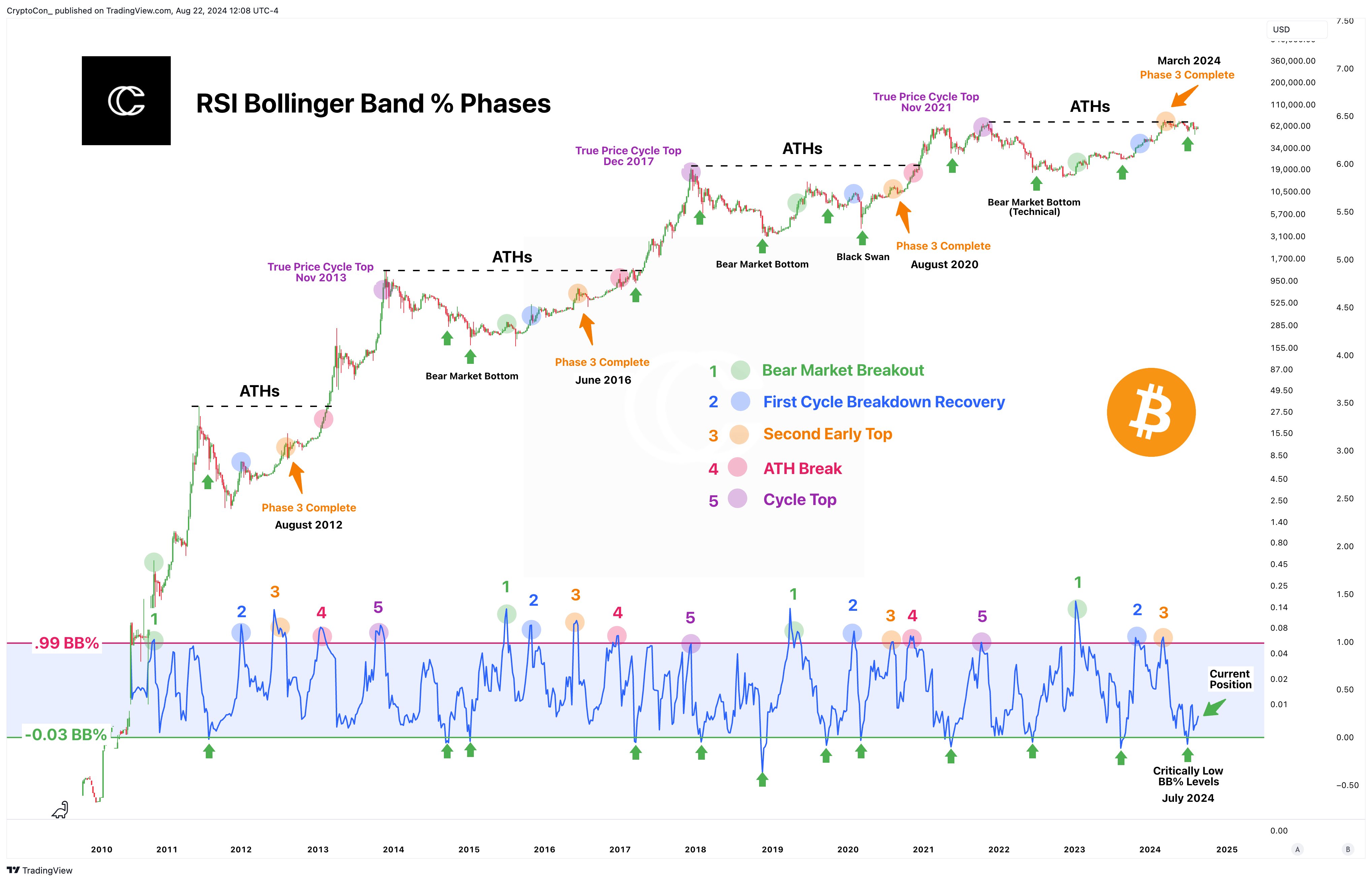

Taking to X, one dealer, pointing to Bitcoin’s historic worth cycles, is satisfied that there are two extra phases to go earlier than the coin breaks an all-time excessive and registers recent all-time highs. Up to now, all cycles tops–from the RSI Bollinger Band % Phases indicator, the analyst continued, are inclined to print out on the fifth transfer. To this point, solely three of those 5 cycles have been accomplished.

Judging from the present state of worth motion, one other analyst, commenting on this preview believes Bitcoin bulls might not have the momentum to interrupt above $73,800 and maintain this degree on the primary try.

As a substitute, within the subsequent two months or so, between September and October, the all-time excessive shall be conquered. Nonetheless, these beneficial properties shall be prolonged with the coin printing new all-time highs in early January 2025. This forecast will align with the Bitcoin historic 4-year cycle.

Will Bitcoin Discover Favor In This fall 2024?

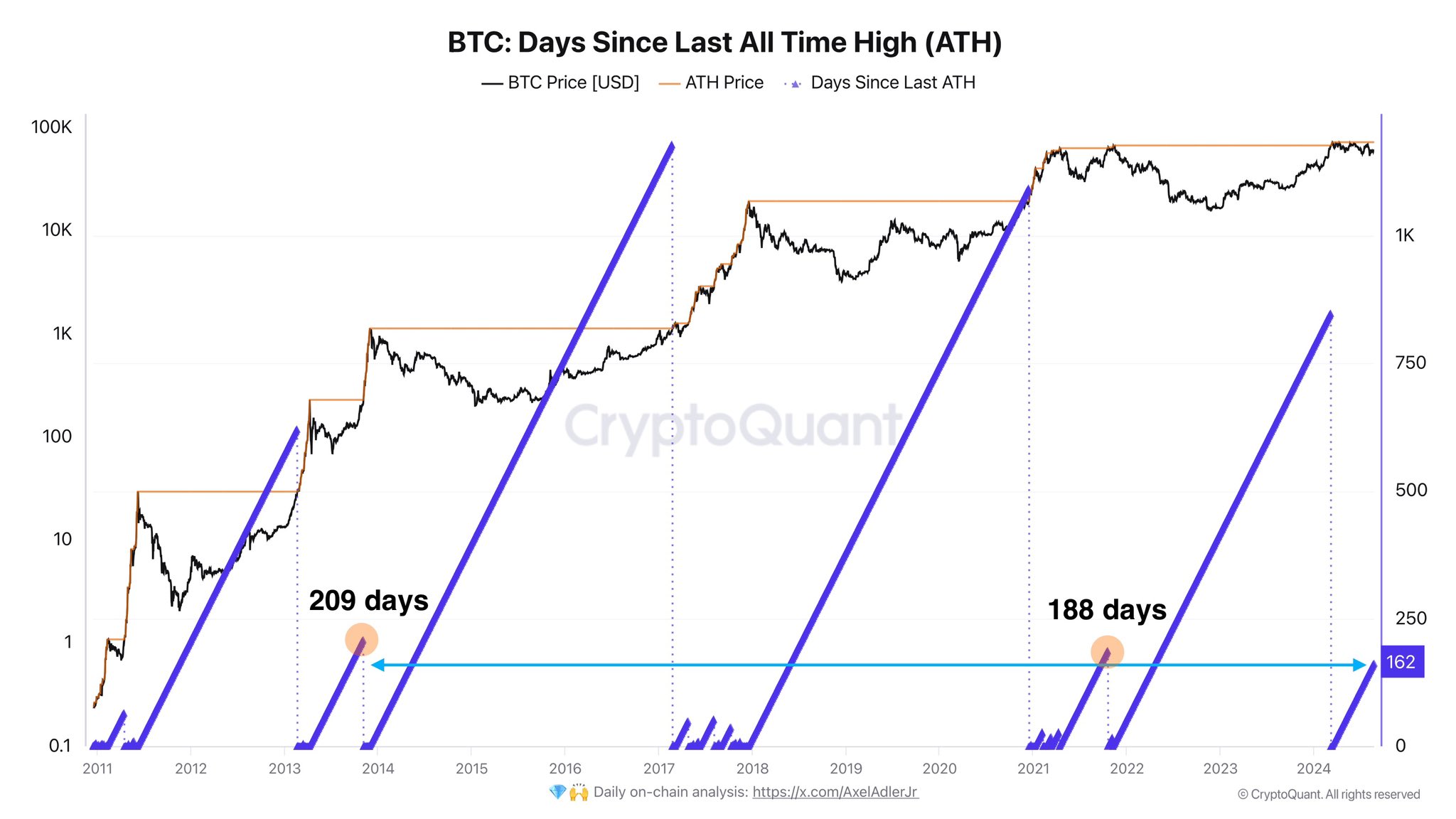

As merchants chip in, making predictions, one other analyst, pointing to cost knowledge, notes that it has been 162 days since Bitcoin broke November 2021 highs and printed recent all-time highs.

The earlier cycle solely required 209 and 188 days to print recent all-time highs. Now that historical past favors Bitcoin in each final cycle of the 12 months, the analyst expects costs to broaden quickly within the final three months.

As of August 23, bulls are again within the equation, in response to the Bitcoin bull-bear market cycle indicator. After fluctuating since early August, the sign is again to blue, pointing to curiosity, a internet constructive.

Total, Bitcoin stays inside a slender vary. Bulls should decisively push costs larger, reversing all losses of early August. Nonetheless, any drop under $50,000 would set off a sell-off to new H2 2024 lows.

Function picture from DALLE, chart from TradingView