Bitcoin’s latest market exercise reveals vital shifts in demand and accumulation patterns amongst giant holders, suggesting potential influences on its value trajectory. The highest cryptocurrency’s value surged from round $40,000 in January 2024 to above $70,000 by March earlier than retracing. It has lately begun to once more threaten $70,000, coinciding with notable will increase in obvious demand and whale holdings.

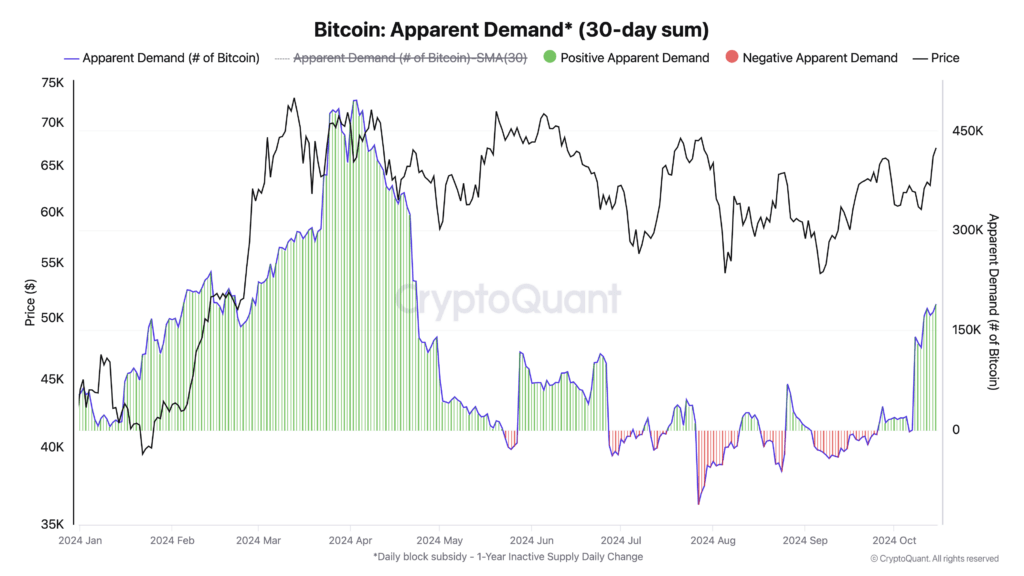

Knowledge signifies that the obvious demand for Bitcoin rose sharply in early 2024, aligning with the worth escalation. Constructive demand intervals, marked by will increase in demand relative to earlier intervals, have been prevalent throughout this time. A renewed surge in demand seems to have once more fueled the latest value hike, demonstrating a powerful correlation between demand tendencies and market valuation.

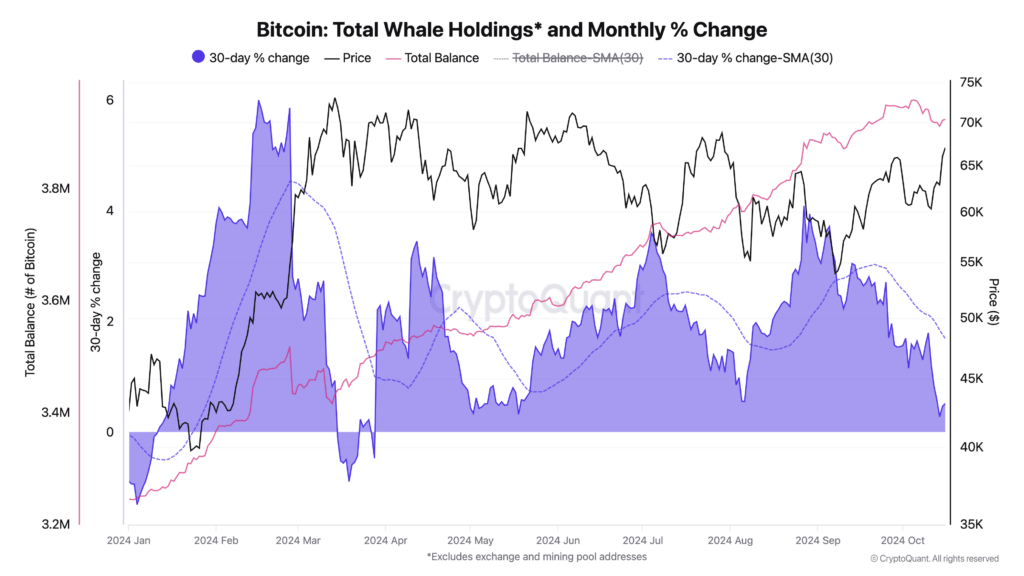

Whale holdings—accounts holding substantial quantities of Bitcoin—additionally exhibited vital exercise. Complete whale holdings elevated steadily from roughly 3.2 million BTC firstly of the yr to over 3.7 million by October.

The month-to-month proportion change in these holdings spiked between January and April, reflecting speedy accumulation as costs climbed. Nevertheless, the center of the yr noticed fluctuations, with steep drops in holdings throughout June, adopted by a sturdy restoration approaching October.

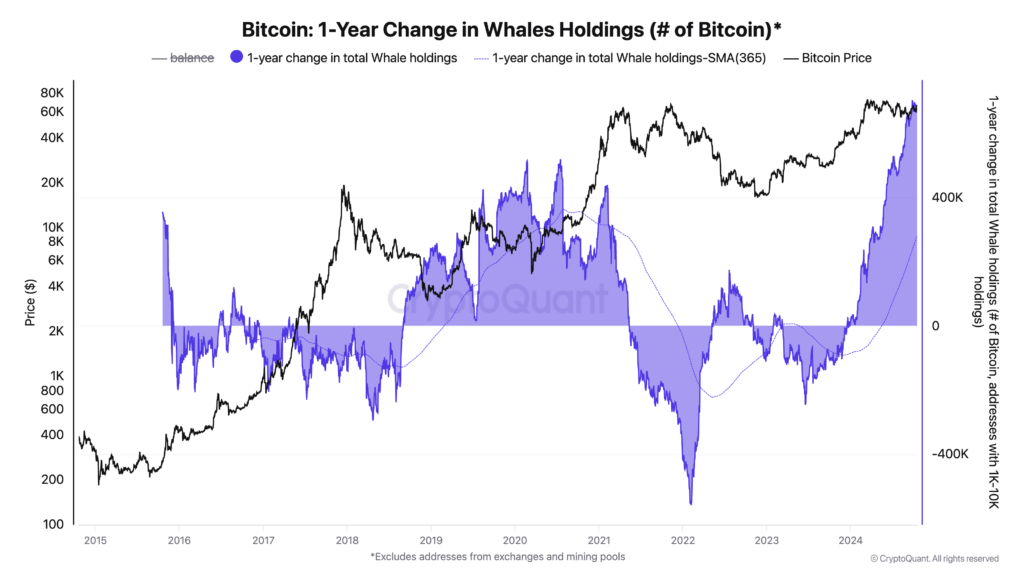

Lengthy-term evaluation reveals that whale conduct usually mirrors main market actions. Intervals of elevated whale accumulation have traditionally corresponded with vital upward value tendencies. As an illustration, substantial accumulation occurred through the 2020-2021 bull run, with whales including to their holdings as Bitcoin’s value escalated. Conversely, after value peaks, whales have a tendency to scale back their holdings, suggesting strategic profit-taking or market repositioning.

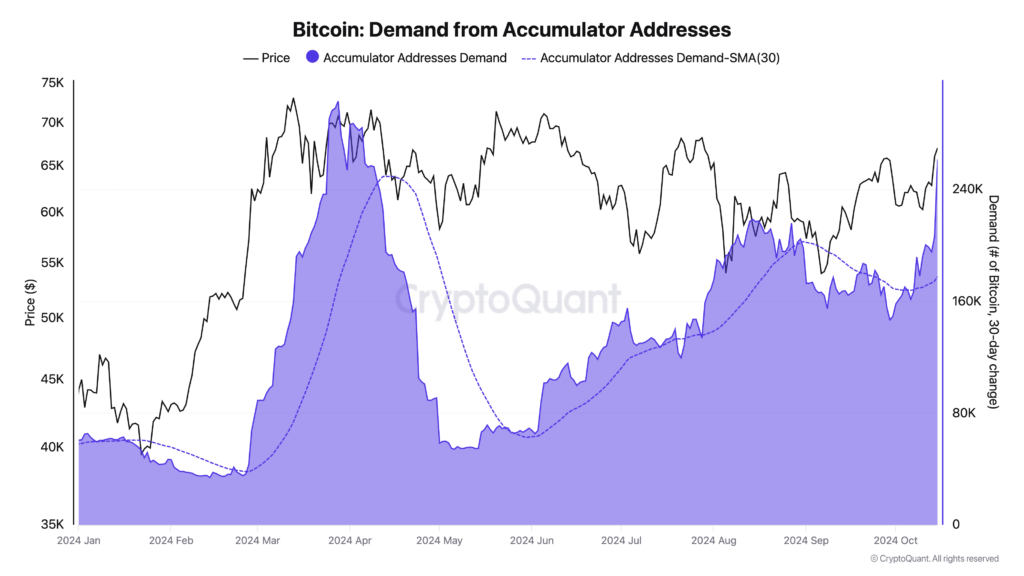

Accumulator addresses—wallets that maintain or constantly enhance their Bitcoin holdings—additionally play a vital position out there forces of 2024. Demand from these addresses has begun rising quickly this month, closing in on the height from Bitcoin’s all-time excessive value in late March.

The interaction between these components highlights the affect of huge holders on Bitcoin’s market conduct. Whales and accumulator addresses seem to behave in anticipation of value actions, accumulating throughout upswings and adjusting holdings throughout downturns. Their actions mirror market sentiment however may contribute to cost volatility.

Whereas the correlation between demand, whale exercise, and value is clear, causation stays a fancy subject. Market forces are influenced by a myriad of things, together with macroeconomic situations, regulatory developments, and broader investor sentiment. Nevertheless, the noticed patterns recommend that monitoring whale holdings and accumulator demand can present beneficial insights into potential market tendencies.

As Bitcoin matures as an asset class, understanding the behaviors of its largest holders continues to be more and more necessary. Their actions can sign shifts in market momentum and provide clues about future value actions. The buildup patterns noticed this month might point out strategic positioning by giant buyers, doubtlessly setting the stage for the subsequent vital market part.

The publish Bitcoin accumulation fuels market uptick signaling potential surge in value appeared first on cryptoteprise.