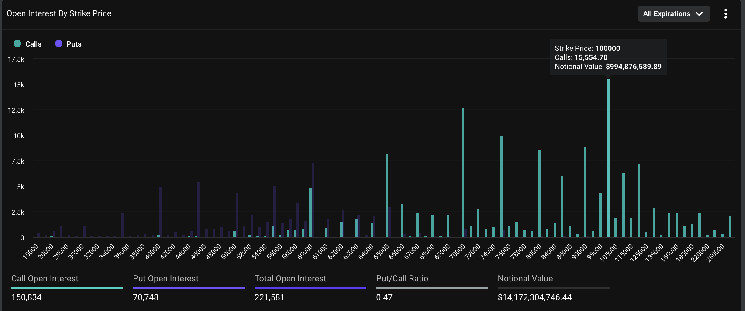

Merchants have locked in over $990 million in BTC $100,000 name choice, in line with Deribit.

The $45,000 put is hottest among the many U.S. elections expiry choices.

Merchants over Polymarket see solely 15% likelihood of costs rising to $100,000 by the 12 months finish.

Want proof of simply how bullish the bitcoin (BTC) market sentiment is? Look no additional than crypto alternate Deribit, the place merchants have locked in almost $1 billion in name choices at a $100,000 strike, offering patrons with an uneven upside above the mentioned degree.

As of writing, the greenback worth of the variety of energetic name choices contracts on the $100,000 strike value was over $993 million, the very best amongst all different BTC choices listed on the alternate, in line with knowledge supply Deribit Metrics. On Deribit, one choices contract represents one BTC.

The second hottest choice was the $70,000 name, boasting an open curiosity of over $800 million. Extra importantly, name choices accounted for over 50% of the entire BTC choices open curiosity of $14.15 billion on the alternate.

“The very best open curiosity throughout all expirations seems at $100K and $70K for bitcoin, which some market individuals interpret as supporting the bullish sentiment that appears to be pervading the market,” crypto buying and selling agency Wintermute mentioned in a notice shared with CoinDesk.

A name purchaser has the correct however not the duty to buy the underlying asset at a predetermined value on or earlier than a selected date and is implicitly bullish in the marketplace. Merchants, anticipating value rallies, usually purchase low cost out-of-the-money choices just like the $100,000 name, that are comparatively cheaper than these nearer to the continued spot value.

U.S. elections choices

BTC choices expiring on Nov. 8, the day when the outcomes of U.S. election outcomes might be introduced, boast a cumulative open curiosity of $938 million, with $117 million concentrated within the $45,000 strike put choices.

The recognition of the $45,000 factors is according to the tendency of merchants to hunt draw back hedges forward of a binary occasion just like the election outcomes.

“The volatility floor signifies a bias towards the draw back till late October/November when the market begins to favor calls over put safety. Present positioning suggests assist for a post-election rally,” Jake Ostrovskis, OTC Dealer at Wintermute, instructed CoinDesk in an electronic mail.

Open curiosity in December expiry is concentrated closely in name choices, with the $100,000 strike being the most well-liked in an indication of expectations of a year-end surge.

Polymarket merchants are uncertain

Merchants over decentralized betting platform Polymarket see a low likelihood of the cryptocurrency tapping the !00,000 mark by the top of the 12 months.

At press time, the Sure aspect shares within the “Will Bitcoin Hit $100K in 2024” contract traded at 15 cents, representing a minuscule likelihood of a rally into six figures. The contract will robotically resolve to sure ought to BTC’s value Coinbase hit a excessive of $100,000 on or earlier than Dec. 31.

In the meantime, merchants see simply over 50% likelihood of bitcoin surpassing the document excessive of $73,798 by the 12 months’s finish.