Binance, the world’s largest cryptocurrency alternate, introduced the proof-of-reserve system to regain the lowering belief in Bitcoin exchanges after the sudden chapter of FTX.

On this context, Binance, which publishes reserve studies at common intervals, has printed the twenty third Report (snapshot date October 1) of its reserves.

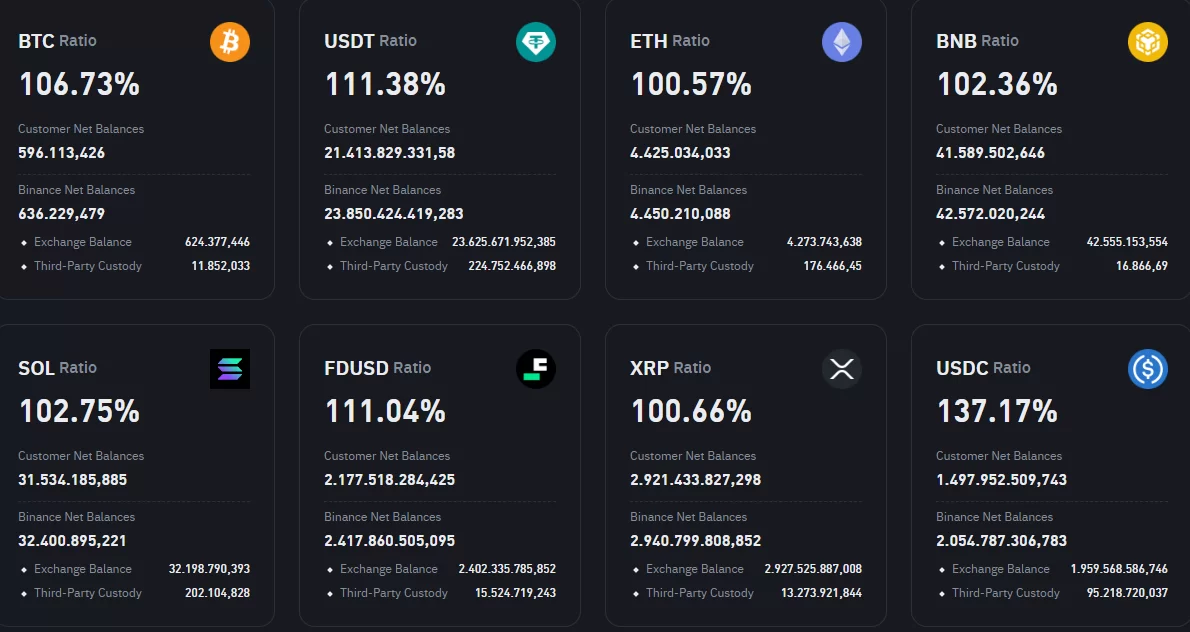

Other than Bitcoin (BTC), the report contains USDT, Ethereum (ETH), BNB, Solana (SOL), FDUSD, XRP, USDC, TUSD, Dogecoin (DOGE), Polygon (MATIC), Polkadot (DOT), Chainlink (LINK), SHIB, Arbitrum (ARB), Litecoin (LTC), Optimisim (OP), Chilliz (CHZ), UNI, Aptos (APT), GRT, SSV, CHR, ENJ, 1INCH, CRV, WRX, MASK, HFT, BUSD and CVP and Pepecoin (PEPE) was featured.

Accordingly, customers’ Bitcoin property decreased by 1.58% in comparison with the earlier report back to 596 thousand BTC, whereas USDT property decreased by 3.16% to 21.4 billion.

It was additionally seen that customers’ BNB property elevated by 2.17%, reaching 41.58 million.

Lastly, when customers’ Ethereum property, it was seen that it decreased by 1.37% to 4.42 million.

Binance’s newest proof of reserves exhibits that regardless of the dwindling property, BTC, USDT, and ETH reserves stay overcollateralized by 106.73%, 111.38%, and 100.57%, respectively.

*This isn’t funding recommendation.