Binance Labs, Binance’s enterprise arm, has invested an undisclosed quantity in OpenEden, a platform centered on tokenizing real-world property (RWAs).

This transfer goals to combine conventional monetary merchandise, corresponding to US Treasury Payments (T-Payments), into decentralized finance (DeFi). Furthermore, it’ll create new funding alternatives for institutional and retail buyers.

Why Tokenized US Treasury Payments Are Gaining Recognition Amongst Buyers

With Binance Labs’ latest funding, OpenEden is ready to broaden the supply of yields backed by RWAs throughout the DeFi ecosystem. This growth will contain launching new merchandise, forging partnerships with new channels, and venturing into new markets.

“We consider OpenEden has the aptitude to drive additional adoption of tokenized real-world property,” Andy Chang, Funding Director at Binance Labs, stated.

Learn extra: What’s Tokenization on Blockchain?

OpenEden’s core goal is to deliver conventional monetary property onto blockchain networks, offering a bridge between conventional finance and DeFi. By the TBILL product—which US Treasury Payments again, OpenEden provides buyers a technique to earn yields on stablecoins, with each day liquidity accessible for members.

This setup appeals to institutional buyers, corresponding to decentralized autonomous organizations (DAOs) and crypto treasury managers. They’re searching for safe and controlled yield-generating merchandise.

By dealing with your entire token issuance course of, asset administration, and operational actions, OpenEden goals to offer environment friendly and cost-effective entry to tokenized treasuries. The platform is designed to fulfill the wants of buyers looking for a blockchain-based technique to entry conventional property.

This newest funding from Binance Labs follows the same transfer by Ripple earlier this 12 months. BeInCrypto reported that in August 2024, Ripple invested $10 million into OpenEden’s TBILL product. On the time of writing, information exhibits that TBILL has a market capitalization of $102.8 million.

Backings from each Binance Labs and Ripple towards OpenEden additional showcase the rising curiosity on this section. Tokenized RWAs, particularly US Treasury Payments, are more and more standard as buyers search to make the most of blockchain expertise for secure, regulated property. These digital variations of conventional US Treasury securities present a streamlined means for buyers to commerce property with enhanced liquidity and effectivity.

Learn extra: What’s The Affect of Actual World Asset (RWA) Tokenization?

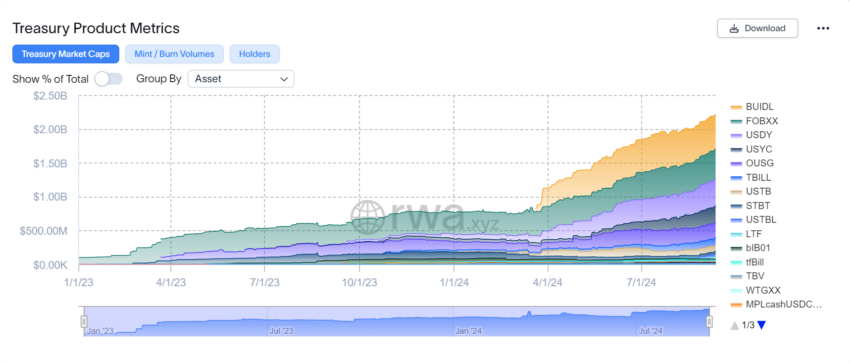

Tokenized US Treasury Market Capitalization. Supply: RWA.xyz

Throughout the broader market, different key gamers, together with Franklin Templeton and BlackRock, have additionally explored tokenized treasury options. RWA.xyz information reveals that by September 2024, the whole worth of those tokenized property can have reached $2.22 billion. This rise in worth highlights their rising attraction amongst non-public and institutional buyers, who worth the steadiness and regulatory compliance of US T-Payments, making them a most popular possibility for tokenization.