Binance, one of many world’s largest crypto exchanges, has achieved a brand new milestone as its open curiosity (OI) surged to an all-time excessive (ATH) of $8.3 billion, in keeping with a report by CryptoQuant analyst Burak Kesmeci.

This enhance, representing a ten.24% progress over the previous 24 hours, emphasizes Binance’s substantial share of worldwide crypto futures positions.

The surge in OI additionally highlights Binance’s affect on market tendencies, provided that it now accounts for roughly 35% of all open futures positions throughout all exchanges globally. The entire OI throughout exchanges, together with Binance, reached $23.3 billion, setting a file within the sector, Kesmeci reveals.

Implications Of Binance Excessive Open Curiosity

To know what the rise in Binance open curiosity means for the crypto market, it’s value first trying into what the time period ‘open curiosity’ means. Notably, open curiosity (OI) refers back to the complete variety of excellent contracts within the futures market, encompassing each lengthy and brief positions.

An increase on this metric usually suggests elevated buying and selling exercise and curiosity, making it an important indicator for market individuals.

Binance OI Reaches New ATH of $8.3 Billion

“Open Curiosity throughout all exchanges—together with Binance—stands at $23.3 billion, marking a brand new ATH. This implies Binance alone accounts for round 35% of all international futures positions.” – By @burak_kesmeci

Hyperlink 👇https://t.co/zfnGiGUtKL pic.twitter.com/DfWbZH3tfN

— CryptoQuant.com (@cryptoquant_com) November 6, 2024

Kesmeci defined {that a} important bounce in open curiosity akin to that of Binance—notably when it exceeds a 3% enhance inside a 24-hour interval—incessantly precedes heightened market volatility and potential liquidations.

Which means each bullish and bearish positions might come beneath elevated stress as market dynamics shift, creating potential for main strikes throughout the crypto panorama.

The CryptoQuant analyst notably wrote:

Bear in mind, the OI metric represents the entire variety of open lengthy and brief positions available in the market. Sharp will increase in OI recommend that, as volatility spikes, each lengthy and brief positions might face elevated stress, probably resulting in liquidations.

BNB’s Value Motion Amid Broader Market Developments

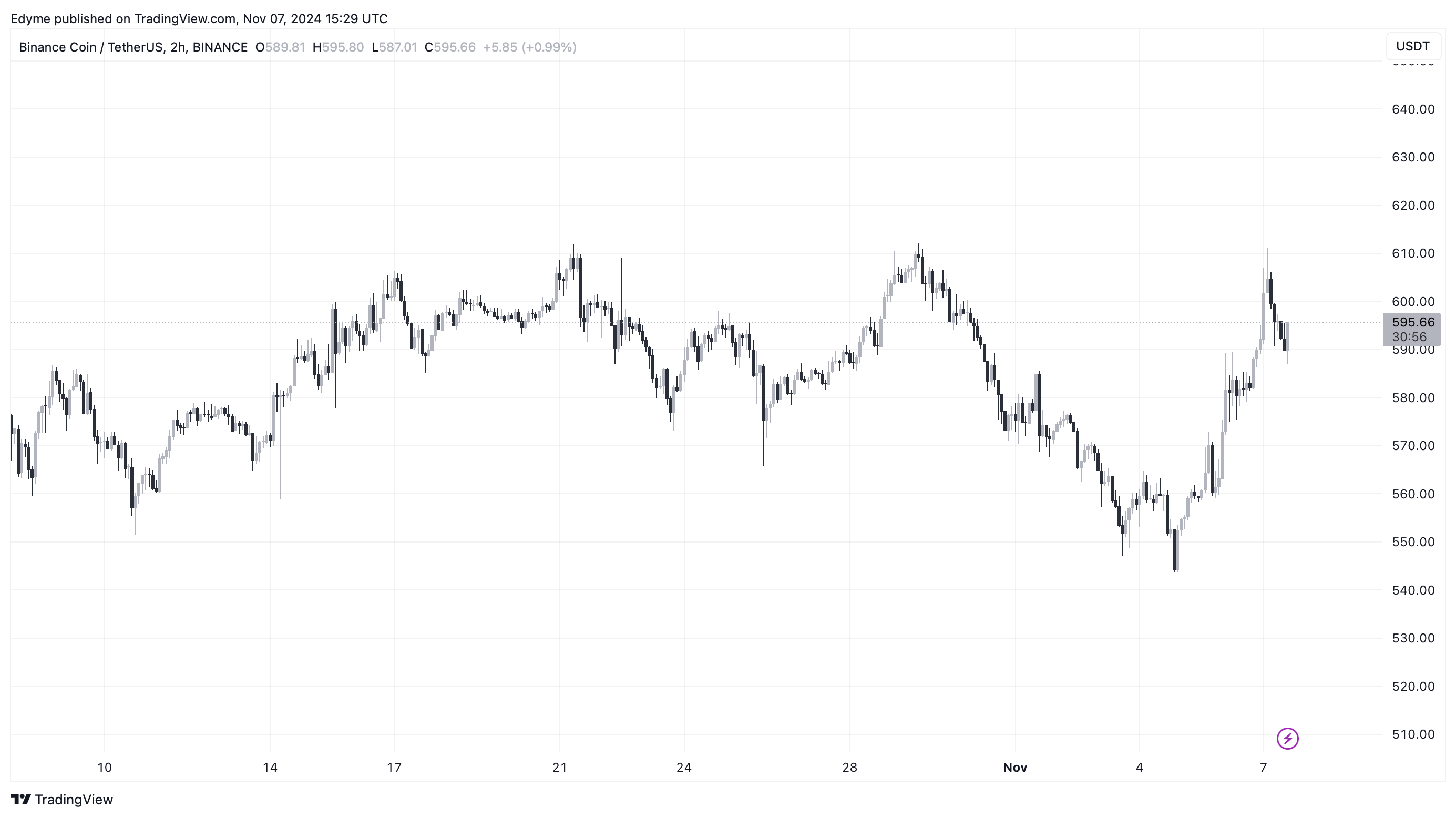

Binance’s native token BNB, has additionally skilled a notable worth motion, mirroring the broader uptrend inside the crypto market led by Bitcoin’s resurgence.

Earlier right this moment, BNB breached the $600 mark, reaching a 24-hour excessive of $610 earlier than experiencing a slight pullback to $595, on the time of writing. Regardless of this correction, the asset stays up 2% over the previous 24 hours.

This worth motion brings BNB nearer to its earlier ATH of $717, recorded on June 6 of this 12 months, with the present worth reflecting a 17.3% lower from that peak.

Featured picture created withe DALL-E, Chart from TradingView