In gentle of the Securities and Trade Fee dropping its probe into Paxos over its branded Binance stablecoin (BUSD) — after it was nearly fully unwound — one wonders whether or not there was any materials influence on Binance.

It seems, not a lot, at the very least going by how a lot crypto customers are preserving there.

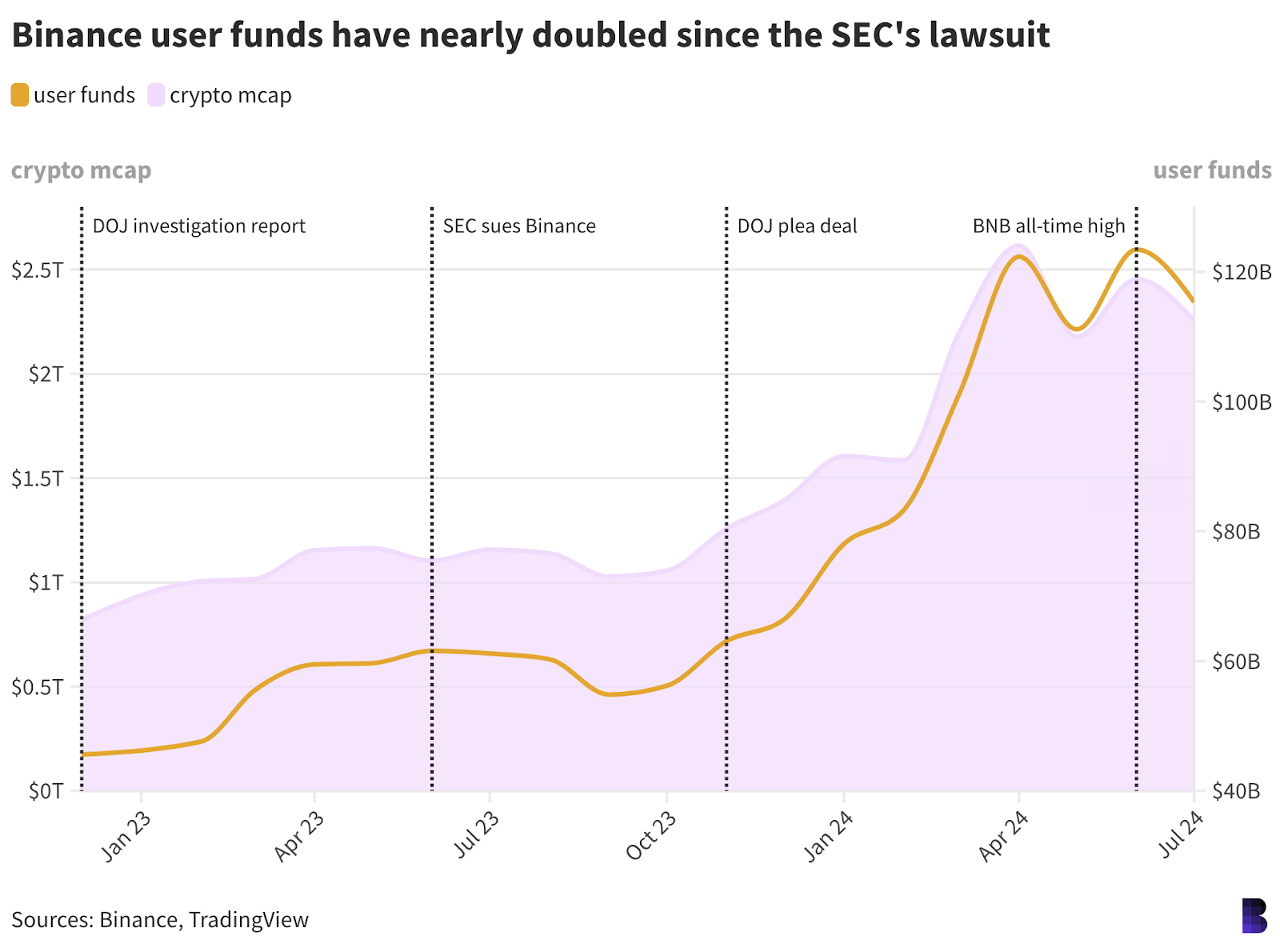

Collating Binance’s month-to-month proof of reserves studies reveals the agency disclosing $115 billion in person funds initially of July, up from $61 billion one yr in the past.

When studies first surfaced of a years-long Division of Justice investigation into Binance in December 2022, there was $45.6 billion. That’s 150% development as US businesses rained down on Binance, then-CEO Changpang Zhao and, apparently, at the very least one firm that supported them.

Learn extra: IRS, Justice Division probing Binance

BUSD was the seventh largest cryptocurrency by market cap, price $16.1 billion earlier than the SEC despatched its Wells discover to Paxos in February 2023.

Paxos stopped minting new tokens and over the subsequent month, BUSD holders redeemed about half the availability. By January this yr, there was solely $100 million in circulation.

Learn extra: SEC triggers billion-dollar ‘financial institution run’ on Binance’s BUSD

Different stablecoins together with TrueUSD, USDT and FDUSD plugged the hole left by BUSD, with the latter two headquartered exterior the US. TrueUSD in the meantime fell out of favor, resulting in plenty of delistings earlier this yr.

The greenback worth of person deposits clearly rises alongside costs, however the purple space and the orange line would decouple if there have been any significant person exodus. It is also that US intervention really boosted confidence in Binance total.

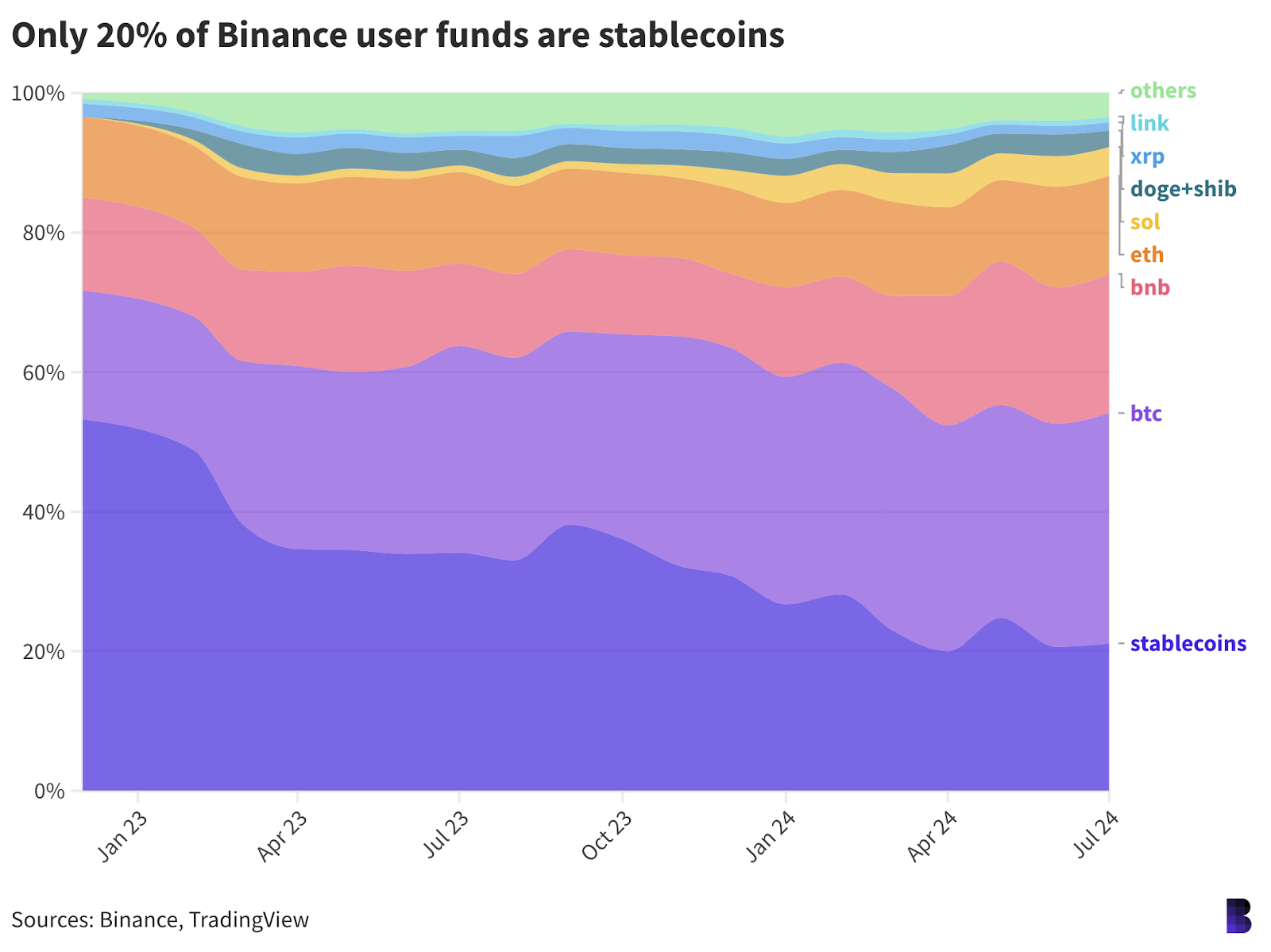

In any case, as Zhao waits out the remainder of his sentence, the make-up of person funds on the platform is morphing, with the information indicating that the overall consensus is to carry.

Bitcoin made up 18% of person funds in December 2022 — now it’s over one-third. Equally, BNB went from 14% to twenty%, whereas ETH has stayed largely unchanged at about 14%, presumably on account of lackluster value development in comparison with bitcoin and BNB.

The true inform is that solely one-fifth of all person funds on the platform are at the moment stablecoins — $24.4 billion — down from greater than half earlier than Zhao’s troubles actually started.

Meaning 80% of Binance person funds are held in non-dollar-pegged crypto belongings, virtually the best level on document (which, sadly, solely started post-FTX).

An analogous distribution is seen on OKX’s newest proof of reserves report, dated final month.

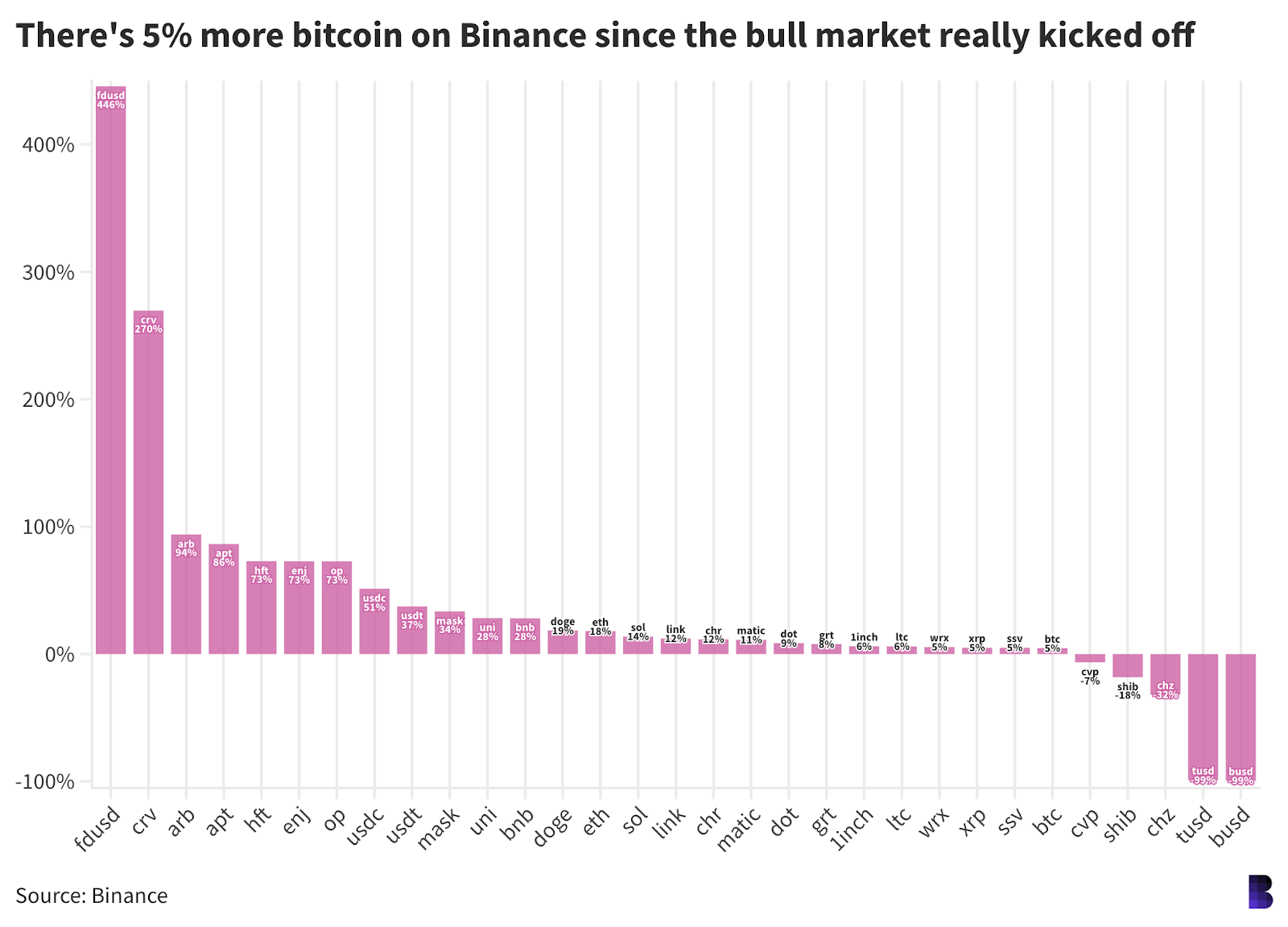

As for which cryptocurrencies Binance customers are gravitating in the direction of, evaluating the latest variety of base items (as in, particular person tokens) they held to what number of have been held in October 2023 can supply some perception. Bitcoin markets actually picked up round then.

The tokens with the biggest steadiness will increase have been curve DAO, arbitrum, aptos, hashflow, enjin and optimism, all rising by greater than 70% (and in CRV’s case, 270%).

Chiliz and shiba inu have been on the opposite finish of the desk, dropping 32% and 18%, respectively. USDT and USDC balances in the meantime grew by 51% and 37%.

That might additionally simply imply CHZ and SHIB holders pulled their tokens off Binance for long-term chilly storage.

Both method, the information means that Binance customers are assured after the SEC and DOJ’s actions that not solely is every little thing at Binance above board, however that costs will broadly rise from right here.

A shorter model of this text first appeared in Friday’s Empire Publication. Enroll right here to by no means miss a problem.