Binance, the world’s largest crypto change by buying and selling quantity, has disabled copy buying and selling companies for its European customers because the implementation of the Market in Crypto Property (MiCA) regulation approaches.

This regulatory change, scheduled to turn out to be efficient on the finish of June, signifies a considerable alteration within the European Union (EU) crypto surroundings.

Binance Notifies EU Customers of Instant Copy Buying and selling Restrictions

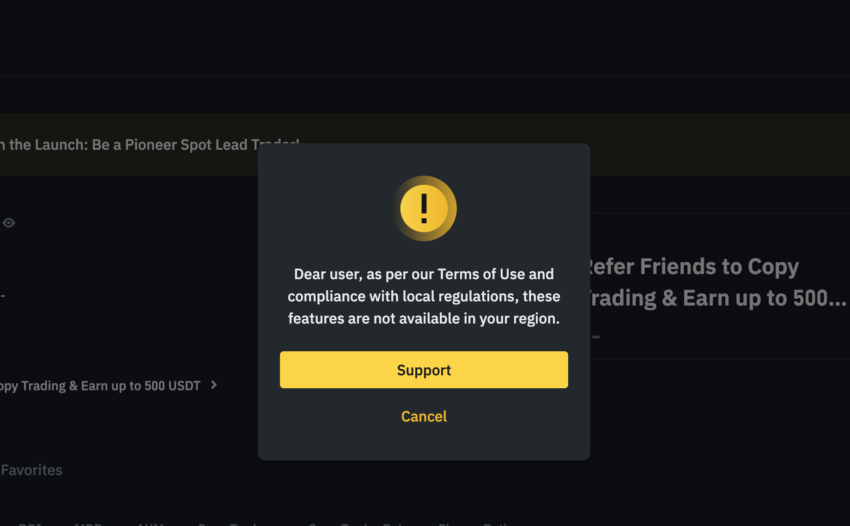

As of immediately, European Binance customers discovered a message on their cell app informing them that the copy buying and selling service is now not obtainable of their area. Earlier than this, Binance had warned “Impacted Lead Merchants and Copy Merchants” amongst its customers.

The change suggested them to shut their positions in copy buying and selling actions and switch their funds again to their respective spot wallets by the deadline of June 27, 2024, at 20:59 UTC. After that date, any remaining open positions will probably be mechanically closed at market value, and property will probably be transferred to identify wallets.

Learn extra: What Is Markets in Crypto-Property (MiCA)?

Binance Notification of Copy Buying and selling Restrictions within the EU. Supply: Binance

BeInCrypto has contacted Binance relating to this matter. Nonetheless, as of publication, we have now but to obtain a response.

This improvement got here after Binance introduced new guidelines on unapproved stablecoins within the EU on June 21. Ranging from June 30, customers can not commerce, deposit, or withdraw stablecoins that don’t observe MiCA tips.

“Stablecoins that aren’t approved beneath MiCA, together with USDT and others, will proceed to be obtainable for buying and selling on Binance on Spot, for deposits and withdrawals, and in your pockets as common. They can even be obtainable on the market on Convert. Binance is not going to section out these stablecoins,” the e-mail announcement reads.

The change has additionally modified its rewards and referral programs. Efficient June 24, spot and margin buying and selling referral commissions will probably be paid in BNB, Binance’s native token, as a substitute of stablecoins. Thus, Binance has suggested its European customers to evaluation their holdings and contemplate transitioning to regulated stablecoins or different digital property earlier than the June 30 deadline.

MiCA Regulation Units New Requirements for Crypto Property within the EU

Launched in 2023, MiCA is the primary specific regulation for crypto property within the EU, providing authorized readability for stakeholders. It categorizes digital property, specifies relevant legal guidelines, and designates accountability for enforcement.

This regulation addresses regulatory points, making certain a stage enjoying discipline for crypto establishments within the EU and eliminating regulatory fragmentation amongst member states. Furthermore, it protects traders, prevents fraud, and ensures compliance with anti-money laundering (AML) and monetary legal guidelines.

Trade consultants view MiCA as a groundbreaking stride in establishing a cohesive set of rules for crypto property throughout the continent. Mohsin Waqar, CEO of Web3 recreation Senet, thinks that unified regulatory frameworks like MiCA might cut back fragmentation and promote a steady surroundings.

Ilya Volkov, CEO of the crypto platform YouHodler, additionally shared an identical sentiment. Regardless of the challenges surrounding the stablecoin beneath the brand new regulation, Volkov believes that Web3 and crypto platforms ought to migrate from non-compliant stablecoins to these assembly MiCA requirements. Nonetheless, he believes that MiCA units a precedent for worldwide crypto regulation, serving as a mannequin for different areas.

Learn extra: Stablecoin Laws Across the World

“International locations in Latin America and Asia will undertake related approaches within the close to future,” he informed BeInCrypto.