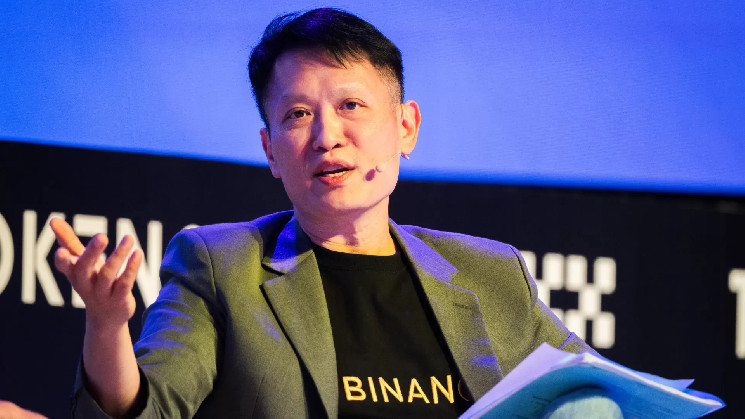

Whereas the decline in Bitcoin and altcoins negatively affected all the market, Binance CEO Richard Teng additionally made a downward remark.

Emphasizing that traders’ curiosity in Bitcoin continues regardless of the declines, Binance CEO pointed to identify Bitcoin ETFs as proof of this curiosity.

Stating that there was an influx of 14.7 billion {dollars} into BTC ETFs within the final six months, Binance CEO mentioned that these inflows are an indicator of traders’ confidence in BTC and digital property typically.

Declaring that though Bitcoin and altcoin costs have fallen not too long ago, the long-term fundamentals of the cryptocurrency business are nonetheless sturdy, Richard Teng identified that short-term declines shouldn’t negatively have an effect on traders and that they need to suppose long-term.

“Bitcoin ETFs listed within the US generated over $14.7 billion in internet inflows in 6 months. Curiosity in Bitcoin and digital property stays excessive.

Token costs and market caps fluctuate, however the long-term fundamentals of our business are sturdy.

Keep targeted and hold enhancing! “

In 6 months, US-listed Bitcoin ETFs introduced in over $14.7B in internet inflows. Key takeaway? Curiosity in #Bitcoin and digital property stays excessive.

Token costs and market caps fluctuate, however the long-term fundamentals of our business is powerful.

Keep targeted and hold constructing! 🚀

— Richard Teng (@_RichardTeng) July 9, 2024

*This isn’t funding recommendation.