Binance broke above 240M registered customers after the most recent document crypto increase. Towards the tip of 2024, Binance remained the highest alternate each when it comes to visits and liquidity.

Binance carried the increase of 2024, increasing each its volumes and person base. Richard Teng, CEO of Binance, introduced the milestone, underscoring the scale of the crypto market.

https://x.com/_RichardTeng/standing/1857395323016032644

Binance stays a full KYC alternate, although up to now it has been accused of internet hosting bot accounts or spoofed identities. Nevertheless, the current person progress is corroborated by on-line developments, the place Binance’s app and web site additionally develop in reputation.

Binance additionally confirmed the market nonetheless wanted a central settlement hub, because it carried an enormous a part of the site visitors throughout Bitcoin’s run as much as $93,000. Binance was additionally instrumental to a number of meme token rallies, together with PEPE, NEIRO, ACT, and PNUT. Curiosity in Binance additionally rose for its current coverage so as to add extensively distributed meme property with no indicators of insider holdings.

Within the quick time period, Binance is a approach for tokens to undergo a increase. As of November 15, among the most actively buying and selling pairs concerned DOGE and PEPE, with excessive exercise for ACT and PNUT as effectively.

Binance is the market share chief with inflows from Asia and Europe

Binance nonetheless carries greater than 25.5% of all alternate volumes, based mostly on information from Messari. The alternate handles extra volumes than different high rivals, together with Coinbase and Crypto.com. The alternate carries one of many greatest Bitcoin (BTC) wallets, holding greater than $36B in deposits. The alternate carries greater than $102B in its balances, unfold throughout main L1 and L2 chains. The alternate is seen as extra clear as a consequence of common on-chain reviews of present reseres.

Binance is a worldwide market, with a particular division for US merchants. The alternate has moved its registration to the Kayman Islands for a worldwide presence, cautious of earlier issues with laws.

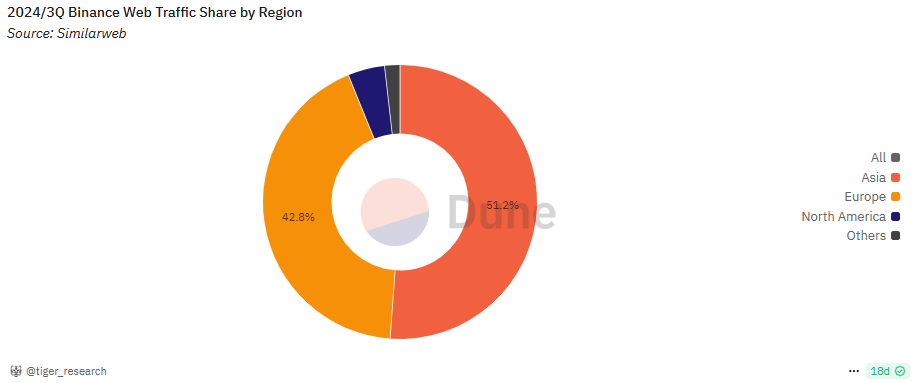

Binance additionally derives an enormous a part of its volumes from Asia and Europe, based mostly on web site go to information. BinanceUS works as a separate entity, unrelated to the worldwide alternate and going through some limitations for US-based merchants. Near 35% of Binance net site visitors comes from Asian international locations, with 42.8% from Europe, the place the alternate sees no limitations within the SEPA space.

Binance derives most of its site visitors from the booming Asian and European crypto markets. | Supply: Dune Analytics

For the European markets, Binance can be adapting to native laws, swapping out merchandise utilizing Tether (USDT) for USDC, a extra clear stablecoin with bank-based fiat reserves. Binance can even adjust to the second stage of EU necessities from 2025 onward, and isn’t threatened for its presence on the European market. Binance is each a retail hub and a settlement platform for bigger offers, not too long ago seeing whale inflows for profit-taking.

The highest centralized DEX additionally reinvented its affect after swapping its management. Former CEO and co-founder Changpeng ‘CZ’ Zhao moved on to the technical facet, not too long ago discussing crypto tech with Vitalik Buterin.

Binance ecosystem stays much less lively

Binance has confirmed its worth as a CEX, however its decentralized ecosystem lags behind different networks. Binance Good Chain and its DEX, PancakeSwap, retain fewer customers and lag behind Uniswap and Raydium.

Moreover, BNB, the native asset, hovers simply over $600, with no important breakouts to a better tier. The Binance ecosystem additionally phased out Binance USD (BUSD), changing it with the centralized FDUSD.

BNB Good Chain is among the busiest when it comes to initiatives. Nevertheless, these startups have been added throughout the Web3 gaming increase and the NFT craze. A number of the initiatives misplaced their customers and their worth, hardly contributing to the Binance model.

To date, the main crypto model appears to derive its greatest worth from centralized exercise. On the similar time, Binance retains its incubator applications, academic hub and numerous fashions of DeFi, staking and passive revenue applications.

Up to now years, among the property listed on Binance didn’t fare higher, particularly when it got here to VC-backed tokens. Within the current case of Binance listings, meme tokens truly benefitted, getting into a stage of worth discovery.