Ethereum’s current failure to reclaim the multi-month descending channel’s center threshold of $2.6K has resulted in a major rejection, signaling a doable continuation of the downtrend towards the mid-term $2.1K assist stage.

By Shayan

The Each day Chart

Ethereum’s worth motion on the each day chart displays a bull entice. After briefly surpassing the $2.6K resistance, the worth rapidly misplaced momentum as a consequence of intense promoting strain, resulting in a 15% drop.

This rejection underscores the dominance of sellers available in the market, as ETH didn’t reclaim this vital threshold. Including to the bearish sentiment, a “Loss of life Cross” has occurred, the place the 100-day shifting common crossed beneath the 200-day shifting common, a traditionally bearish sign.

The market is now poised for an extra retracement towards the $2.1K assist zone, which aligns with a previous important swing low. Ethereum is predicted to enter a descending consolidation part, step by step trending decrease towards this key stage within the mid-term.

The 4-Hour Chart

On the 4-hour chart, ETH’s wrestle to take care of momentum close to the 0.5 ($2.6K) – 0.618 ($2.8K) Fibonacci ranges triggered a steep decline towards the ascending flag’s decrease boundary of $2.3K. Ethereum is at the moment hovering round this assist stage, with low volatility and sideways consolidation, signaling market indecision.

Though patrons or sellers haven’t any specific management for the time being, the bearish momentum means that they’re making an attempt to push the worth beneath the flag’s decrease boundary.

If Ethereum breaks beneath this stage, it may set off a sustained damaging development, concentrating on the $2K psychological assist. Nevertheless, the $2.1K threshold stays an important protection for patrons to forestall additional decline.

By Shayan

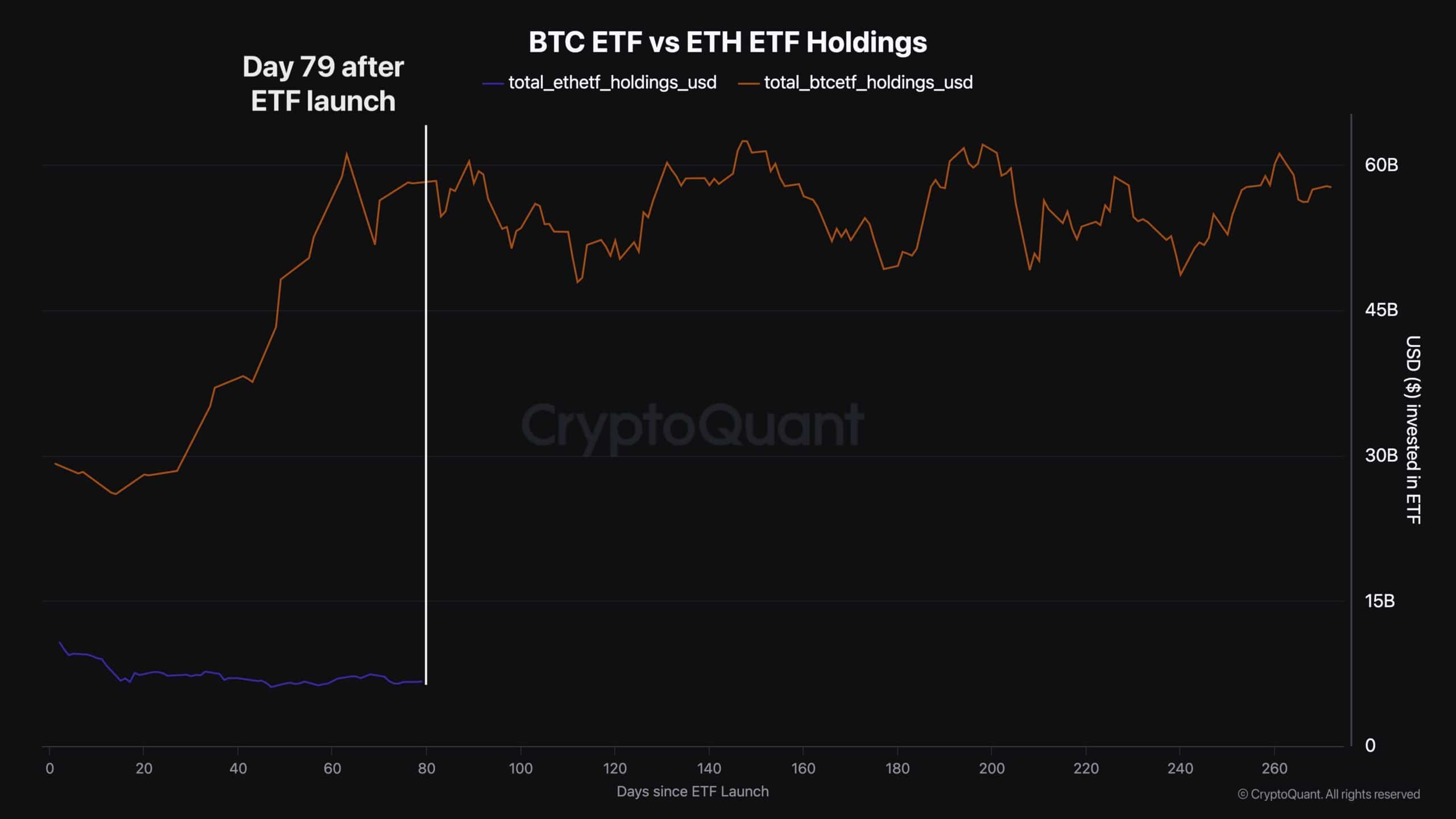

The offered chart highlights a stark distinction between the efficiency of Bitcoin and Ethereum ETFs over the 79 days since their launch. The divergence in investor habits suggests completely different demand and confidence ranges between these two cryptocurrencies, with Bitcoin displaying substantial inflows and Ethereum struggling to draw curiosity.

As of Day 79, Bitcoin ETFs have amassed $29.1 billion in inflows, with whole belongings beneath administration rising from $29.2 billion in the beginning to a excessive of $58.3 billion earlier than stabilizing round $59.7 billion. This progress displays a gentle and constant demand for Bitcoin from buyers.

In distinction, Ethereum ETFs have seen a internet outflow of $4.1 billion over the identical interval, with AUM declining from $10.7 billion to $6.6 billion.

The continual downtrend displays weak demand, indicating that Ethereum, a dominant pressure within the broader crypto ecosystem, has not but captured the identical stage of curiosity from ETF buyers. This development means that whereas each belongings are pivotal within the cryptocurrency market, Bitcoin’s stability and institutional adoption at the moment make it the extra enticing possibility in ETF merchandise. On the identical time, Ethereum might have to beat short-term market issues to regain its footing.