Based on the newest report from CoinGecko, the NFT market is experiencing a interval of great problem.

Not like the remainder of the crypto property, the place there is a rise in participation, within the non-fungible token exchanges it’s nonetheless a bear market.

The angle emerges each on the entrance of the costs of the most important collections and on the general gross sales volumes of the market.

Let’s see every part intimately under.

CoinGecko: the crypto winter for the NFT market will not be over but

Based on CoinGecko, the biggest impartial cryptocurrency knowledge aggregator, the NFT market remains to be in a bear market.

From the newest report revealed, it clearly emerges how the neighborhood has considerably diminished its investments within the sector.

The truth is, whereas on one hand the marketplace for crypto property has grown considerably throughout 2024, we can not say the identical for the counterpart of non-fungible tokens.

Particularly within the third quarter, CoinGecko observes buying and selling volumes lowering by 61% from 3.1 to 1.2 billion {dollars}. On the similar time, NFT mortgage volumes additionally dropped drastically by practically 74%, going from 1.1 billion to 284 million {dollars}.

After the robust growth of 2021, this market area of interest has not recovered, regardless of persevering with to innovate technologically.

Customers want to allocate their liquidity in the direction of property which are extra simply liquidated and with higher Yield alternatives.

Contributing to this grim situation for the NFT market can be the affect of Bitcoin, which within the final 2 years has elevated its dominance over the remainder of the sector by 50%.

Moreover, the absence of a good panorama for hypothesis and the emergence of a variety of various funding choices have drained a lot of the liquidity that was current till just lately within the NFT world.

Such a distinctive property of their form, nonetheless, stay a basic useful resource for actions comparable to tokenizzazione, gaming, and l’arte.

An increasing number of organizations are implementing non-fungible tokens inside their actions, reflecting the utility worth of this revolution nonetheless underappreciated by the market.

Costs of the most important collections in keeping with CoinGecko knowledge

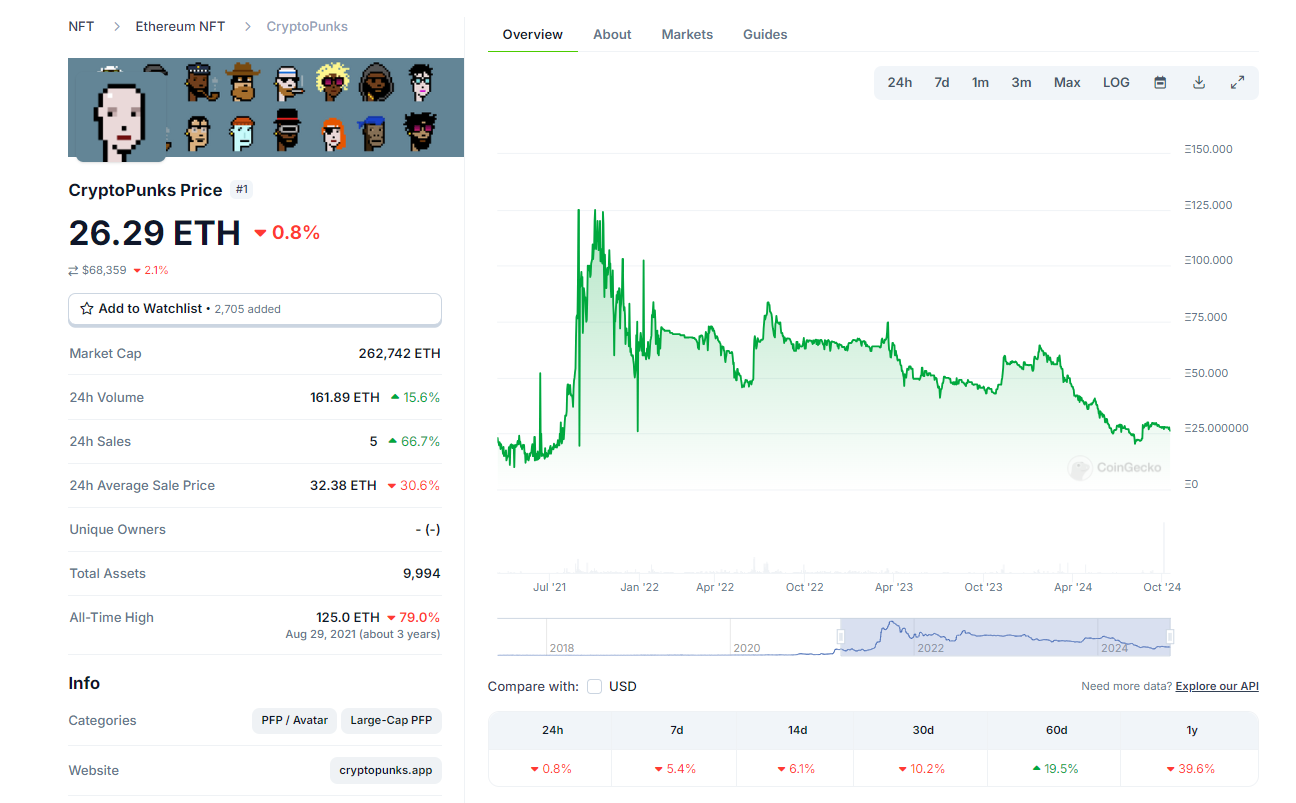

Based on CoinGecko knowledge, the principle collections of the NFT market are dropping worth when it comes to {dollars} and ETH.

In comparison with the historic highs recorded on the finish of 2021, immediately the quotations of probably the most established collections are in a robust drawdown.

For instance, the “CryptoPunks”, which in October 2021 had a ground worth of 120 ETH, now are value simply 26.29 ETH.

Changing to FIAT in keeping with the historic costs of Ethereum, the loss seems much more dramatic with over 350,000 {dollars} of worth worn out.

The general capitalization of the gathering stays at 267,742 ETH, equal to roughly 700 million {dollars}.

Supply: https://www.CoinGecko.com/en/nft/cryptopunks

The identical destiny of the CryptoPunks has additionally befallen different NFTs available in the market such because the “Bored Ape Yacht Golf equipment”, “Azuki”, “Mad Lads” and so on.

As highlighted by CoinGecko, all these cryptographic artworks that skilled skyrocketing will increase over the past bull market are actually within the icy bear market.

Only some exceptions of collections created extra just lately are saved, comparable to Milady and Pudgy Penguins, which have elevated their ground worth over the previous 12 months.

In any case, final week there was a small signal of restoration: whereas the crypto market was dropping, the market cap of NFTs rose by 0.58%.

It might be the start of a protracted restoration part for the quotations, which can must be confirmed within the coming months to realize credibility.

The overall world #NFT market cap is up 0.58% to $69.4B, whereas the full #crypto market cap is down 1.5% to $2.26T immediately.

Are you watching any NFT collections? 👀https://t.co/cSds1qt3K4 pic.twitter.com/qSnxKpUP7P

— CoinGecko (@coingecko) October 9, 2024

Gross sales volumes declining for the NFT market all through 2024

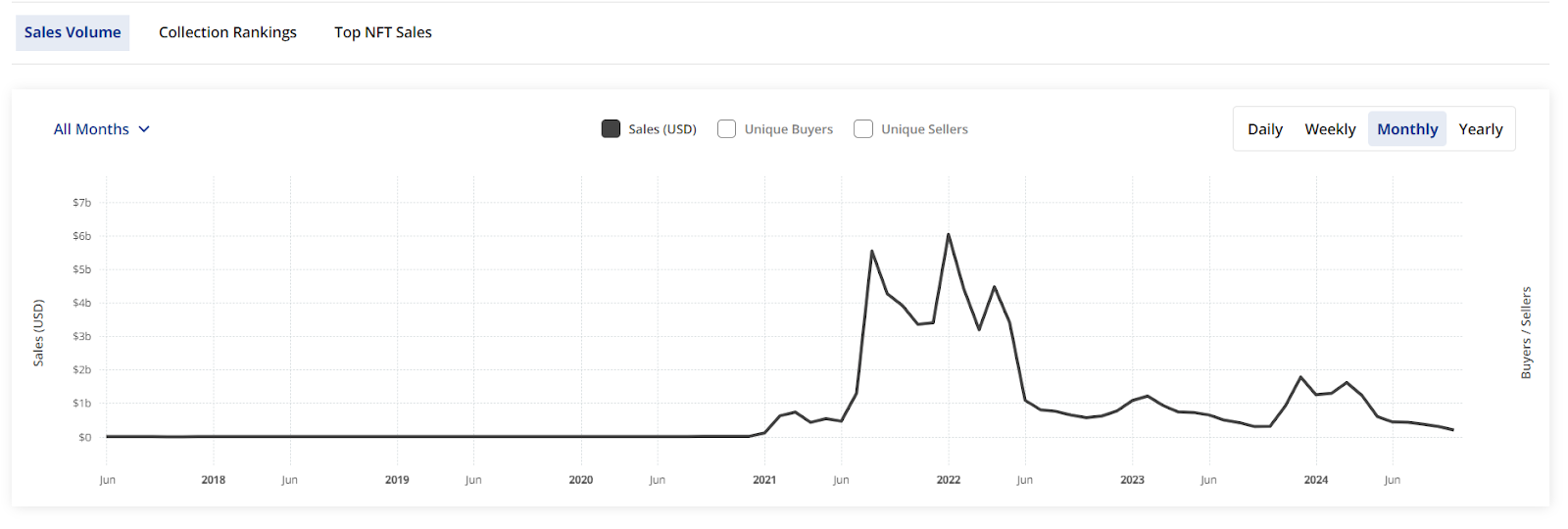

As talked about within the CoinGecko report, even the gross sales volumes of NFTs are in sharp decline, reflecting the market’s low curiosity in these merchandise.

Within the final 30 days, gross sales on Ethereum have decreased by 43% to 110 million {dollars}.

The identical on Bitcoin and Solana have dropped by 16% and 39%, respectively, whereas the biggest loss was on Polygon with a decline charge of 70%.

General, the NFT market processed gross sales for 303 million {dollars} within the month of September, in comparison with 370 million within the earlier month.

This situation has remained unchanged since December 2023, with knowledge in downtrend for every following month.

Solely in March 2024 was there a rise in buying and selling volumes, supported by the overall market euphoria which was then dampened within the following weeks.

From the CoinGecko and CryptoSlam knowledge, we discover that in comparison with the highest in December, gross sales have decreased by over 1.4 billion {dollars}.

If we take as a reference the all-time excessive of January 2022, when gross sales reached 6 billion {dollars}, the losses attain 95%.

Supply: https://www.cryptoslam.io/nftglobal?timeFrame=month

It’s evident that the NFT market remains to be in disaster and has not managed to emerge from the bear market of 2022.

The primary indicator of a restoration on this sense could be to see for 2 consecutive months gross sales volumes exceeding one billion {dollars}, displaying continuity in speculations.

Till then, it’s possible that the NFT sector will proceed to underperform Bitcoin and the opposite crypto tokens.