After years of refinement, Ethereum, the world’s largest good contracts platform, is scaling. Nonetheless, it doesn’t scale in the way in which most decentralization purists want. The community, attempting to accommodate all its customers, now depends primarily on off-chain options utilizing roll-up strategies to course of extra transactions and relieve the mainnet.

The Ethereum Layer-2 Growth

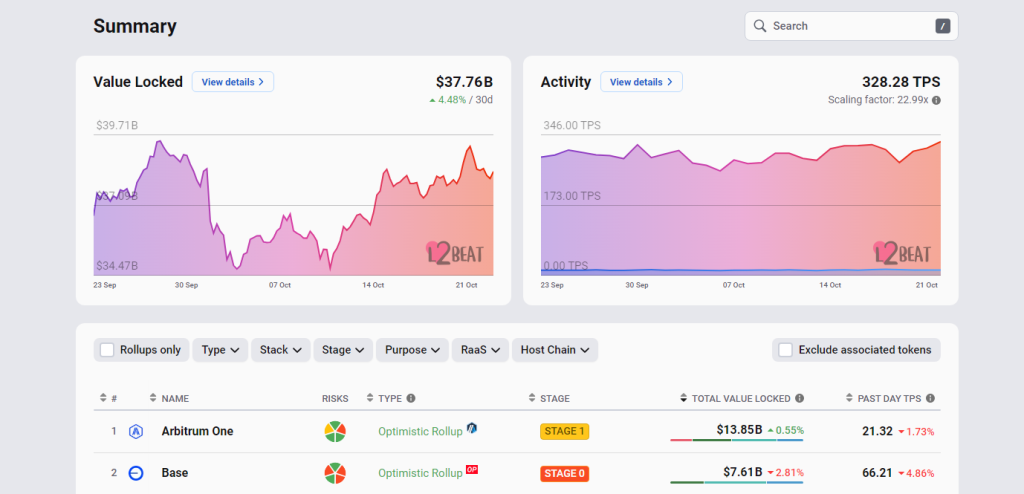

The end result has seen a increase with layer-2 platforms. In line with L2Beat, all these off-chain options scaling Ethereum handle over $37 billion value of belongings. The most important of all of them is Arbitrum, which controls greater than $13 billion.

Regardless of the increase, the query of decentralization nonetheless lingers. Arbitrum, Base, and different layer-2s on Ethereum could be gaining traction, however most have but to decentralize.

For instance, their builders’ failure to launch a decentralized fault-proof system or a sequencer makes them a weak point within the broader Ethereum ecosystem.

Public knowledge exhibits that Arbitrum has a permissioned fault-proof system, with Optimism having to withdraw after audits reveal flaws. In any layer-2 setup, a fault-proof system exists to make sure any transaction despatched to the sequencer is legitimate, similar to it will if despatched on the mainnet.

From the fault-proof, it’s sequenced earlier than batched and confirmed on the mainnet. There’s a charge paid at any time when Ethereum validators settle this batch of transactions.

Will L2s Have To Purchase Decentralization From Mainnet Validators?

The issue is that charges have fallen quick over the previous few months after Dencun’s activation. This development means that low fuel charges amidst a booming layer-2 ecosystem may disincentivize validators. Whereas it is a concern, Token Terminal analysts are satisfied that that is about to vary.

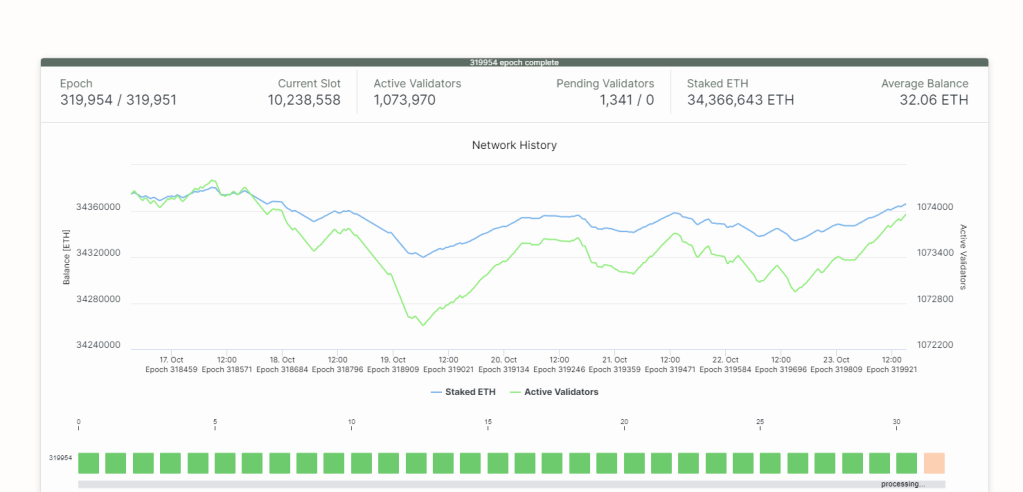

Of their prediction, all Ethereum layer-2s will ultimately must “purchase” decentralization from mainnet validators. The excellent news is there are various to select from. In line with Beaconcha.in, over a million validators are securing the blockchain.

Token Terminal argues that although they’ll additionally select to construct, creating a fancy internet of a decentralized community of layer-2 validators will probably be resource-intensive.

Because of this, shopping for decentralization from a subset of Ethereum layer-1 validators will probably be possible. If picked, these validators will negotiate for higher charges than the community presents, considerably rising their revenues.

On the identical time, because the demand for layer-2 decentralization resolution rises, the validators’ stream will even spike.

Function picture from Canva, chart from TradingView