Non-public fairness agency Aurum Fairness Companions stated Tuesday it’s launching a $1 billion tokenized fairness and debt fund on the XRP Ledger (XRP) community, an enterprise-focused blockchain carefully related to Ripple.

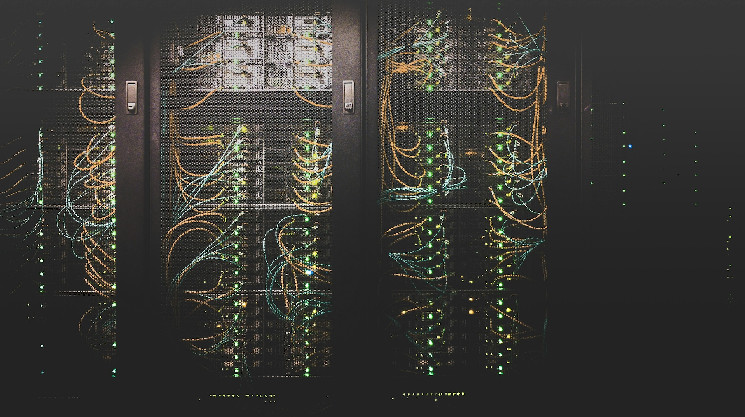

The fund focuses on investments in knowledge facilities throughout the U.S, United Arab Emirates, Saudi Arabia, India, and Europe, and it’s claimed to be the “world’s first mixed fairness and debt tokenized fund,” based on the press launch.

The fund leverages tech by San Francisco-based tokenization service supplier Zoniqx to create safety tokens of the underlying monetary devices.

The issuance marks a milestone for XRP Ledger and improvement agency Ripple Labs’ newfound ambition to assert a share of the booming real-world asset (RWA) tokenization house. Institutional buyers are more and more inserting conventional monetary merchandise like bonds, credit score and fairness on blockchain rails in pursuit of operational effectivity beneficial properties and speedier around-the-clock settlements. The RWA market may develop to trillions of {dollars} over the subsequent years, varied reviews from McKinsey, BCG, 21Shares and Bernstein estimated.

Ripple can also be awaiting approval from New York state regulators to launch its U.S. greenback stablecoin, which might play a key function to enhance liquidity and help establishments to tokenize and settle monetary property on the XRPL community, Ripple Labs President Monica Lengthy stated final week on the firm’s annual Swell convention.

Learn extra: Ripple Names Trade Companions for Stablecoin RLUSD, Awaits NYDFS Approval

“Tokenizing non-public fairness is one other rising use case in RWA, tackling the challenges of illiquidity and restricted entry in these markets,” stated David Schwartz, chief know-how officer of Ripple and co-creator of the XRP Ledger. “Through the use of XRPL’s means to course of transactions effectively and securely, Aurum and Zoniqx are exhibiting how real-world property may be managed extra successfully harnessing a decentralized blockchain.”