Animoca Manufacturers has surpassed different VC funds each in quantity and cash invested. The fund reworked from a recreation ICO and pivoted into supporting Web3, NFT initiatives, and extra video games.

Animoca Manufacturers is on observe to wrap up 2024 with double its common month-to-month investments. As essentially the most energetic VC fund for months in a row, Animoca Manufacturers has additionally expanded into 33 sectors for on-chain decentralized startups.

Animoca Manufacturers continued to maintain its hand on the heart beat of Web3, selecting out high-profile initiatives like Pudgy Penguins. In the middle of 2024, Animoca Manufacturers continued its observe document with new picks every month, taking part in mid-range rounds of as much as $10M.

Past securing funds, Animoca Manufacturers can be serving to choose the very best potential performers in Web3, gaming, and different on-chain sectors.

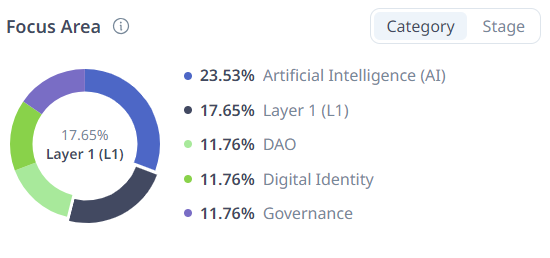

Animoca Manufacturers pivoted to AI whereas reducing its share in gaming initiatives. | Supply: Cryptorank

As an entire, crypto funding in 2024 responded positively to the bull market reawakening. Though removed from the funding hype of 2021 and 2022, VC funding grew in comparison with 2023, essentially the most stagnant 12 months of the bear market.

Animoca Manufacturers prolonged the success of Q3 funding, the place investments reached $2.4M. For the primary three quarters of 2024, funds injected $8B in crypto startups, on observe to match and barely exceed the funding ranges of 2024. Animoca Manufacturers has expanded its portfolio and funding efforts above the common degree for different funds.

In 2024, the overall variety of funding rounds is on observe to rise to three,308, up from 2,589 in 2023. A lot of the funding has gone to US-based initiatives. Animoca Analysis additionally expanded the fund’s affect, with a current particular give attention to the TON ecosystem.

Animoca Manufacturers breaks above 100 rounds for 2024

Animoca Manufacturers achieved over 101 rounds as of December 1, however continued with new investments within the remaining stretch of 2024. The corporate additionally served as a wise cash indicator, discovering probably sizzling video games and platforms.

On common, VC funds joined 85 rounds within the 12 months to this point.

The tempo of funding continued in December with Neptune Protocol for $3.9M. Earlier than that, Animoca Manufacturers engaged with startups like Bounty Bay, Haven 1, and GAIB. The most important current funding spherical was for BLIFE Protocol, the place Animoca Manufacturers helped increase $7M.

As with earlier months, the VC fund focused seed-stage startups, although it additionally participated in undisclosed rounds for normal functions.

In 2024, Animoca Manufacturers accomplished a median of 9 rounds, in comparison with a median of 4 rounds in 2023. This 12 months, the VC fund additionally diversified its portfolio of initiatives. Regardless of remaining a supporter of Web3 video games, Animoca Manufacturers decreased its share of recreation initiatives from 40% in 2023 to 30% this 12 months.

Animoca Manufacturers additionally decreased its allocation to high narratives, as an alternative shifting to AI. The fund participated in a wider collection of manufacturers and in a smaller variety of top-notch rounds.

Animoca Manufacturers was a backer in a few of the high funding offers in 2024. The offers included Monad Labs ($225M), Berachain ($100M), and OG Labs ($40M).

Smaller funds sustain the tempo in 2024

The years of large-scale VC-backed initiatives appear to be over. Whereas Pantera Capital, Andreessen Horowitz, and others have been nonetheless energetic, the largest variety of rounds accrued to crypto-native funds.

OKX Ventures and Binance Labs have been among the many high 5 traders this 12 months. Robotic Ventures additionally rose to prominence, with a complete of 52 rounds within the 12 months to this point.

Previously 30 days, Coinbase Ventures, Pantera Capital and Vitalik Buterin joined a sequence of rounds. For the previous month, the highest 3 offers included StakeStone ($22M), OG Labs, and Suilend ($4M).

For now, VC funds are staying away from the meme token pattern, which is just too risky for any strategic intentions. VC firms are additionally searching for new fashions to keep away from the accusations of dumping tokens on the group and crashing costs.

Land a Excessive-Paying Web3 Job in 90 Days: The Final Roadmap