Ethereum’s current value surge could also be constructed on shaky floor, in keeping with analyst ‘Crypto Lion’ in a ‘Quicktake’ on blockchain analytics platform CryptoQuant. The analyst cautioned {that a} correction might be imminent, citing information that implies a scarcity of real demand for Ether, regardless of current positive factors pushed by the approval of ETH ETFs.

Crypto Lion highlighted the shortage of demand for Ether, citing the “Trade Withdrawing Transactions” diverging considerably from the digital asset’s value trajectory. “Because of this bodily withdrawals are declining, so it’s protected to imagine that there’s merely no demand,” the analyst acknowledged:

“Because of this bodily withdrawals are declining, so it’s protected to imagine that there’s merely no demand.”

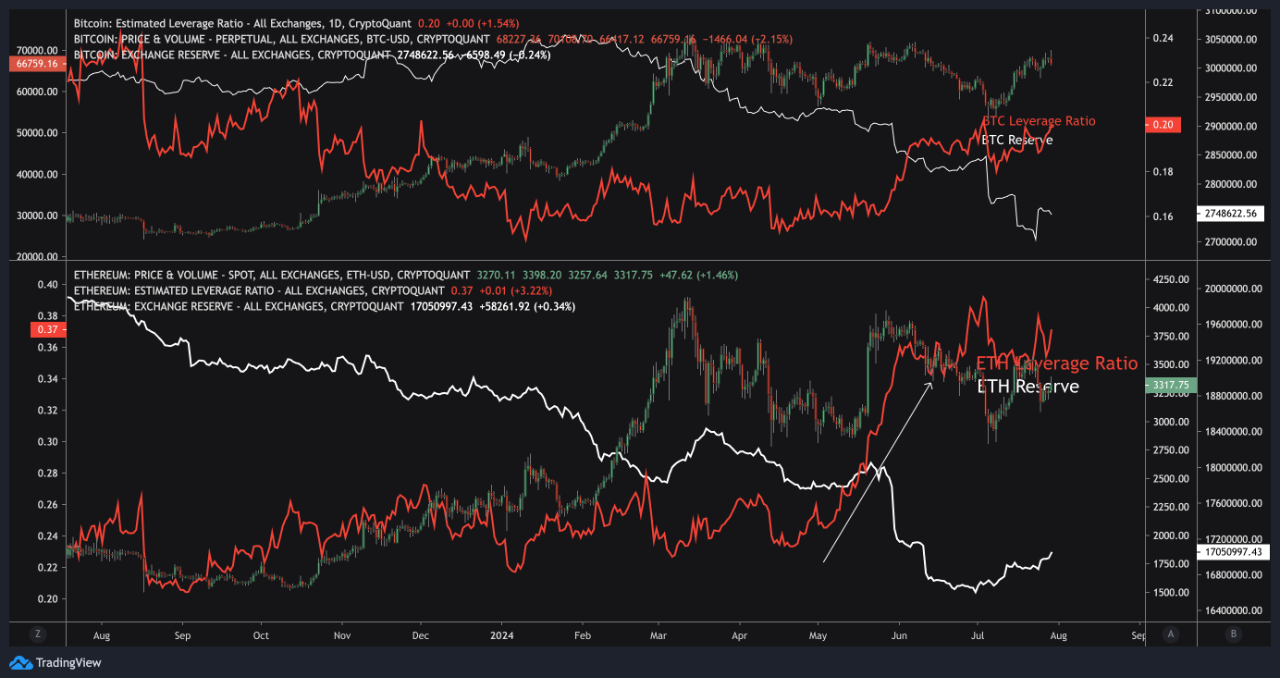

In response to Crypto Lion, the worth of Ether is being pushed greater by the Estimated Leverage Ratio (ELR) of ETH which printed monumental positive factors simply earlier than mid-Might when the ETH ETF was authorized. The analyst defined the explanations for the rise in ELR.

The components for ELR is Open Curiosity / ETH Trade reserve and as per Crypto Lion, the ELR rose sharply even earlier than the reserve decreased. This surge resulted from a spike in Open Curiosity, “which implies that a considerable amount of vertical balls have been loaded, and the assumed leverage rose sharply,” Crypto Lion mentioned, including:

“ETH value strikes like a variety after ETH ETF approval. Nevertheless, within the absence of Withdraw and whereas the ELR has not but been resolved, it’s advisable to chorus from shopping for.”

Up to now 24 hours, Bitcoin, the main digital asset, has crashed greater than 4%. Then again, ETH dropped just one.5% and is presently buying and selling at $3,316 with a 59.39% surge in buying and selling quantity, which stands at $17.3 billion, as per CoinMarketCap information.

In response to SoSoValue information, spot ETH ETFs witnessed outflows totaling $98.29 million on July 29, bringing the entire internet outflow to $439.64 million. Over $1.72 billion has left Grayscale’s ETHE whereas BlackRock’s ETHA has recorded $500 million in inflows till now.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not answerable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.