Ethereum (ETH) has proven vital power in opposition to Bitcoin (BTC), reclaiming a key pattern line and sparking discussions of a possible altseason.

The cryptocurrency has outperformed BTC since mid-Could, pushed by the anticipation of spot Ether exchange-traded funds (ETFs) in the US.

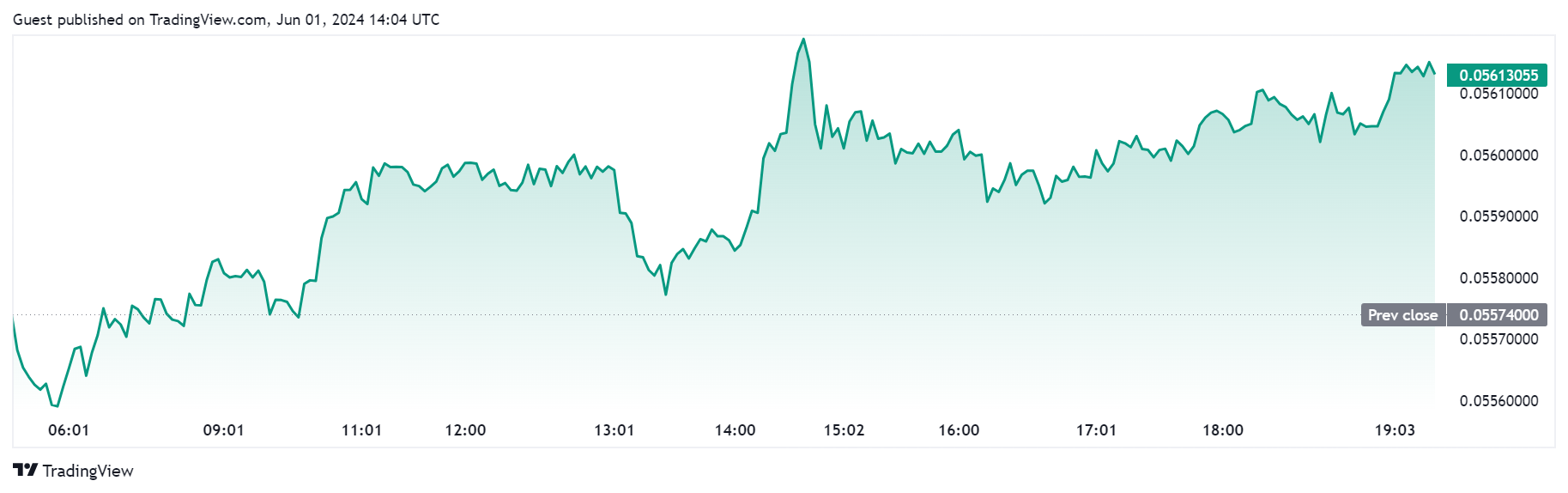

Ethereum’s worth noticed a major surge following the announcement of the approval for the Ethereum Spot ETF. The ETH to BTC ratio at present stands at 0.056, indicating a major improve for Ethereum.

Against this, Bitcoin has discovered assist at $67,000 and faces potential drops to $65,000. In the meantime, Ethereum holds regular at $3,700 amid heightened volatility.

Since Could 15, ETH has surged roughly 30%, in comparison with BTC’s modest 9% achieve. This efficiency is mirrored within the ETH/BTC ratio, which reached a two-week excessive of 0.05854 on Could 23, marking a 31% improve.

An in depth evaluation by pseudonymous crypto analyst Moustache revealed that the ETH/BTC ratio is reversing from a multi-year assist pattern line. Traditionally, when costs bounce from this line, altcoin costs are inclined to pattern greater.

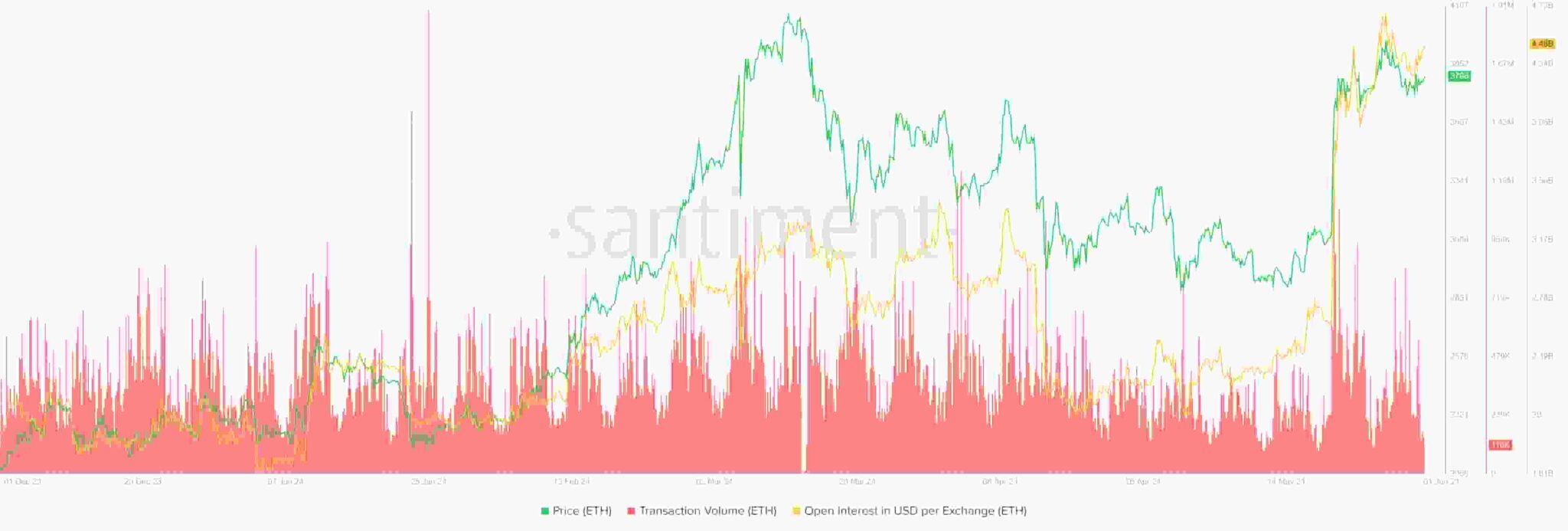

The approval of spot Ether ETFs by the US Securities and Trade Fee (SEC) on Could 23 has additional fueled bullish sentiment. This growth is seen as a major milestone for Ethereum, growing its attractiveness to institutional traders and probably driving additional worth appreciation.

Including to the bullish outlook, on Could 31, 920,000 Ether choices value $3.5 billion expired.

Traditionally, the expiry of crypto choices contracts is linked to cost volatility out there. The put/name ratio (PCR), a technical indicator that displays dealer market sentiment, is essential right here.

A PCR under 0.7 is taken into account a powerful bullish sentiment, whereas a PCR above 1 is taken into account bearish. This ratio compares the variety of lively places (bearish) contracts to name (bullish) choices, with a decrease PCR usually indicating a bullish bias.

Ethereum worth evaluation

Ethereum’s worth has skilled vital volatility over the previous week, fluctuating between a excessive of $3,965 and a low of $3,757. Regardless of this, within the final three days, the value has struggled to remain above $3,800, with bearish momentum prevailing.

At press time, ETH is buying and selling at $3,803.09, reflecting a 27% improve on a month-to-month foundation.

A bullish momentum is anticipated as a result of expectations of spot Ethereum ETFs, with the SEC asking companies for his or her amended S-1 types.

The general outlook for Ethereum stays optimistic as traders look ahead to additional regulatory developments and market reactions

Disclaimer: The content material on this website shouldn’t be thought-about funding recommendation. Investing is speculative. When investing, your capital is in danger.