In accordance with a number of crypto analysts, altcoins are exhibiting a notable breakout, hinting at a possible shift towards an altcoin-dominated market part.

Analysts noticed that the whole market capitalization of altcoins is rising, breaking out of longstanding downward traits. Technical and on-chain analyst Ali Martinez famous that whereas it’s unsure if a full-blown altcoin season has arrived, the present developments characterize a promising begin.

Analyst Caleb Franzen shared insights that altcoins measured by TradingView indexes like TOTAL.3 and OTHERS have surpassed vital transferring averages, particularly the 100-day and 200-day exponential transferring averages (EMAs). Franzen highlighted that the final such breakout occurred in July 2023, throughout which altcoins used these EMAs as dynamic assist to attain greater highs. He emphasised the significance of monitoring each day closes to substantiate this development.

Negentropic additionally identified the cyclical nature of the crypto market, suggesting that altcoins sometimes comply with Bitcoin’s bullish momentum, typically coming into a vigorous part as soon as Bitcoin breaks its all-time excessive and strikes into uncharted territory. The evaluation signifies that after a number of cases since Might the place Bitcoin surged with out triggering an altcoin season, present indicators present a simultaneous uptick in each Bitcoin and altcoin markets.

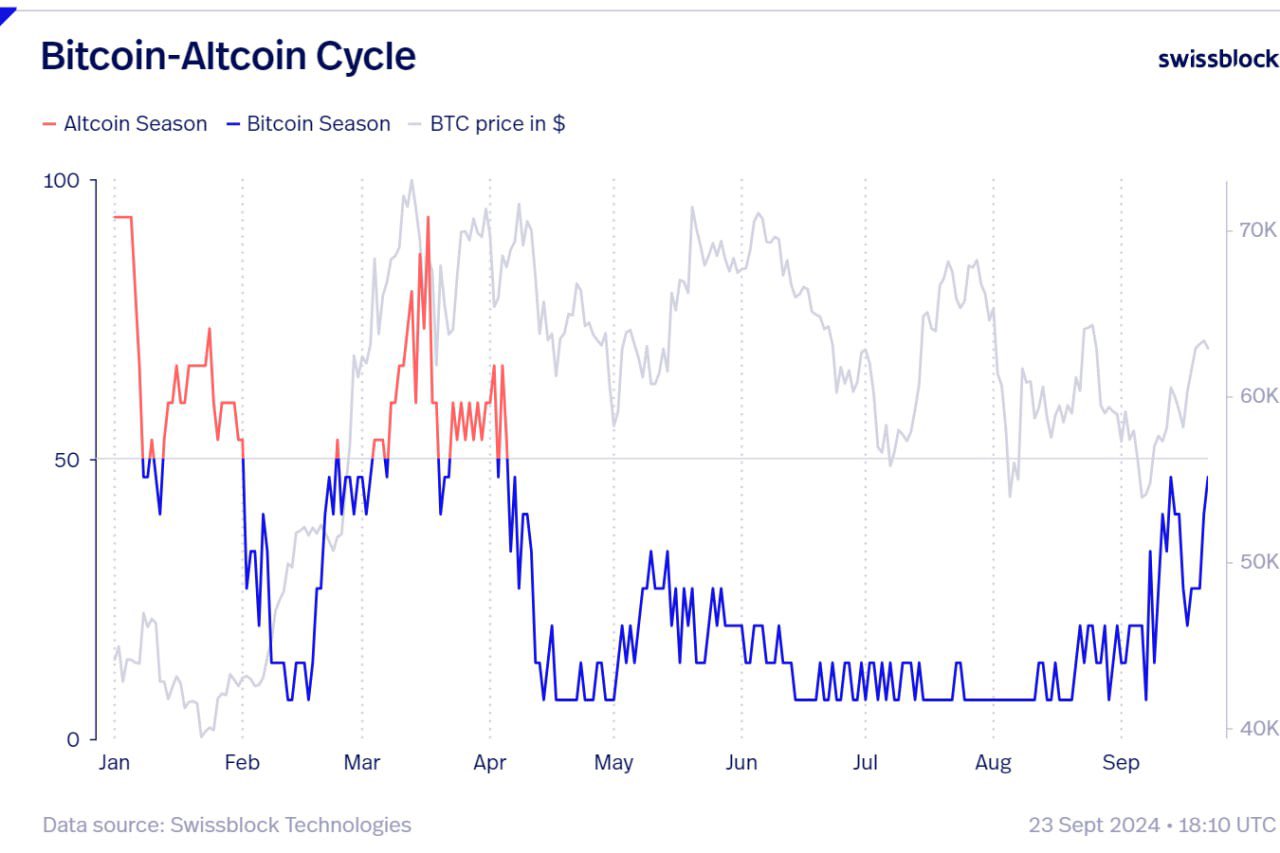

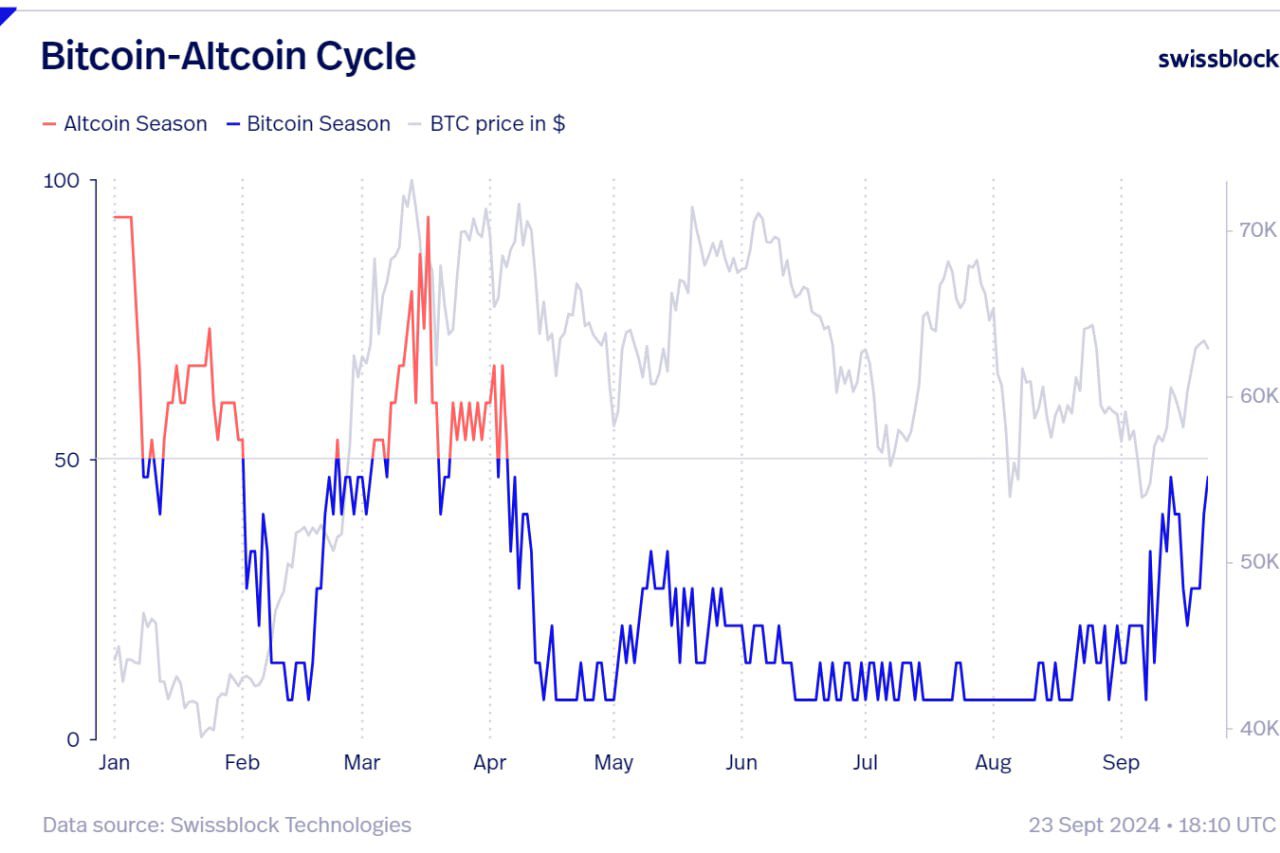

The Bitcoin-Altcoin Cycle chart from Swissblock Applied sciences illustrates this relationship. The chart depicts the inverse dynamics between Bitcoin and altcoin seasons all year long. When the Altcoin Season Index is excessive, Bitcoin’s dominance tends to be decrease, and vice versa. Presently, the index means that altcoins are gaining power alongside Bitcoin reasonably than lagging behind as in earlier cycles.

Bitcoin season dwarves altcoins to date in 2024

Regardless of these constructive indicators, it’s necessary to contemplate the broader market context. Over the previous 9 months, altcoins have usually underperformed in comparison with Bitcoin by way of value restoration and proximity to their all-time highs. Bitcoin is buying and selling round $64,334, roughly 12.77% under its ATH of $73,750, reached in March 2024. In distinction, many altcoins stay considerably under their peak costs. As an illustration, Dogecoin is about 86.12% under its ATH, Cardano is down by 89.22%, and Polkadot has declined by 92.49% from its highest worth.

This disparity means that whereas Bitcoin has regained a lot of its worth, altcoins have struggled to get better to the identical extent. Components contributing to this efficiency hole could embody elevated regulatory scrutiny affecting smaller cryptocurrencies, Bitcoin’s market maturity providing resilience throughout volatility, and heightened institutional curiosity predominantly benefiting Bitcoin.

The present breakout in altcoin markets might signify a change on this development. If altcoins proceed to construct on this momentum, it could result in a extra balanced restoration throughout the broader crypto market.

Presently, Bitcoin dominance is at 57%, down barely from 58.6% on Sept. 19. It reached its lowest on Sept. 10, 2022, at 38.9%, and has been climbing steadily for the previous two years. Over the previous 5 years, the best it reached was 72% towards the highest of the 2019 and 2021 bull runs.

Talked about on this article