Ethereum (ETH) worth is anticipated to notice an enormous surge following the launch of spot ETH ETFs this week.

Nevertheless, the larger query is whether or not the hype surrounding the ETFs will be capable to deliver curiosity again into staking or not.

Spot Ethereum ETF May Deliver Main Modifications

Ethereum’s transition from proof of labor to proof of stake was met with excessive bullishness. It launched a brand new type of yield for ETH holders, one thing that Bitcoin can not supply since it’s a proof-of-work chain.

Plus, with ETH staking got here the facility of partial governance as turning into or endorsing a validator made the traders an integral a part of the chain.

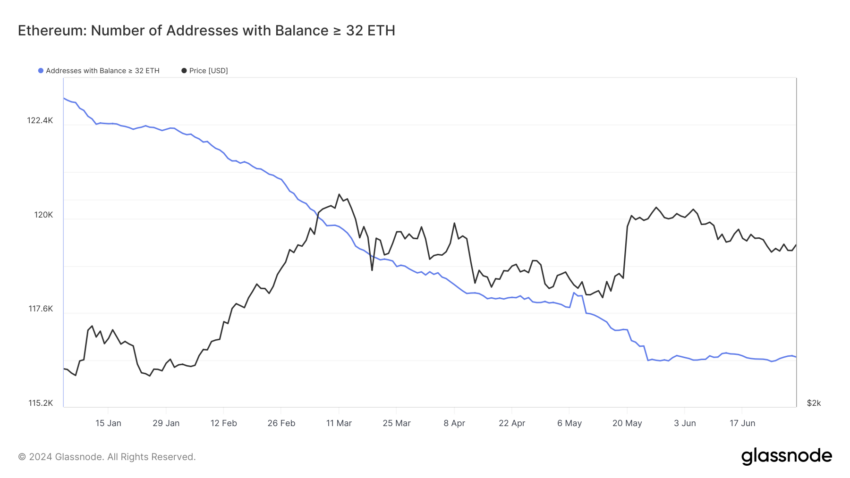

This ideology led to hundreds of thousands of ETH being staked within the chain. Nevertheless, the eventual arrival of restaking in June 2023 resulted in important outflows of staked ETH, which have been steady since Might 24 this 12 months.

Because the spot Ethereum ETF functions obtained approval on Might 23, the validators halted their unstaking. Since then, the variety of validators, i.e., the variety of distinctive addresses holding no less than 32 ETH, has been steady at round 116,480.

Learn Extra: The right way to Spend money on Ethereum ETFs?

Ethereum Validator Addresses. Supply: Glassnode

Nonetheless, the launch of spot ETFs is anticipated to revive the curiosity in staking once more. Discussing the identical, Chen Arad, Co-founder and CXO of Solidus Labs, completely advised BeInCrypto,

“A key factor for institutional curiosity in Ethereum ETFs transferring ahead could be staking of ETH held by ETF funds, which isn’t at present included within the permitted rule-change and proposals. This might make ETH ETFs an much more engaging product for wider audiences and open the door to additional institutional inflows and engagement with DeFi.

Nevertheless, to get regulators comfy with the staking of ETH ETF funds, the business must proceed addressing elementary considerations about compliance and safety dangers within the pre-chain block-building course of.”

This might have a equally bullish impression on Ethereum’s worth as properly.

ETH Worth Prediction: Eyeing $4,000

Ethereum’s worth bounced again from the assist of 38.2% Fibonacci Retracement at $3,336. The second-generation cryptocurrency is at present altering fingers at $3,474. There may be anticipation that ETH will reclaim the 50% Fib line at $3,582.

Ethereum’s worth could be open to an enormous restoration if this occurs, doubtlessly even flipping 61.8% of the Fib line into assist. This stage lies at $3,829, which might increase ETH towards $4,000 in the long term.

Learn Extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum Worth Evaluation. Supply: TradingView

Alternatively, a failure to breach any of those key resistance ranges might lead to a slowdown in restoration. If ETH traders promote their holdings throughout this period, the altcoin might find yourself at $3,336 once more, invalidating the bullish thesis.