Ethereum (ETH), the second-largest cryptocurrency by market capitalization, continues to dominate conversations within the crypto house. With its current worth actions creating ripples of uncertainty, traders are asking: Will ETH drop additional, or is a surge simply across the nook? By analyzing the supplied TradingView charts, we’ll break down the indications and patterns to assist reply this urgent query.

How has the ETH Value Moved Not too long ago?

The present worth of Ethereum (ETH) is $3,309.05, with a 24-hour buying and selling quantity of $29.86 billion, a market capitalization of $398.65 billion, and a market dominance of 11.88%. Over the previous 24 hours, ETH’s worth has seen a slight decline of 0.46%.

Ethereum reached its all-time excessive on November 10, 2021, buying and selling at $4,867.17. In distinction, its all-time low was recorded on October 21, 2015, when it traded at simply $0.420897. Following its peak, the bottom worth ETH has touched was $897.01 (cycle low), whereas the best worth since that time was $4,094.18 (cycle excessive). In the mean time, the value prediction sentiment for Ethereum is bearish, whereas the Concern & Greed Index sits at 50, reflecting a impartial market sentiment.

Ethereum’s circulating provide at the moment stands at 120.47 million ETH, with an annual provide inflation fee of 0.24%, translating to an addition of 287,841 ETH over the previous 12 months.

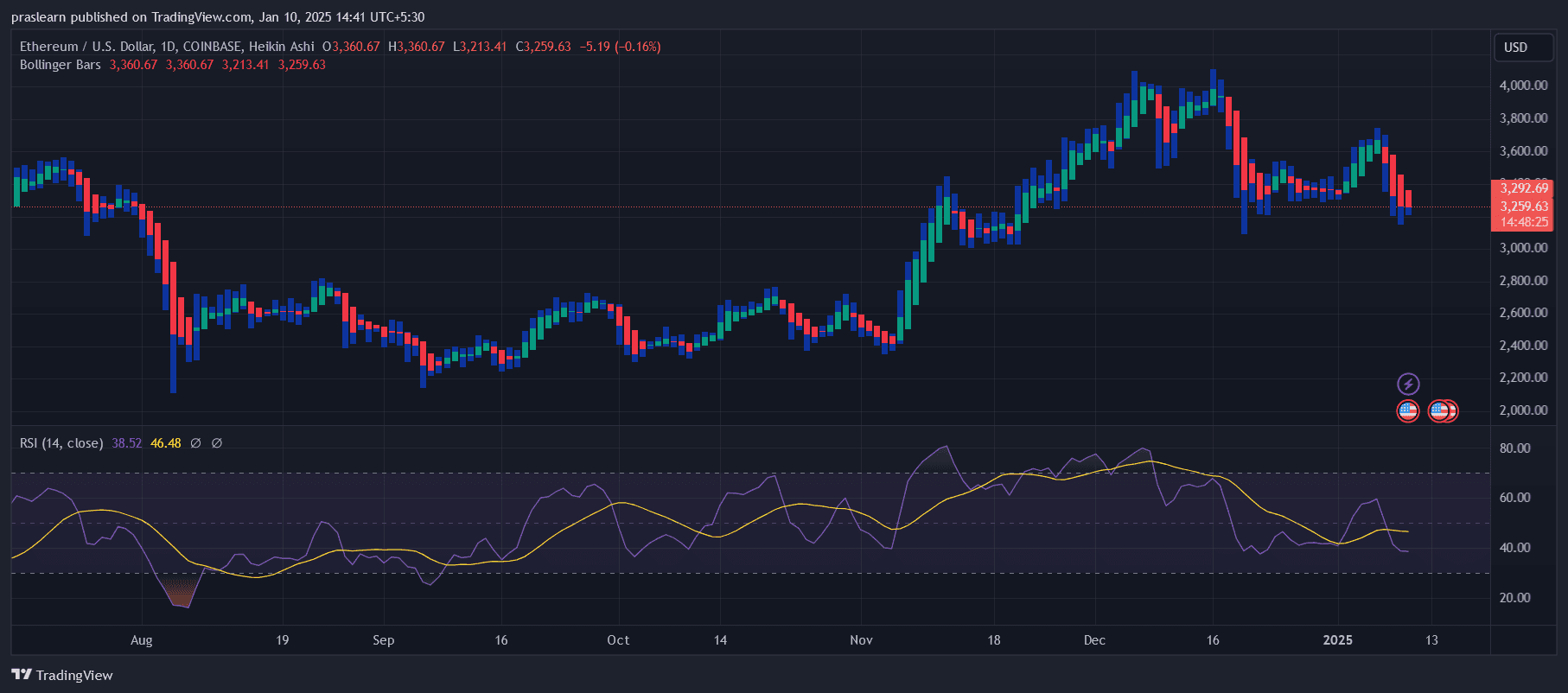

Day by day Chart Overview: Bearish Alerts Dominate

ETH/USD Day by day Chart- TradingView

Bollinger Bands Point out Oversold Circumstances

The day by day chart reveals Ethereum’s worth nearing the decrease Bollinger Band, a basic signal of bearish stress. Bollinger Bands measure worth volatility, and when the value hovers close to the decrease band, it usually suggests oversold circumstances. This doesn’t assure a direct rebound however highlights potential shopping for alternatives for merchants on the lookout for worth.

RSI Nears Oversold Territory

The Relative Energy Index (RSI), a preferred momentum indicator, sits at 38.52 on the day by day timeframe. RSI values beneath 30 sometimes sign oversold circumstances, whereas values above 70 point out overbought circumstances. At 38, ETH is approaching a degree the place patrons may see the asset as undervalued, which might result in an inflow of demand and stabilize the value.

Heikin-Ashi Candles Replicate Bearish Momentum

Heikin-Ashi candles on the day by day chart present consecutive crimson candles with minimal wicks, confirming bearish momentum. The slender physique of current candles suggests this momentum could also be shedding power, signaling a possible turning level if patrons step in.

Key Help and Resistance Ranges

- Help at $3,200: This psychological degree has held agency throughout current worth assessments. A breach beneath this might result in additional losses.

- Resistance at $3,360: For a bullish restoration, ETH should break this quick resistance. Sustained motion above $3,360 might pave the best way for a retest of $3,500.

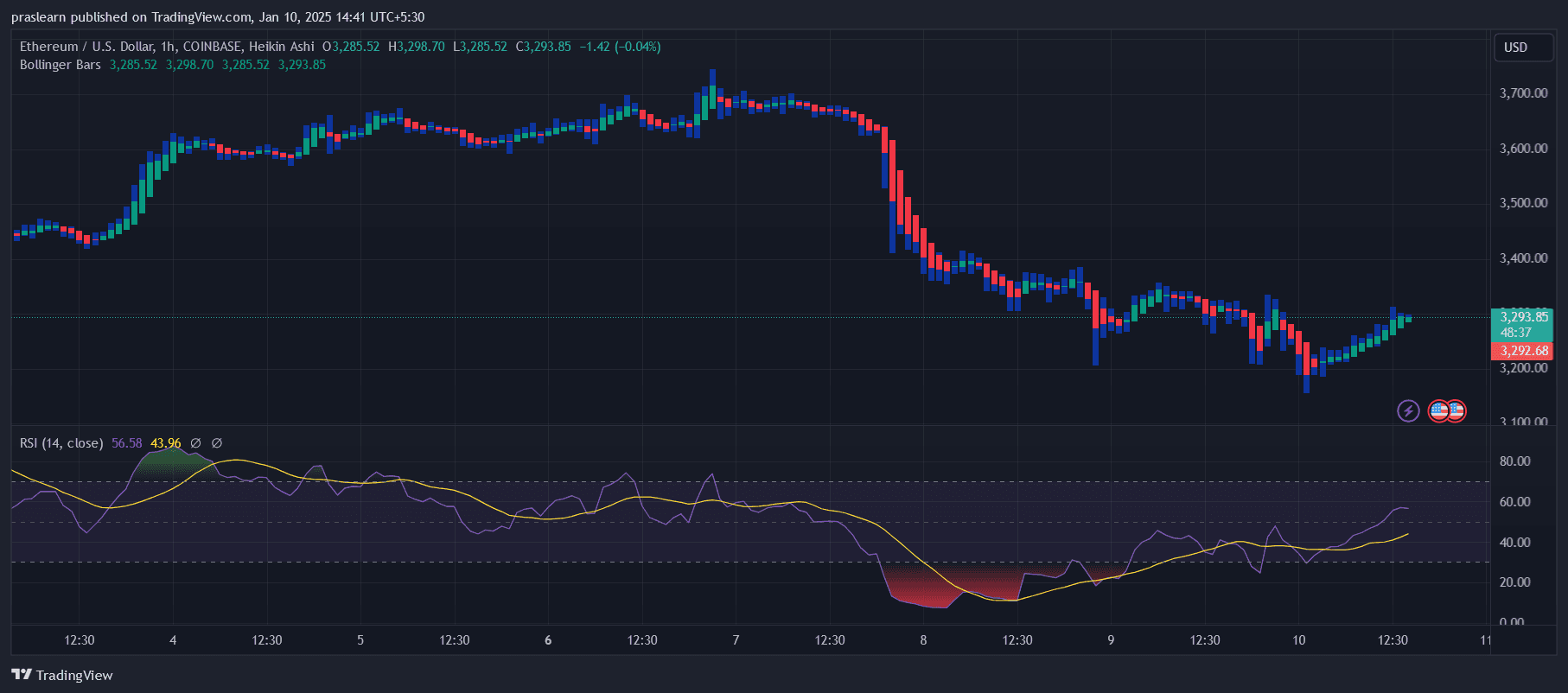

ETH Value Hourly Chart Overview: Early Indicators of Stabilization

ETH/USD Hourly Chart- TradingView

Brief-Time period Restoration in Progress

The hourly chart supplies a extra optimistic view. ETH has bounced again from the decrease Bollinger Band and is now flirting with the median line, suggesting a short-term stabilization. The narrowing Bollinger Bands trace at diminished volatility, usually a precursor to a decisive worth transfer.

RSI Factors to Impartial Momentum

On the hourly chart, the RSI has climbed to 56.58, reflecting a restoration from oversold circumstances. This implies ETH could expertise consolidation or a light upward development within the brief time period.

Shift in Heikin-Ashi Candles

Current inexperienced Heikin-Ashi candles with growing physique sizes present a shift towards bullish sentiment. Whereas not definitive, this may very well be the beginning of a short-term rally, significantly if shopping for quantity will increase.

Ethereum Value Prediction: Decoding Market Sentiment

Bearish Indicators

- Lingering Downward Momentum: On the day by day chart, the downward trajectory stays intact, with ETH unable to maintain above $3,360.

- Potential Breakdown: A detailed beneath the crucial $3,200 assist degree might set off panic promoting, with the subsequent goal round $3,000 or decrease.

Bullish Indicators

- Oversold RSI: RSI nearing oversold territory on the day by day chart might entice patrons, resulting in a reduction rally.

- Hourly Restoration: Brief-term stabilization on the hourly chart hints at rising purchaser curiosity. If sustained, this might translate into bullish momentum on greater timeframes.

Key Ranges to Watch

Help Ranges:

- $3,200: A crucial degree that should maintain to keep away from a deeper correction.

- $3,000: If $3,200 fails, $3,000 turns into the subsequent important assist.

Resistance Ranges:

- $3,360: The quick hurdle ETH should overcome to substantiate short-term bullishness.

- $3,500: A stronger resistance zone that aligns with earlier consolidation ranges.

Situations: Will ETH Drop or Surge?

Bearish Situation

If Ethereum fails to carry above the $3,200 assist, the bears might take management, pushing costs towards $3,000 and even decrease. This consequence would seemingly require exterior catalysts, equivalent to detrimental macroeconomic developments or weak spot in Bitcoin.

Bullish Situation

For ETH to rally, it should decisively break above $3,360. This may point out a reversal of bearish momentum and open the door for a transfer towards $3,500 and even $3,700. The hourly chart’s early indicators of stabilization counsel that is doable, however it can require sturdy shopping for quantity and improved market sentiment.

Conclusion

Ethereum’s worth is at the moment at a crucial juncture. Whereas the day by day chart reveals bearish dominance, the hourly chart hints at short-term stabilization. The subsequent important transfer will depend upon whether or not ETH holds above $3,200 or breaks by $3,360.

- For merchants: Monitor the RSI and Bollinger Bands for affirmation of a development reversal or continuation.

- For long-term traders: Think about the broader market context and ETH’s fundamentals, which stay sturdy regardless of short-term worth fluctuations.

Ethereum’s subsequent transfer might set the tone for the broader crypto market, so keep vigilant and be ready for each eventualities. Whether or not it’s a drop or a surge, ETH’s volatility is a chance for individuals who commerce with a plan.