Delta, a brand new layer-1 platform difficult the established order for constructing high-throughput decentralized functions, has raised $11 million in funding.

The platform positions itself as a “community of networks” that seeks to interrupt the normal trade-off between blockchain sovereignty and interoperability, a nagging drawback that many builders face at this time.

Delta’s funding spherical was led by Figment Capital and Maven 11, with contributions from Variant, DBA and different buyers. (Blockworks co-founder Michael Ippolito can be an angel investor.)

The purposeful objectives of Delta’s structure are much like these of the key rollup “clusters” — OP Superchain, the AggLayer or ZKsync Elastic Chain frameworks — all of which face interoperability challenges born from Ethereum’s rollup-centric roadmap.

Dapp builders typically have to decide on between two approaches: constructing throughout the confines of a single framework or creating an impartial appchain that should retrofit interoperability options.

The brand new strategy goals to mix the perfect of each worlds by providing builders native management over their atmosphere whereas nonetheless sustaining world connectivity by means of the bottom layer, in keeping with Ole Spjeldnaes, CEO of Repyh Labs, which is constructing Delta.

“Initially we thought that that is what Ethereum was going to be like — you wouldn’t have to have these native clusters,” Spjeldnaes advised Blockworks.

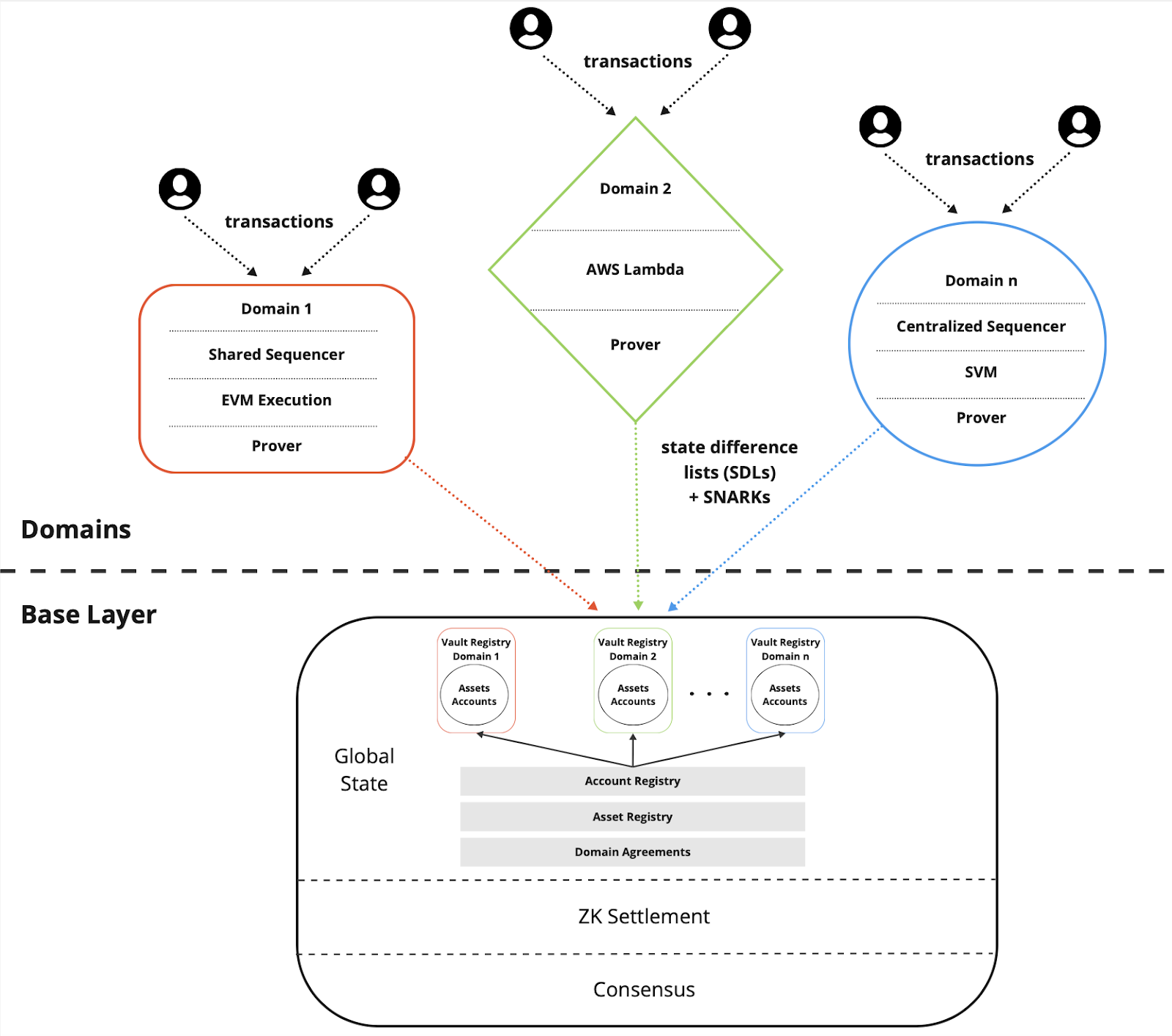

Delta’s structure separates execution and transaction ordering from information availability and settlement, providing theoretical benefits over each appchains and rollups, which usually require complicated bridging options. In Delta, execution happens inside particular person “domains,” that are akin to app-specific rollups or execution shards.

The important thing distinction from, say, a ZKsync Elastic Chain, is that these domains retain full energy over their blockspace and might use any current digital machine or develop customized packages. Nevertheless, Delta eschews Ethereum, and all its domains decide on a brand new decentralized base layer, which ensures shared world state and interoperability.

“Delta is a extra bottoms up strategy to attaining, initially, stronger properties than what one thing just like the ZK Elastic Chain can present as a result of it’s a single state machine,” Spjeldnaes stated. “If Ethereum didn’t have to consider being backwards suitable and had had the foresight, this might need been what it could have in the end regarded like.”

Not like Ethereum rollups, all belongings inside Delta’s community keep on the bottom layer, notes Myles O’Neil, Repyh’s chief product officer.

“There’s no actual equal for this in rollup terminology,” O’Neil advised Blockworks.

That has penalties for asset issuance and liquidity — as an example, a stablecoin will get issued as soon as on the bottom layer and is routinely accessible to be used in all domains.

One other standout function of Delta is its use of zero-knowledge proof-based settlement built-in instantly into the bottom layer, permitting domains to interoperate with none exterior coordination or middleman bridges.

Supply: Repyh Labs

“There are a minimal variety of issues that should be confirmed by all domains,” Spjeldnaes defined, however as long as they’re following this set of what are known as Delta’s “world legal guidelines,” they maintain the flexibleness to make use of no matter execution, sequencing or permissions mannequin they need.

Domains generate a State Diff Checklist (SDL), a compressed standardized format for state modifications based mostly on their very own transaction ordering, and submit it to the bottom layer, together with proofs that the SDL doesn’t violate any world legal guidelines (or the domains personal “native legal guidelines”). The state mannequin prevents conflicts between every domains’ subset of state.

“We let the domains be opinionated about how a lot else they wish to show,” O’Neil stated. “So in the event that they wish to be utterly trustless, similar to a ZK rollup, they’ll select to show their complete execution path.”

All domains might want to use a shared prover, which ought to be “essentially the most environment friendly one for all” Spjeldnaes stated. “The objective is de facto to maximise sturdy interop with out infringing on the sovereignty of every area,” he added.

Delta’s proof-of-stake validator set makes use of a leaderless and orderless consensus mechanism, often known as Byzantine Dependable Broadcast (BRB), which Spjeldnaes compares to Sui’s Narwhal-Bullshark consensus algorithm.

“I feel Sui may be very elegant,” Spjeldnaes stated. “They can simply do ordering for these transactions that want ordering [but] that provides a ton of overhead — which you’ll be able to inform by their benchmarks — you’ve Narwhal after which it’s a must to add consensus on prime of Narwhal, and that’s actually the bottleneck.”

BRB avoids this overhead, and Spjeldnaes famous the computation necessities for validators will likely be very low, as a result of their major job is verifying proofs. By foregoing the necessity for world transaction ordering, the community scales linearly as extra machines are added, Spjeldnaes stated.

“We see this as being additionally a protocol which might scale fairly effectively when it comes to the variety of validators, however we haven’t examined this but, so we can not actually make a robust declare about it.”

Delta’s greatest drawback will likely be the right way to bootstrap utilization and herald belongings to yet one more new layer-1 community. With the mainnet launch nonetheless over a yr away, O’Neil stated they’ll be going after each crypto natives and non-crypto builders from the fintech and Web2 world.

By taking over the shortcomings of present main ecosystems like Ethereum and Solana, the group hopes to display the deserves of a brand new paradigm.

“What a system would appear like for those who have been to rebuild issues from scratch,” O’Neil stated.