DWF Labs, a outstanding crypto buying and selling and market-making agency, is making ready to enter the booming stablecoin sector.

In an Aug. 1 assertion on social media platform X, Andrei Grachev, the agency’s managing associate, said:

“Following our plans to be a worldwide web3 monetary establishment, I’m glad to announce that DWF Labs is engaged on a CeDeFi artificial stablecoin that can permit customers to obtain a pleasant yield with out shedding any flexibility in utilizing their belongings.”

Grachev didn’t disclose additional particulars in regards to the stablecoin. Nonetheless, this transfer alerts growing institutional curiosity within the stablecoin market. Over the previous yr, main monetary establishments like PayPal and Ripple have proven curiosity within the quickly increasing sector.

Stablecoins have confirmed to be one of the sensible functions of crypto, providing a secure various to the volatility of digital belongings like Bitcoin.

Stablecoin customers in rising economies like Venezuela and Nigeria usually depend on the belongings to hedge in opposition to declining nationwide currencies and for on a regular basis transactions.

CryptoSlate’s information reveals that Tether’s USDT and Circle’s USDC dominate the $164 billion stablecoin business, holding roughly 90% of the market share.

Stablecoin’s market cap grows.

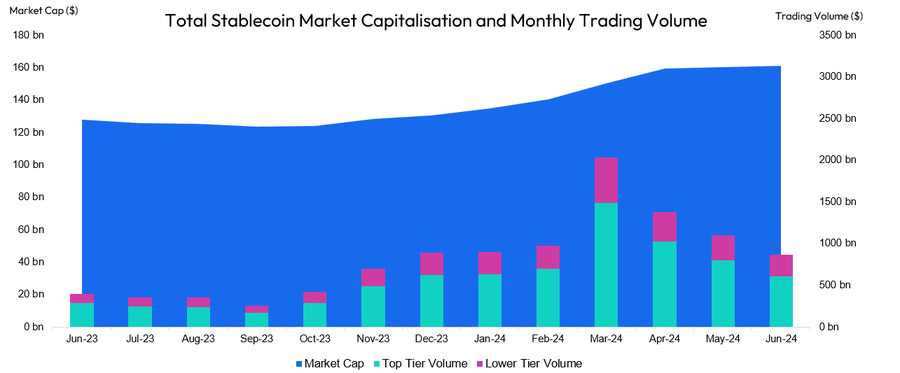

DWF Labs’ transfer comes amid the continued rise in stablecoins market capitalization.

CCData reported that the entire market capitalization for the belongings grew by 2.11% in July to $164 billion, its highest level since Terra’s ecosystem collapsed in Could 2022.

This improve marks the tenth consecutive month of development for the sector and is the very best month-to-month rise since April.

Market observers defined that the rise signifies new capital getting into the market, mirrored within the constructive motion of digital asset costs in July.

Regardless of this rising provide, stablecoins buying and selling quantity on centralized exchanges fell for the fourth month, dropping by 8.35% to $795 billion as of July 25.

Conversely, on-chain transactions surged by 18.3%, reaching $999 billion in July, the very best degree since April. This represents a 69.4% improve from the earlier yr, pushed by the influence of spot ETFs within the US.