Dakota will provide returns based mostly on lending by decentralized finance protocols to beat the drawbacks of centralized lenders.

The corporate was based by former Airbnb, Anchorage and Coinbase executives.

It’s geared toward companies, which pays a month-to-month price.

Dakota, which describes itself as a crypto financial institution that’s trying to proper the wrongs of centralized lenders comparable to Celsius and BlockFi, emerged from stealth on Wednesday.

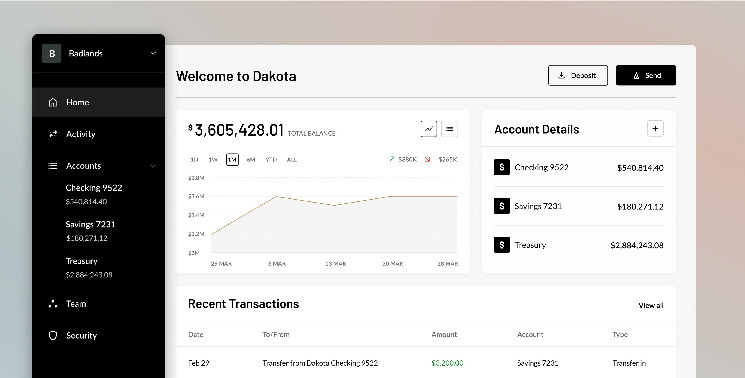

The corporate, which was based by a gaggle of former Airbnb, Anchorage and Coinbase Custody executives, provides treasury administration, lending and cost providers to companies that pay a month-to-month price and achieve entry to a platform that permits them to lend out their deposited crypto throughout a number of decentralized finance (DeFi) protocols.

The mannequin differs from earlier, centralized crypto lenders comparable to Celsius Community, which filed for chapter in July 2022, and BlockFi, which adopted go well with 4 months later, stated CEO Ryan Bozarth. In these instances, the businesses stood on the middle of the method: receiving deposits, lending them out and taking a price from the curiosity cost.

At Dakota, the purchasers make the lending resolution and select which decentralized finance (DeFi) protocol they want to use. The month-to-month price ranges between $150 and $1,500, and purchasers who select to lend their deposits can earn returns of as much as 9%. Stablecoin holders will obtain a yield based mostly on U.S. Treasuries.

“The most important distinction for us is that we solely lend out by DeFi protocols and so there is no such thing as a centralized lending,” Bozarth, who was beforehand the CEO at Coinbase Custody, stated in an interview. “DeFi protocols there’s, admittedly, some threat with that, but it surely’s at the very least a clear threat, it is sensible contract threat.”

Whereas Dakota seems to be a novel concept that’s fixing an issue, the crypto business continues to be tending to the scars earned throughout the collapse of firms together with Celsius, BlockFi and FTX.

Celsius filed for chapter in July 2022 regardless of having $12 billion in belongings underneath administration two months prior. The corporate’s plight was brought on by setting an overambitious yield of 17%, which led the agency to make use of newer and riskier blockchains like Terra. The eventual chapter, like BlockFi’s, left lots of of hundreds of collectors at nighttime over whether or not their deposited funds would ever be returned.

With DeFi, there is a better diploma of transparency, Bozarth stated, pointing to DeFi lending protocol Aave.

“In case you take a look at the final downturn, [Aave] carried out completely as everybody knew there was nothing to barter with, you’ll be liquidated if you happen to hit this marker and they also labored phenomenally nicely whereas centralized lenders didn’t.”

Dakota additionally caters to the fiat forex market greenback transfers, deposits and withdrawals. These providers are designed for treasury-management functions, with all {dollars} deposited to the platform being backed by U.S. Treasuries.

One of many largest hurdles for U.S.-based crypto companies is constructing a product that may adjust to various ranges of regulation throughout jurisdictions. Final yr Coinbase (COIN) needed to roll out an offshore sector of its firm on account of restrictions within the U.S.

Dakota’s dollar-based providers usually require cash transmitter licenses (MTL) in each state. The corporate will bypass that within the U.S. by utilizing a 3rd get together that has an MTL the place wanted. In Europe, it plans to safe a Digital Asset Service Supplier License (VASP) and every area can have its personal regulatory and compliance necessities, a few of which will likely be constructed in-house by Dakota and third events will likely be used for the remainder.