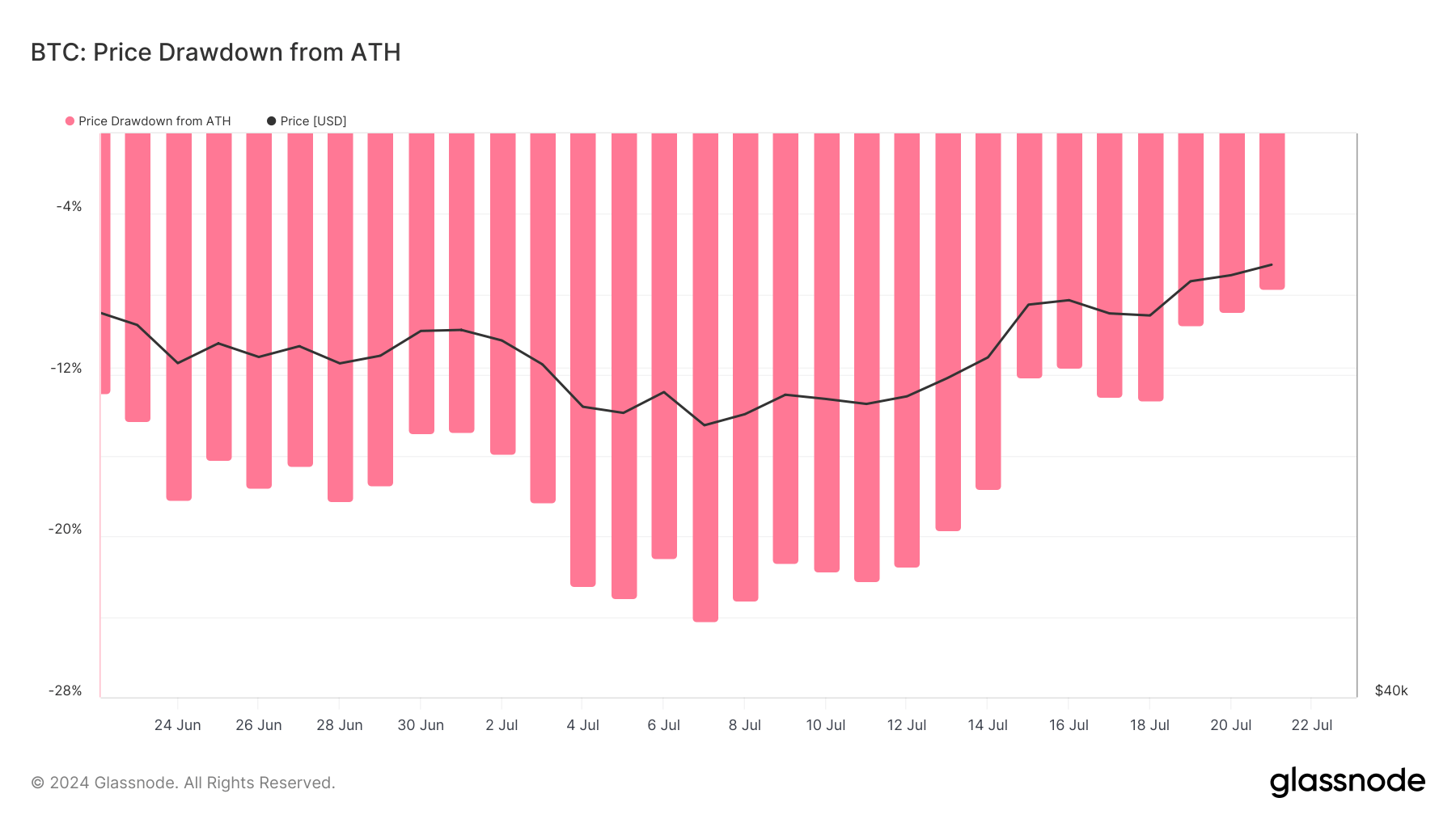

Bitcoin crossed the $68,000 mark through the weekend after President Joe Biden introduced his exit from the presidential race for the upcoming elections in November 2024.

The occasion confirmed simply how delicate the worldwide crypto market is to US political occasions. The discrepancy between America’s affect on the worldwide crypto market and its share of the worldwide market turns into evident when analyzing buying and selling volumes.

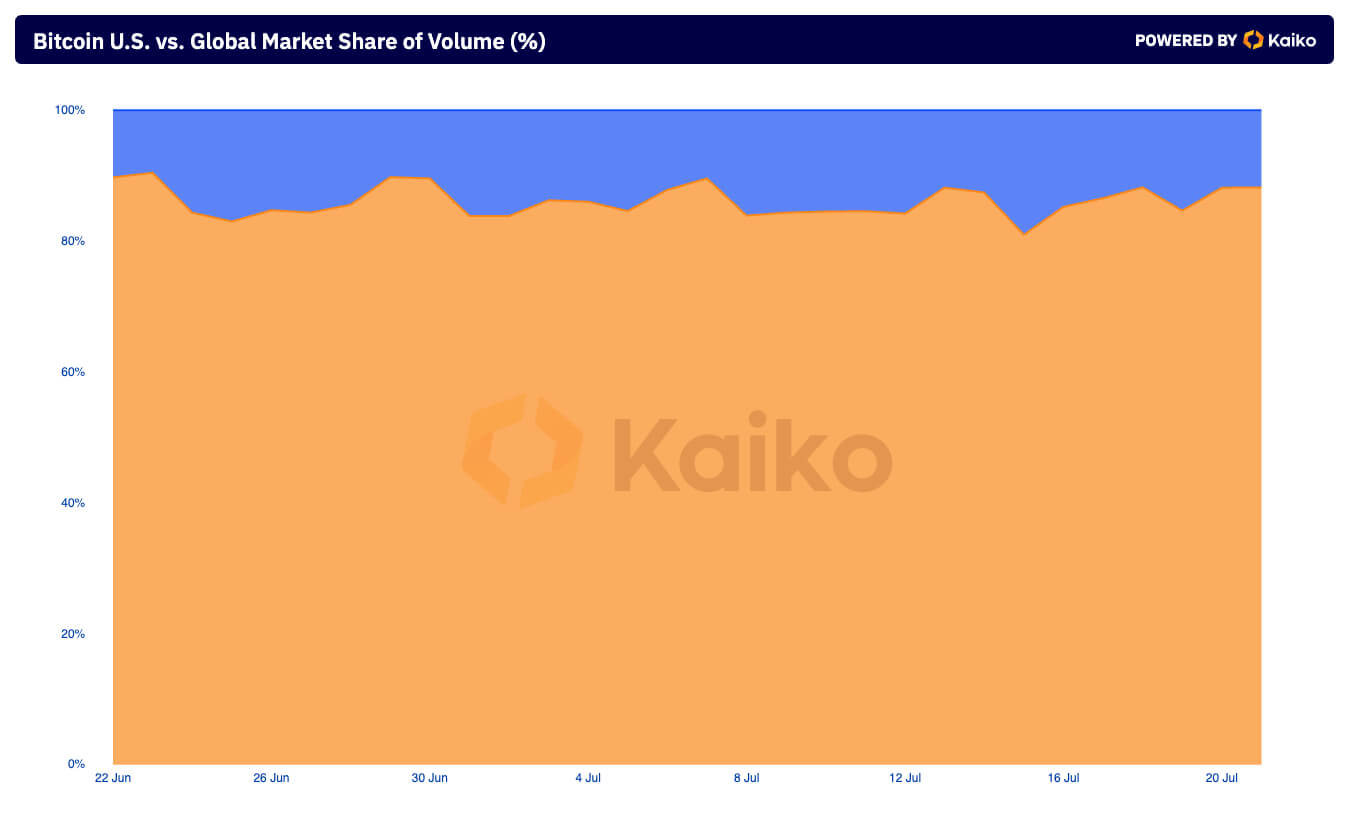

Kaiko information reveals that the market share of US exchanges when it comes to buying and selling quantity at the moment stands at 11.79%. International exchanges, then again, dominate with 88.12%.

The disparity reveals that the majority crypto buying and selling exercise on centralized exchanges occurs outdoors the US. Whereas quite a few causes have contributed to this discrepancy, the regulatory surroundings within the US stands out as essentially the most vital issue.

The regulatory panorama within the nation is way harsher in comparison with different areas. The SEC’s strict oversight and enforcement actions have led to cautious participation by retail and institutional buyers. US-based exchanges have needed to implement rigorous compliance measures that differ from state to state, deterring a big portion of retail merchants.

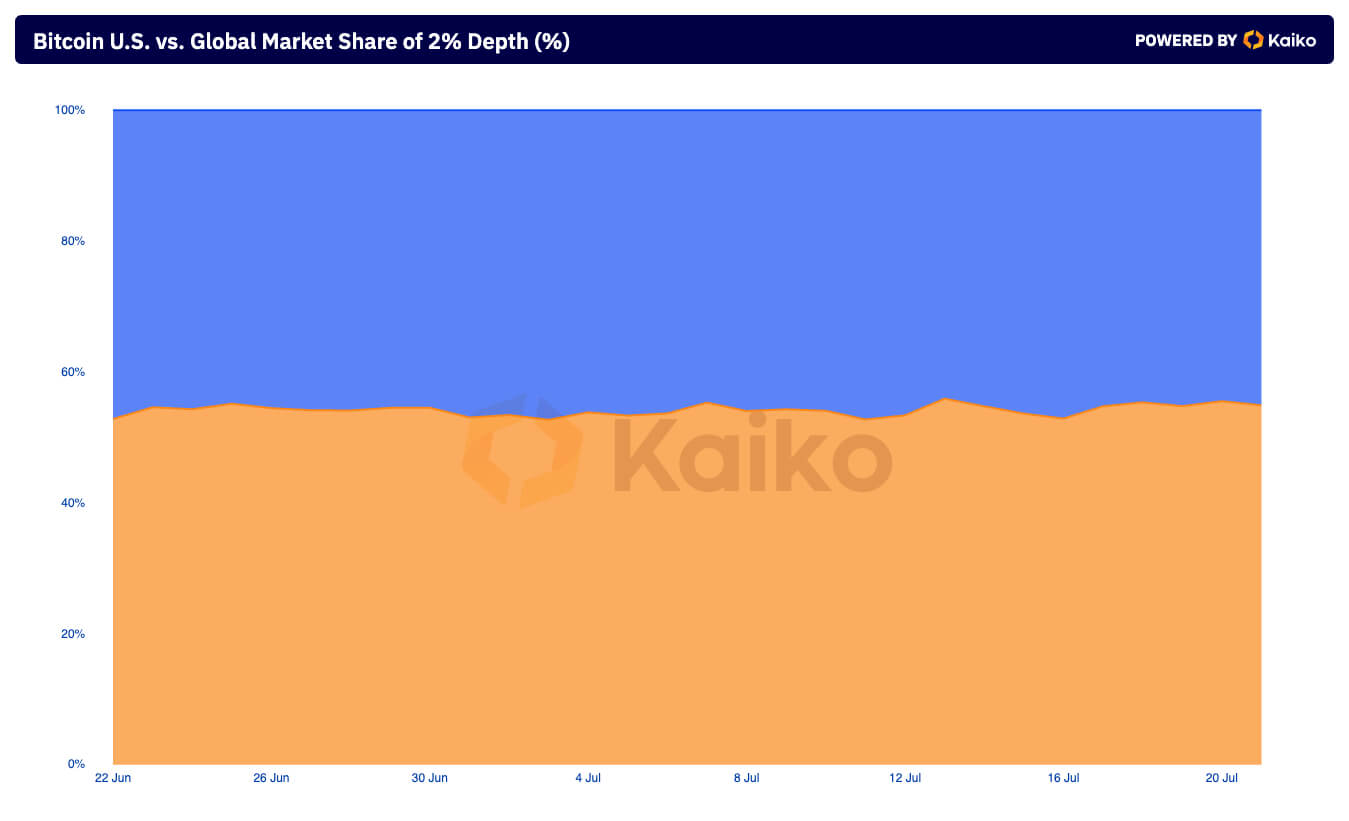

Nonetheless, regardless of the low quantity share, the US accounts for nearly half of the market’s liquidity. Kaiko information reveals that US-based exchanges account for a considerable 45.09% of the worldwide market depth on the 2% degree.

Market depth reveals the market’s basic capacity to maintain comparatively giant orders with out considerably impacting value. This is a vital metric because it acts as an indicator of total liquidity. A deep market with substantial orders throughout the 2% vary reveals that giant orders can happen with out inflicting vital value fluctuations. This excessive liquidity then helps scale back value volatility, which is especially vital for institutional buyers who cope with giant purchase and promote orders.

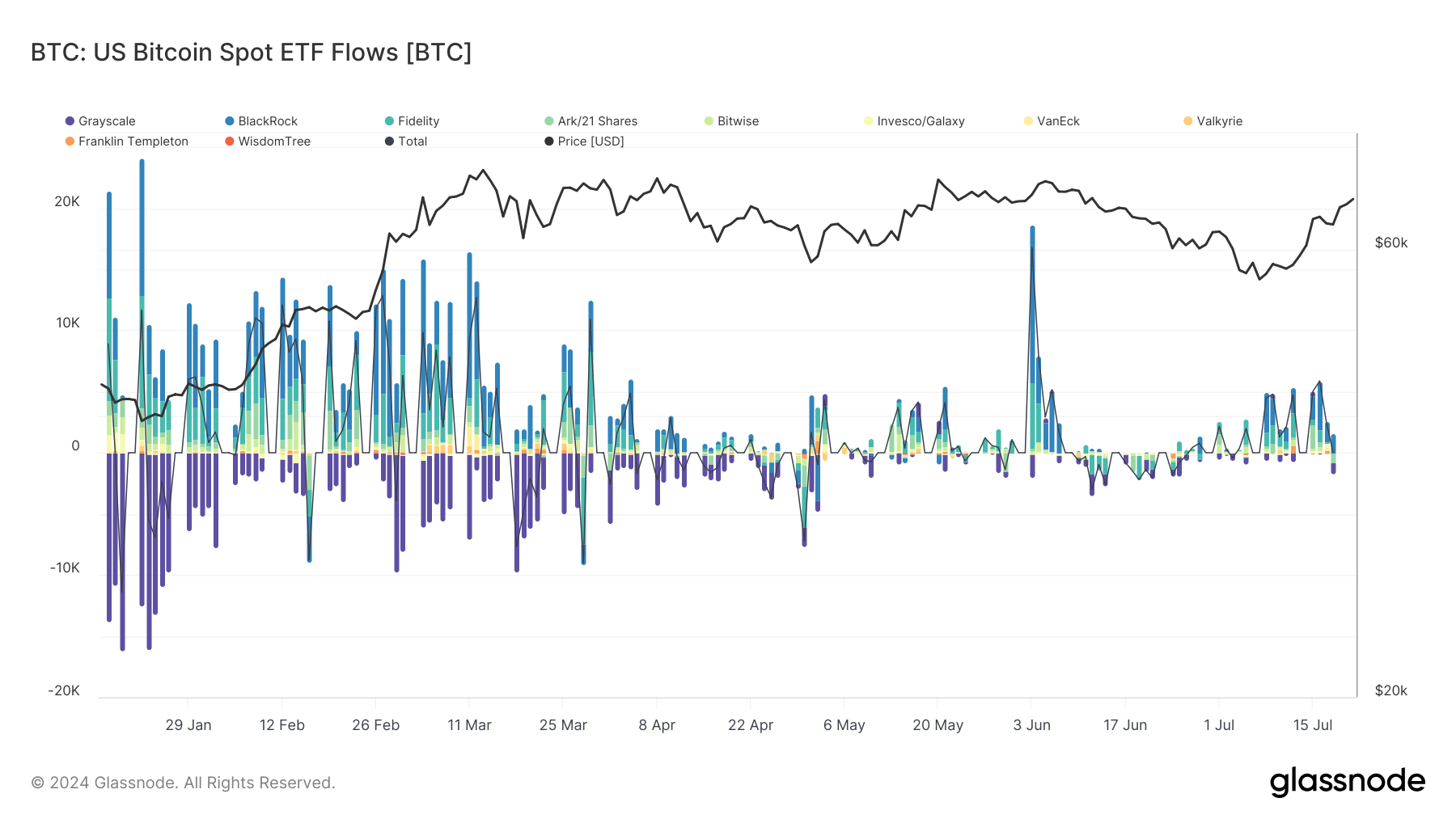

Excessive liquidity within the US could be attributed to the massive presence of institutional buyers. Their presence has elevated drastically for the reason that launch of spot Bitcoin ETFs this 12 months, as these merchandise contribute to greater liquidity and deeper order books on exchanges the place these ETFs are traded or tracked.

The creation and redemption processes of spot Bitcoin ETFs contain large-scale transactions within the underlying Bitcoin market. When new ETF shares are created, licensed contributors (normally exchanges like Coinbase) buy the equal quantity of Bitcoin from the market, contributing to market depth. Conversely, when ETF shares are redeemed, the underlying Bitcoin is bought, additional including to the liquidity and depth of the market.

The sheer dimension of this market is why information coming from the US can transfer Bitcoin’s value lower than 8% away from its ATH regardless of accounting for such a small share of quantity.

The put up US strikes world markets due to liquidity, not quantity appeared first on cryptoteprise.