Earlier this week, BlackRock’s BUIDL crossed $500 million — a milestone by no means earlier than reached by a tokenized cash market fund.

Tokenized funds have actually taken off in the previous couple of years, Securitize CEO Carlos Domingo advised Blockworks. BlackRock and Securitize launched BUIDL earlier this yr.

Nevertheless, just some traders can entry the fund. Certified traders with greater than $5 million in belongings can subscribe by means of Securitize.

So what has led to this progress?

The rise of stablecoins is unquestionably an element, as a result of it made people take into consideration what else may very well be tokenized, Domingo mentioned.

Learn extra: Circle debuts method to commerce BlackRock tokenized fund shares for USDC

Proper now the full worth of the tokenized treasurys market, which incorporates BUIDL, sits at $1.8 billion. Domingo wouldn’t be stunned to see that market cap prime $2 billion quickly.

Whereas the market is clearly far smaller than the $160 billion stablecoin market, “it’s undoubtedly rising means sooner than stablecoins.”

“Bear in mind, stablecoins are simpler to buy and use as a result of they’re permissionless, whereas tokenized treasurys are securities. So that they have some restrictions when it comes to who can buy them, how one can switch them, and so forth. So that they’re by no means going to be — in my view — as massive as stablecoins…however I believe they’ll simply develop into 10% to twenty% of the market of stablecoins,” he mentioned.

Whereas the remainder of the business was little doubt buoyed by the launch of the bitcoin ETFs earlier this yr, Domingo thinks the 2 have operated in “parallel paths.”

“The best way I see it’s: You’re taking a Web3 asset, which is bitcoin, and you place it on the [traditional finance] world by means of an ETF. Relatively, I believe tokenization is the other. You’re taking a [traditional finance] asset and you place it on the crypto — on the Web3 house — by means of tokenization. So they’re like two distinct issues which can be very beneficial however don’t have anything to do with one another,” he mentioned.

Domingo mentioned the conversations he’s been having with others within the house, noting that they’ve intensified for the reason that launch of BUIDL.

“Each single asset supervisor on the market is considering how they’ll take part,” he advised me. Which is maybe not shocking, given the urge for food for BUIDL.

However that success isn’t solely reserved for BlackRock.

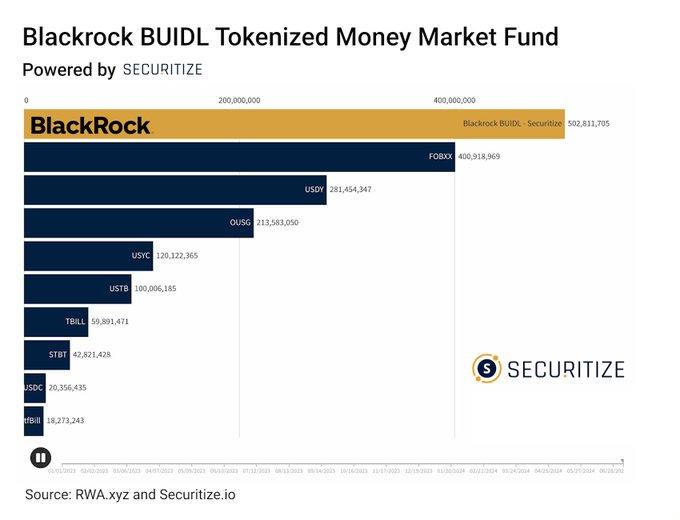

In keeping with rwa.xyz, Franklin Templeton’s fund, FOBXX, which was launched in April of final yr, has topped $400 million — a 16% enhance over the previous 30 days. BUIDL, to place it in perspective, noticed an almost 9% leap in the identical time interval.

A have a look at the most important funds within the house. Credit score: Securitize.

However Domingo thinks that BUIDL’s subsequent $500 million may come even faster — the fund simply launched 4 months in the past. A part of that could be due to some “new options,” he teased. Some can be unveiled in just some weeks.

There’s additionally the truth that, due to the character of the fund, there could be a little bit of a delay when making an attempt to subscribe to it.

He added, “When it comes to onboarding entities, which — as a result of these are establishments — takes time…for them to have the ability to spend money on BUIDL. However we’ve got a really massive pipeline of entities being onboarded [so] that when they’re on board, they may make investments, proper?”

The success of BUIDL has led to discussions between BlackRock and Securitize about future initiatives. Domingo mentioned that each corporations are very conscious that they’re solely 4 months into BUIDL, so nothing else is coming at this level.

Learn extra: How the most recent TradFi blockchain trial may mark the ‘five-yard-line’ for mass adoption

“So issues take an extended time than [it would] take if we had been working with a startup, which is ok as a result of additionally you get the credibility of BlackRock…I believe that within the subsequent few months, we’re going to focus extra on rising BUIDL when it comes to the utility of the token, the performance and the combination with all of the components of the ecosystem, reasonably than launching a brand new mission,” he mentioned.

However regardless of the will to develop whereas working with a “small firm” (Domingo says Securitize has 150 staff at the moment), he mentioned that his agency isn’t seeking to elevate additional funds any time quickly. In Could, ICYMI, BlackRock led an almost $50 million spherical for the agency.

“We have to execute on what we’ve got. We now have loads of cash. We weren’t elevating cash when BlackRock got here. We already had cash within the financial institution. So it’s not that we wanted the cash…I believe that elevating cash [has] been an enormous distraction to me, significantly, since you discuss to lots of people, and at this cut-off date, I don’t need to elevate more cash,” Domingo mentioned.

A shorter model of this text first appeared in Thursday’s Empire Publication. Join right here to by no means miss a problem.