Ethereum worth witnesses a 24-hour drop of as much as 5.78%, as its Relative Power Index (RSI) hits lowest stage since August 2023, suggesting oversold circumstances.

Market veteran Michael van de Poppe, disclosed this in a current report. This sharp decline signifies important bearish momentum, suggesting Ethereum may be oversold. Moreover, altcoins have reached their lowest RSI ranges, both traditionally or for this cycle, indicating a widespread market capitulation.

#Ethereum reaches the bottom RSI (Day by day) because the collapse in August ’23.#Altcoins have reached their lowest RSI (Day by day) ever or of this cycle.

Clear capitulation. pic.twitter.com/9eehaITkQI

— Michaël van de Poppe (@CryptoMichNL) July 5, 2024

Potential Downward Targets for Ethereum Worth

Ethereum worth at present hovers round $2,956, marking a 5.78% decline over the previous 24 hours. Key resistance is recognized between $3,800 and $4,200, the place Ethereum struggled to interrupt by, resulting in its current decline. The worth now faces essential help at $2,480. A breach beneath this stage might set off additional declines in the direction of $2,145.

Regardless of the decline, buying and selling quantity stays steady, indicating the absence of panic promoting. This stability means that whereas the market sentiment is bearish, a possible rebound or consolidation section might be on the horizon.

Worth Affect on Holder Profitability

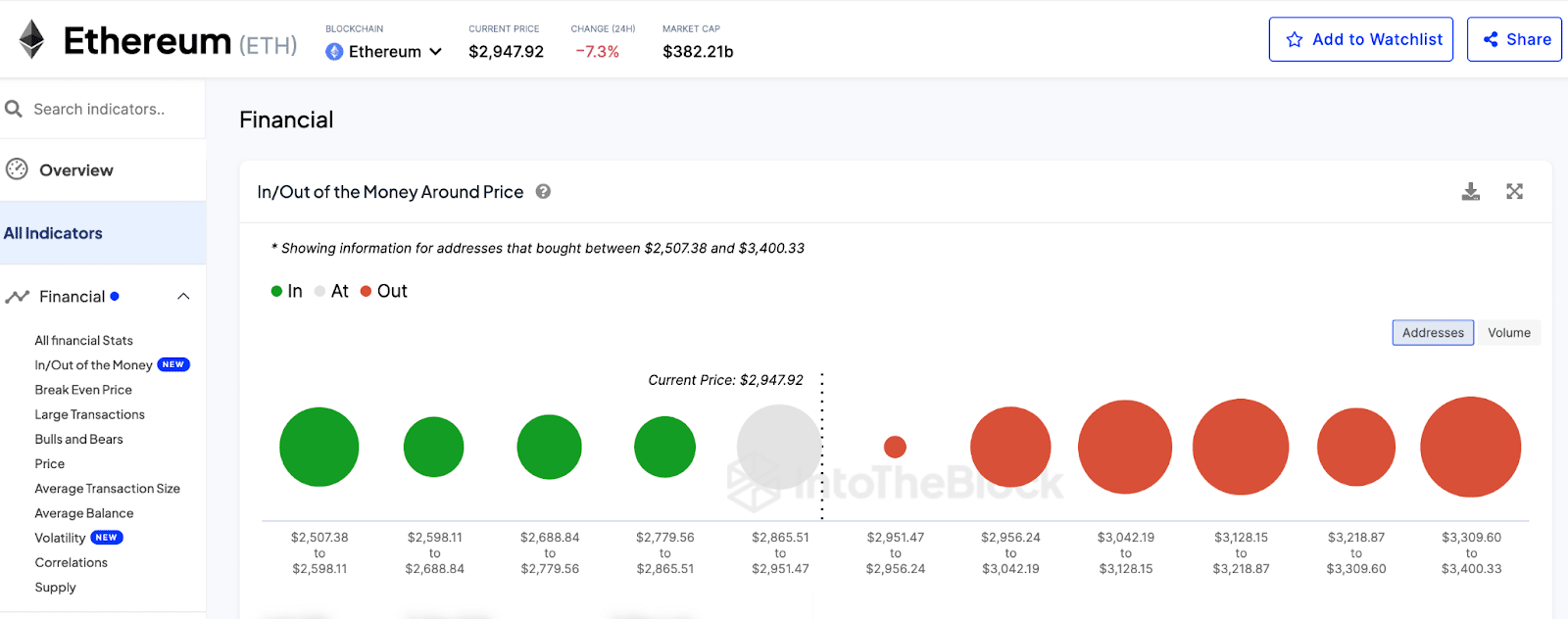

Analyzing Ethereum addresses, various positions are seen primarily based on the present worth of $2,956. Notably, a big variety of addresses are “Out of the Cash,” having bought ETH at costs starting from $2,951.47 to $3,400.33, thus at present incurring losses.

Ethereum Worth GIOM | IntoTheBlock

Market Sentiment and Funding Flows

In the meantime, a earlier report from CoinShares highlighted continued outflow from crypto funding merchandise, totaling $30 million over the previous three weeks, in accordance with The Crypto Fundamental.

Ethereum alone noticed an outflow of $61 million. Regardless of this, Bitcoin-related exchange-traded merchandise (ETPs) skilled an influx of $10 million, bringing the full belongings throughout all Bitcoin ETPs to $67.57 billion.

Curiously, different digital belongings additionally noticed optimistic internet inflows. Multi-asset ETPs attracted $18 million, whereas Solana, Litecoin, Chainlink, and XRP recorded inflows of $1.6 million, $1.4 million, $600,000, and $300,000 respectively. Ethereum’s distinctive outflow information suggests elevated bearish sentiments surrounding the asset.