Bitcoin’s value on July 1, 2024, stands at $62,769, with a 24-hour intraday value vary of $61,261 to $63,694. The cryptocurrency’s market capitalization is $1.23 trillion, and the 24-hour commerce quantity is $21.98 billion.

Bitcoin

Bitcoin’s hourly chart presents a powerful upward pattern ranging from roughly $60,620, peaking at $63,724, adopted by a slight decline. The rise in quantity through the value surge signifies stronger shopping for curiosity. A strategic entry level could possibly be round $62,500 to $63,000 if consolidation and reversal indicators seem, with a short-term goal close to the $64,000 vary.

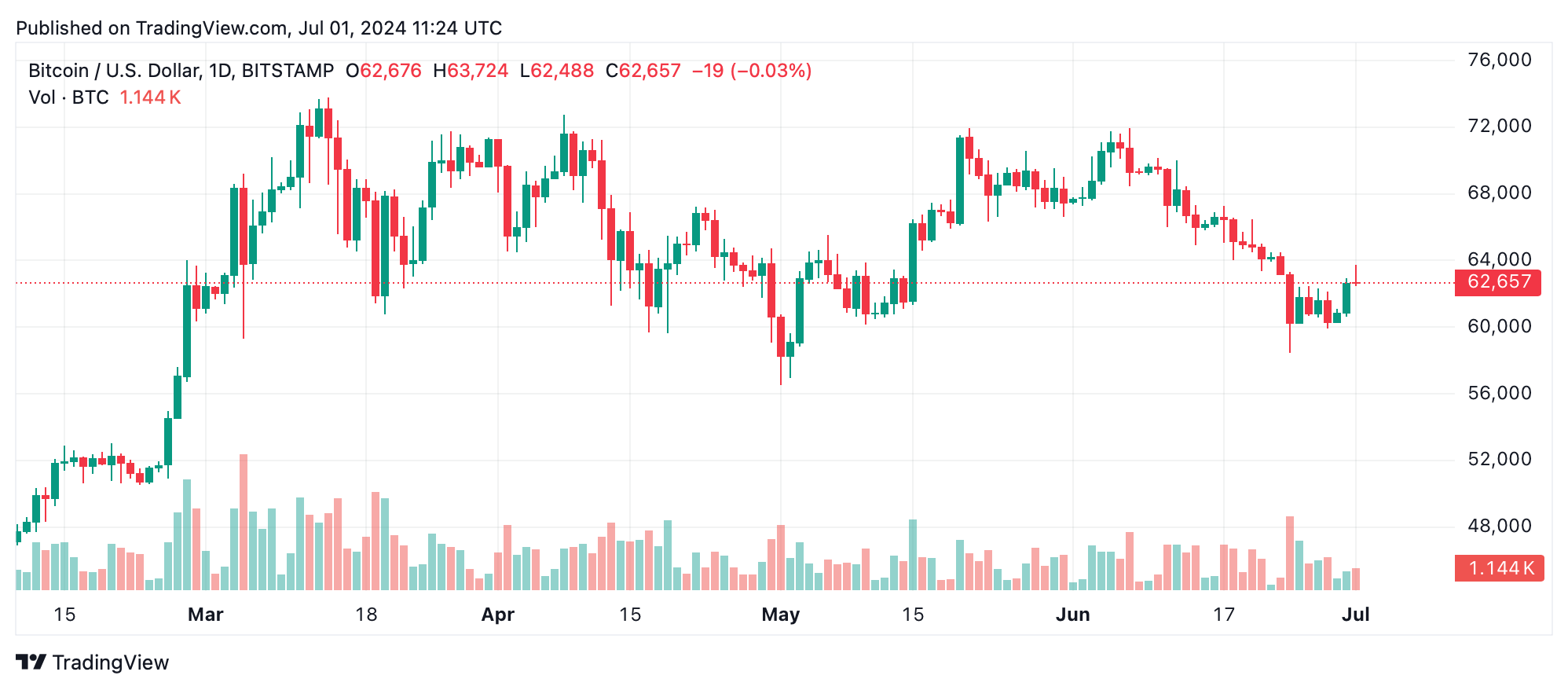

BTC/USD every day chart on July 1, 2024.

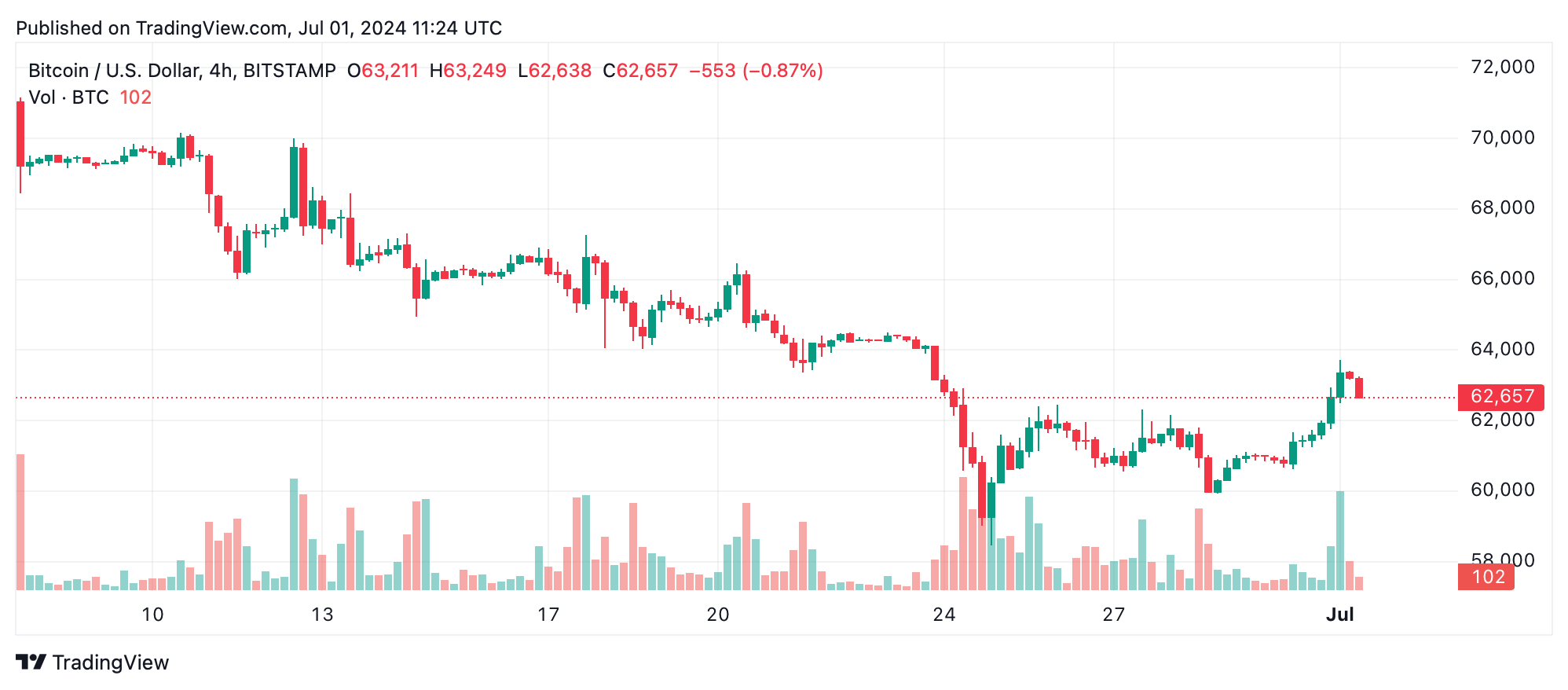

The four-hour chart mirrors the hourly chart, displaying a transparent uptrend from a low of $59,923 to a peak of $63,724, adopted by a minor retracement. The amount sample helps the value motion with a major spike through the breakout above $60,000. An entry level round $62,500, aligning with the decrease finish of the present consolidation zone, is advisable.

BTC/USD 4-hour chart on July 1, 2024.

Analyzing the every day chart, we observe a broader image with a downtrend from a excessive of $71,949 to a low of $58,456, adopted by a restoration to $63,724. Bitcoin quantity has remained steady, with noticeable spikes throughout main value actions. Given the restoration and consolidation, an entry round $62,000 to $63,000 is good, particularly if the value holds above the $60,000 help stage.

The oscillators current a combined image. The relative power index (RSI) at 44 and Stochastic at 43 each point out a impartial stance. The commodity channel index (CCI) at -32 and the common directional index (ADX) at 33 additionally counsel a scarcity of robust directional motion. Nonetheless, the momentum indicator at -1352 suggests a shopping for alternative, whereas the transferring common convergence divergence (MACD) stage at -1530 signifies promoting stress. This combined sign surroundings requires cautious optimism, with shut consideration to additional market developments.

Transferring averages (MAs) present extra insights. The ten-period exponential transferring common (EMA) and easy transferring common (SMA) counsel a shopping for pattern with values at $62,360 and $61,847, respectively. Nonetheless, the 20, 30, 50, and 100-period EMAs and SMAs are signaling a promote, aside from the 200-period EMA and SMA which point out a purchase at $58,195 and $58,212, respectively. This implies a short-term bullish outlook however potential long-term resistance until vital help ranges are maintained.

Bull Verdict:

Bitcoin’s market outlook for July 1, 2024, is cautiously bullish with key ranges to observe round $62,500 for entry and $63,724 for exit. The general pattern suggests potential for upward motion if crucial help ranges are maintained and shopping for curiosity continues.

Bear Verdict:

Regardless of some bullish indicators, bitcoin’s market outlook for July 1, 2024, additionally presents a number of promote indicators from transferring averages and combined oscillator readings. Merchants ought to stay cautious, expecting potential downward stress if key help ranges fail.