Heading into the primary half of 2024, crypto traders are questioning about the way forward for Bitcoin, which continues to lose worth after hitting an all-time excessive in March.

Desk of Contents

In accordance with Bloomberg, Bitcoin (BTC) has misplaced about 13% in worth since March, after sharp surges of 67% and 57% in earlier quarters. Amid the decline within the worth of the primary cryptocurrency, questions have emerged about whether or not cracks in momentum trades akin to Bitcoin point out a stricter outlook for danger urge for food because the prospect of upper rates of interest for longer looms over monetary markets.

Austin Reid, international head of income and enterprise at FalconX, believes the crypto market is just quickly unsure. A slowdown in demand for spot Bitcoin ETFs could possibly be among the finest measures to scale back curiosity.

Matthew O’Neill, co-director of analysis at Monetary Know-how Companions, believes the approval of spot Bitcoin ETFs in January sparked euphoria available in the market, adopted by a pure worth correction after the rally.

The skilled notes that ETFs attracted an outpouring of curiosity from skilled traders who wished publicity to Bitcoin however solely wished to purchase the cryptocurrency by way of institutional means. O’Neill sees the present decline in BTC as a superb time to purchase earlier than the next improve in Bitcoin costs.

You may additionally like: Advisors ‘cautious’ with Bitcoin ETF adoption, says BlackRock exec

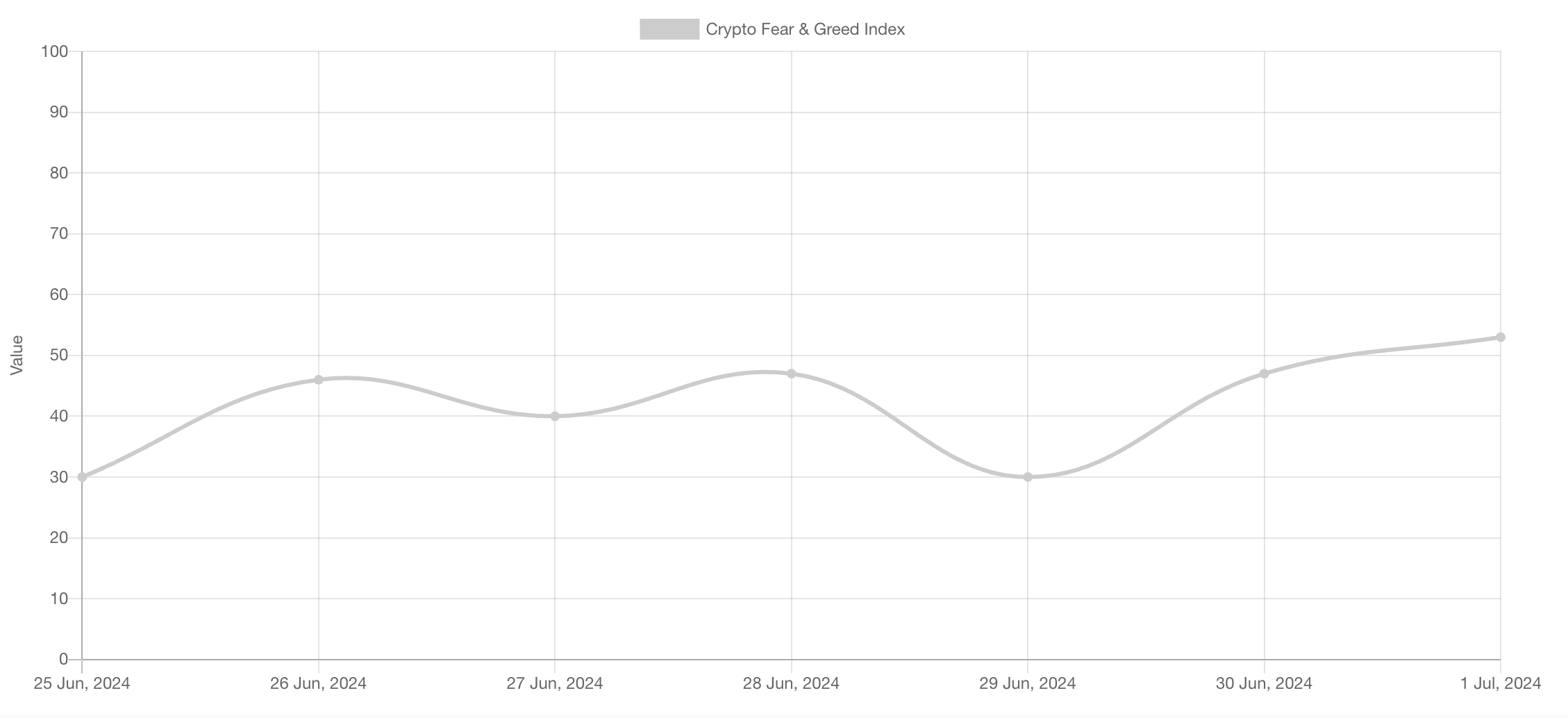

Worry and Greed Index data sharp decline

Final week, on June 25, the index of concern and greed within the crypto market fell to 30 factors, the bottom determine since September 2023.

Supply: Various.me

The index’s transfer in direction of concern occurred towards a normal decline within the crypto market when Bitcoin fell from $62,500 to $59,100, dragging different property with it, after the information of the beginning of funds to Mt. Gox shoppers.

Supply: CoinMarketCap

Blockchain analyst Willy Wu identified a “cascading lengthy squeeze” in BTC. In his opinion, the asset’s fall to a 53-day low occurred towards the backdrop of miners’ capitulation after the Bitcoin halving in April.

…speculators stored including to new lengthy positions, simply including extra gas for extra liquidations in a cascading lengthy squeeze.

Bridging us all the way down to the 58k cluster, which simply bought taken out. pic.twitter.com/8Pvzccm8vF

— Willy Woo (@woonomic) June 24, 2024

The skilled believes miners started promoting off BTC to improve gear since previous units are now not worthwhile. The analyst named $54,000 as the subsequent important degree for BTC. The cryptocurrency market could enter a bearish part if it falls under this degree.

You may additionally like: Worry, greed, and crypto: Deciphering the market’s temper swings

What’s going to occur to the Bitcoin ETF?

In accordance with CoinShares knowledge, traders poured about $2.6 billion into Bitcoin ETFs within the second quarter, up from about $13 billion within the first three months of the yr. After a gentle outflow of funds, spot Bitcoin ETFs once more confirmed constructive dynamics on the finish of June.

The development reversal happens towards the backdrop of normal instability available in the market for cryptocurrency funding merchandise. CoinShares mentioned over $1 billion was withdrawn from the sector over the earlier two weeks. Renewed inflows into spot Bitcoin ETFs might sign a return to investor curiosity within the asset class and the beginning of a brand new part in cryptocurrency market dynamics.

Nevertheless, many of the consideration is now targeted on the Ethereum ETF. In accordance with a current evaluation from Citi, internet inflows into Bitcoin ETFs exceeded $13 billion. These investments triggered a pointy rise within the worth of BTC: in line with the corporate, each $1 billion in inflows elevated the worth of Bitcoin by 6%.

The financial institution predicts that the launch of ETF buying and selling on Ethereum will entice inflows of between $3.8 billion and $4.5 billion over the identical interval, probably growing the worth of ETH by 23-28%. Because of this ETH might rise to $4,417 by November this yr.

You may additionally like: Gary Gensler: Ethereum ETFs probably authorised by finish of summer time

Will the state of affairs enhance?

Specialists from the analytical firm CryptoQuant mentioned they count on constructive actions within the cryptocurrency market within the third quarter of 2024.

$BTC – Miners’ promoting stress decreases

“Promoting stress of miners is weakening, and if all of their promoting quantity is absorbed, a state of affairs could also be created the place the upward rally can proceed once more.” – By @DanCoinInvestor

Learn extra 👇https://t.co/X4J2brhuQu pic.twitter.com/5dI0vB2HgE

— CryptoQuant.com (@cryptoquant_com) June 28, 2024

Analysts defined that the upward rally would proceed once more if miners accomplished the sale of BTC.

CryptoQuant additionally added that the crypto market has been falling not too long ago due to the miners. After the halving, the profitability of their actions fell, and so they have been compelled to dump their property.

Due to this, miners’ exercise decreased, and so they started to promote Bitcoin on over-the-counter markets to cowl mining prices.

Former Goldman Sachs CEO Raoul Pal additionally predicted important cryptocurrency progress within the fourth quarter of 2024. The investor famous that dangerous property like BTC often rally towards the backdrop of the U.S. presidential election.

Thus, specialists keep a bullish forecast for Bitcoin’s medium-term development. Nevertheless, progress slowed down as a part of a neighborhood downward correction.

You may additionally like: Analyst: International ETF market might hit $35t by 2035