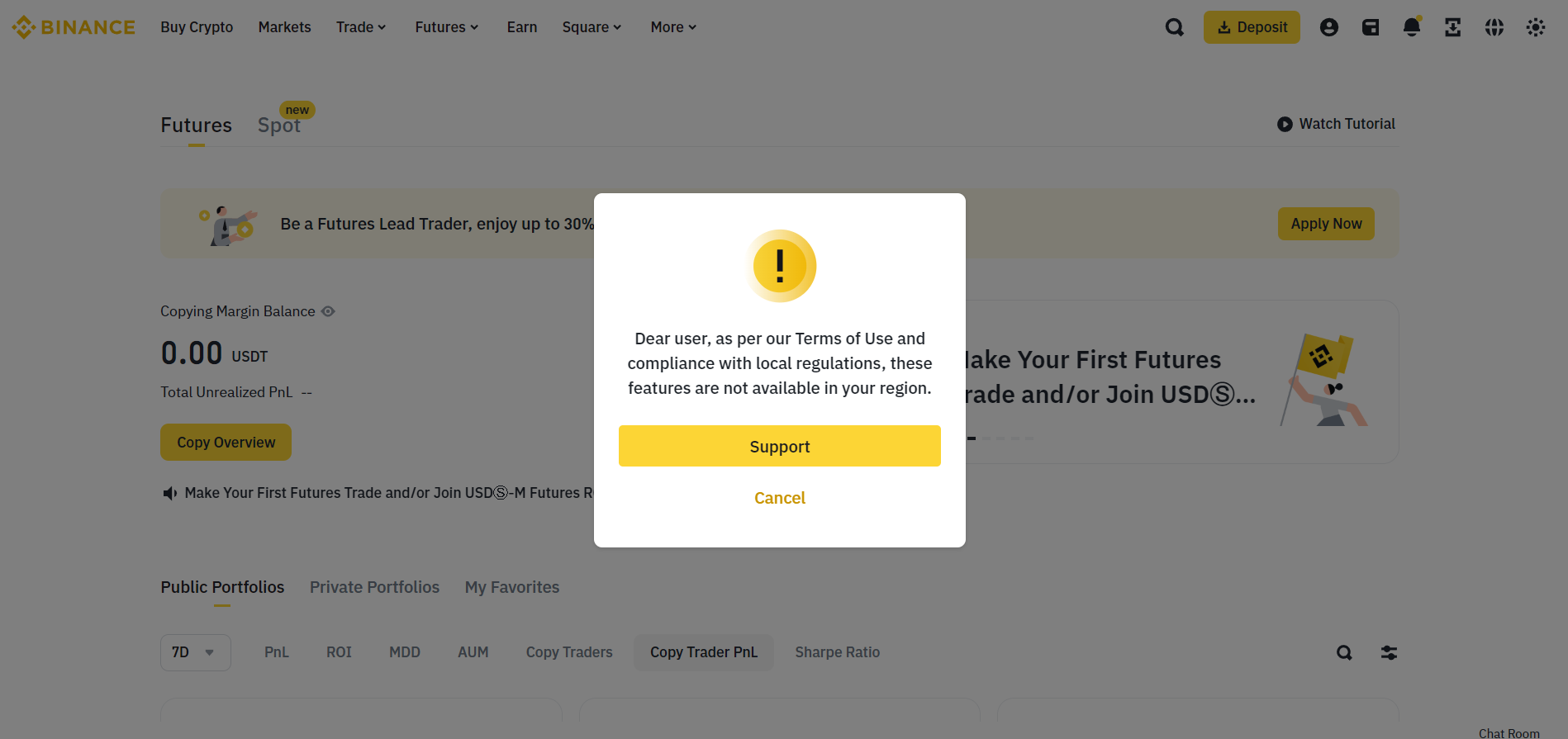

European Binance customers logging into their cellular app on Wednesday had been greeted with an unsettling message indicating that sure companies had been not out there of their area. This sudden change comes as new cryptocurrency laws on the Outdated Continent formally take impact on the finish of June.

Binance, performing proactively, has already blocked entry to some companies, together with copy buying and selling, ranging from June 26.

Binance Customers in Europe Face Vital Restrictions

A 12 months in the past, the European Union launched the Markets in Crypto-assets (MiCA) regulation package deal, governing the digital property business throughout Europe and throughout the European Financial Space (EEA).

The MiCA laws regarding stablecoins will considerably influence the services of European cryptocurrency exchanges efficient June 30, 2024.

Binance, the biggest trade by month-to-month transactions, was the primary to implement these restrictions, which can have an effect on copy buying and selling fanatics instantly beginning at the moment (Wednesday).

“Impacted Lead Merchants and Copy Merchants are inspired to shut their positions of their Copy Buying and selling actions and switch their funds again to their respective Spot Wallets earlier than 2024-06-27 23:59 (UTC +3),” the trade commented a couple of weeks in the past.

After that date, any remaining open positions can be routinely closed at market worth, and property can be transferred to identify wallets.

Unauthorized Stablecoins and Product Limitations

From June 30, Binance can even cease supporting varied different necessary companies in the event that they depend on “unregulated” stablecoins.

„Stablecoins that aren’t regulated beneath MiCA, together with USDT and others, will nonetheless be out there for buying and selling on Binance on Spot, for deposit and withdrawal and in your pockets, as regular. They can even be out there to promote on Convert. Binance won’t be delisting these stablecoins,” the trade commented in an e-mail despatched to its European customers final week.

Beneath upcoming MiCA guidelines some stablecoins will face restrictions as unauthorized stablecoins.

Binance will not delist any unauthorized stablecoins on spot however will restrict their availability for EEA customers solely on sure merchandise, corresponding to launchpool and earn, and can suggest…

— Binance (@binance) June 3, 2024

Key adjustments for EEA customers embody:

- Restricted shopping for of unauthorized stablecoins by means of Binance Convert

- Limitations on new borrowings and transfers of unauthorized stablecoins in margin buying and selling

- Blocking of recent subscriptions involving unauthorized stablecoins in merchandise like Easy Earn, Binance Loans, and Twin Funding

- Restrictions on peer-to-peer (P2P) buying and selling and over-the-counter (OTC) purchases of unauthorized stablecoins

Regardless of these restrictions, Binance has acknowledged that it’s going to not delist any stablecoins till additional discover. Spot buying and selling pairs with unauthorized stablecoins will stay out there, and customers will nonetheless be capable to withdraw or deposit these tokens to their Binance wallets.

The trade can be making adjustments to its rewards and referral programs. Beginning June 24, referral commissions for spot and margin buying and selling can be paid in BNB, Binance’s native token, as a substitute of stablecoins.

Binance has suggested its European customers to assessment their holdings and think about transitioning to regulated stablecoins or different digital property forward of the June 30 deadline.