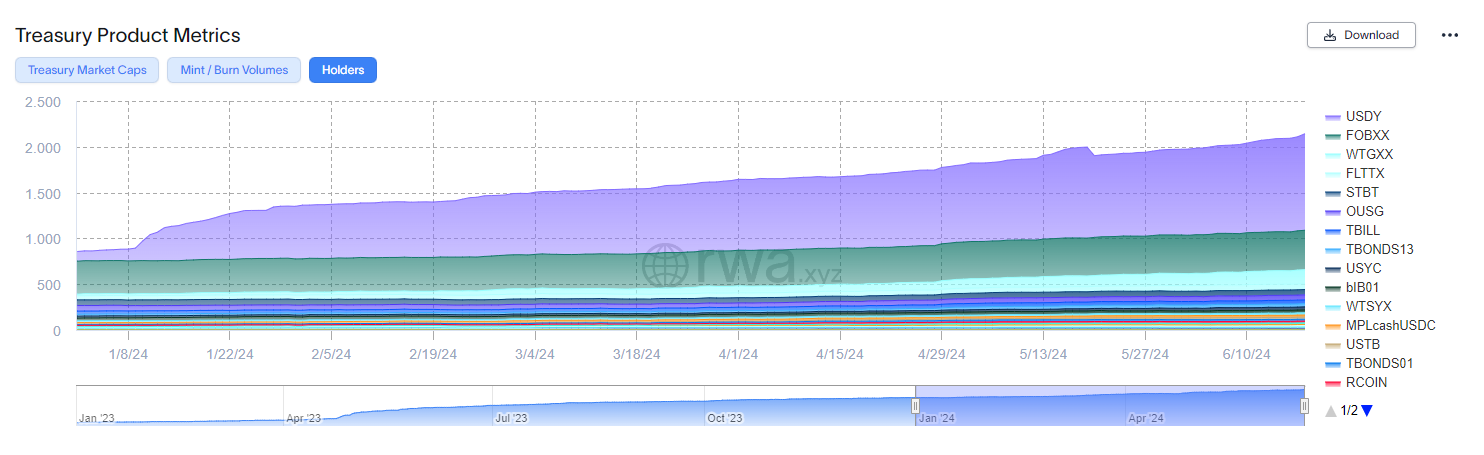

The tokenized US Treasuries market reached an all-time excessive of two,143 holders on June 18th, with a 250% year-to-date development, in keeping with knowledge aggregator RWA.xyz. The Ondo Brief-Time period US Authorities Bond Fund (USDY) leads with 1,054 holders and over $218 million in tokenized bonds.

The BlackRock USD Institutional Digital Liquidity Fund (BUIDL), which leads the market with almost $463 million in tokenized US Treasuries, registers 14 holders, one of many smallest numbers. Notably, BUIDL is reserved for certified institutional traders, with a $5 million minimal funding requirement.

In the meantime, Franklin OnChain U.S Authorities Cash Fund (FOBXX), by asset supervisor Franklin Templeton, is the second-largest by variety of holders and tokenized belongings. The FOBXX registered 430 holders and surpassed $344 million in tokenized belongings.

The Authorities Cash Market Digital Fund (WTGXX), managed by WisdowTree, wraps up the record of tokenized funds with over 100 holders, as 152 traders maintain their digitally represented shares. Moreover, the variety of WTGXX holders grew by 950% this yr.

In June, over $136 million in tokenized fund shares had been issued, whereas $35 million had been burned as traders claimed their belongings. Furthermore, the tokenized US Treasuries market reached its all-time excessive at $1.57 billion on June seventeenth, boasting a 118% year-to-date development.