Justin Solar is among the richest and most necessary people within the cryptocurrency ecosystem; nevertheless, his tendency to unfold his huge wealth between quite a lot of completely different interconnected entities and addresses could make figuring out the total extent of his actions very tough.

Protos has reviewed most of the addresses we imagine to be managed by Solar and located quite a lot of completely different property on Tron and Ethereum being quickly moved between protocols and exchanges.

Ethereum

0x176F3DAb24a159341c0509bB36B833E7fdd0a132 is an deal with labeled as ‘Justin Solar 4’ on Etherscan. The deal with holds over 1,000 ether (ETH) value greater than $4 million, in addition to over $50 million every of wrapped staked ether (wstETH) and staked USDT (STUSDT).

It repeatedly interacts with Aave, Solar-owned Poloniex, and Binance and remains to be repeatedly used, with the latest transactions taking place lower than per week in the past.

0x3ddfa8ec3052539b6c9549f12cea2c295cff5296 is an deal with labeled ‘Justin Solar’ on Etherscan that has over $1 million value of ETH in addition to vital positions on Aave. It has interacted with Binance, Poloniex, and Uniswap and has despatched over 566,000 ETH to the beforehand talked about 0x176F3DAb24a159341c0509bB36B833E7fdd0a132.

0x611f97d450042418e7338cbdd19202711563df01 is an deal with labeled as ‘Justin Solar 3’ on Etherscan and has only a few property nonetheless in it; nearly all of the remaining property had been withdrawn close to the top of final yr. This deal with, like many Solar addresses, interacted with HTX, Binance, Poloniex, and quite a lot of sensible contracts.

0x621fe33ccf74038db90b18365cb450d677d4b3d8 or ‘Justin Solar 2’ was drained of its remaining property a few yr in the past. It beforehand held large portions of staked ether (stETH) and withdrew funds from Solar-owned Poloniex.

A further deal with believed to be Solar that we recognized utilizing Breadcrumbs appears to have been deserted earlier this yr, with most remaining property moved out in February. This deal with interacts with each Binance and Kraken.

Tron

Solar is the founding father of the Tron blockchain and has his fingers in most of the protocols and tasks unfold throughout it.

As a part of our earlier reporting on Solar’s relationship with Tether, we had been capable of determine a number of addresses that had been managed by him. Nonetheless, most of these addresses are deserted at this level, practically solely drained of property and not repeatedly used to transact.

It’s doable to watch tens of millions of the USDT issued by Solar flowing to an deal with labeled as Binance by Breadcrumbs. One other deal with, which was deserted in 2023, additionally interacted with then Huobi, now HTX, a Solar-affiliated alternate.

There may be one deal with that we had been capable of determine from the Tether Papers investigation that’s extra not too long ago used, holding practically 24 million TRON (TRX) value practically $3 million. This deal with hasn’t been utilized in a number of months however has seen exercise this yr, and a more in-depth evaluate of its counterparties on Breadcrumbs reveals that it transacts with each Kraken and Binance.

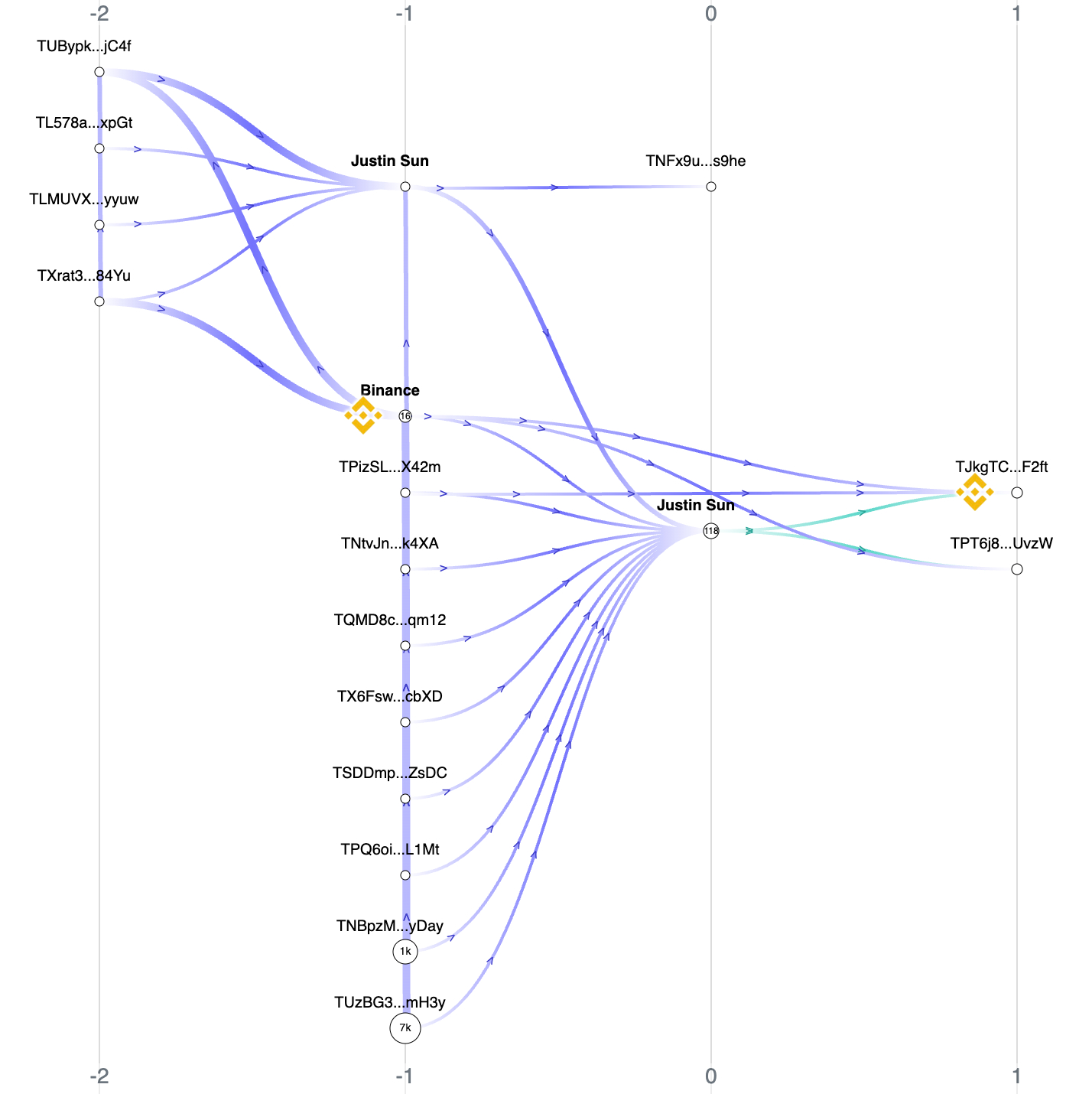

A pattern of some Tron transactions from Solar addresses, created utilizing Breadcrumbs.

Learn extra: Justin Solar’s empire crumbles as USDD depegs once more

TT2T17KZhoDu47i2E4FWxfG79zdkEWkU9N is an deal with that many people imagine is Solar. It’s an necessary redeemer of TrueUSD, a stablecoin deeply linked to Solar. Arkham Intelligence additionally lists this deal with as one in every of its ‘AI-identified potential Solar addresses.’ This deal with at present holds over 1 billion TRX value over $138 million.

It additionally holds quite a lot of different property intently linked to Solar together with over $225 million value of USD Coin (USDD), over $60 million value of TrueUSD, over $50 million value of BitTorrent, $20 million SUN, over $5 million USDT, and over $40 million of JUST stablecoin (USDJ).

It interacts with entities throughout the crypto ecosystem together with Binance, KuCoin, Bitfinex, Gate, JustLend, HTX, and SunSwap.

In complete, these addresses, which probably solely symbolize a portion of Solar’s actions on Tron, comprise practically a billion {dollars} value of property.

Bitcoin

Protos had beforehand recognized one in every of Solar’s bitcoin (BTC) addresses that he issued USDT to. This deal with has not been utilized in over 4 years and has no significant property in it.

Earlier reporting has urged that Solar has saved a good portion of his BTC at Valkyrie Investments, the place in 2022 it was reported that he had stashed roughly $580 million value there, on the time representing over 90% of the property at Valkyrie Digital Belongings LLC.

Solar additionally has quite a lot of connections to Wrapped Bitcoin (WBTC) on Tron, a Poloniex-offered product that accounts for large parts of the reserves at HTX, although it is not going to disclose the place it shops the backing property.

Not too long ago, Poloniex delisted this asset, making it unclear if anybody can probably redeem it, a troubling side contemplating the solvency of two exchanges that depend upon this product.

Different Justin Solar Tasks

Many different tasks linked with Solar even have unusual connections or large issues.

USDD, the algorithmic stablecoin (that lacks a real algorithm) based by Solar shops its collateral at Solar-affiliated HTX, together with it within the calculation of HTX’s proof-of-reserves.

TrueUSD, a stablecoin the place Solar is a companion market maker (and certain extra), not too long ago has seen its market cap collapse as one in every of its banks was pressured into chapter 11.

stUSDT, which Solar usually interacts with, is saved virtually solely in wallets or entities that he’s believed to manage or affect.

The Solar-owned cryptocurrency alternate Poloniex had beforehand acknowledged that it will display a ‘proof-of-reserves’ earlier than ostensibly breaking that promise.

HTX, previously Huobi, the Solar-affiliated alternate, depends on each stUSDT and WBTC on Tron to take care of its reserves, each property with problematic points tied on to Solar.

These issues collectively current an image of a person desperately flinging cash round whereas hoping the continued Securities and Alternate Fee lawsuit that alleges he engaged in market manipulation and wash-trading disappears.