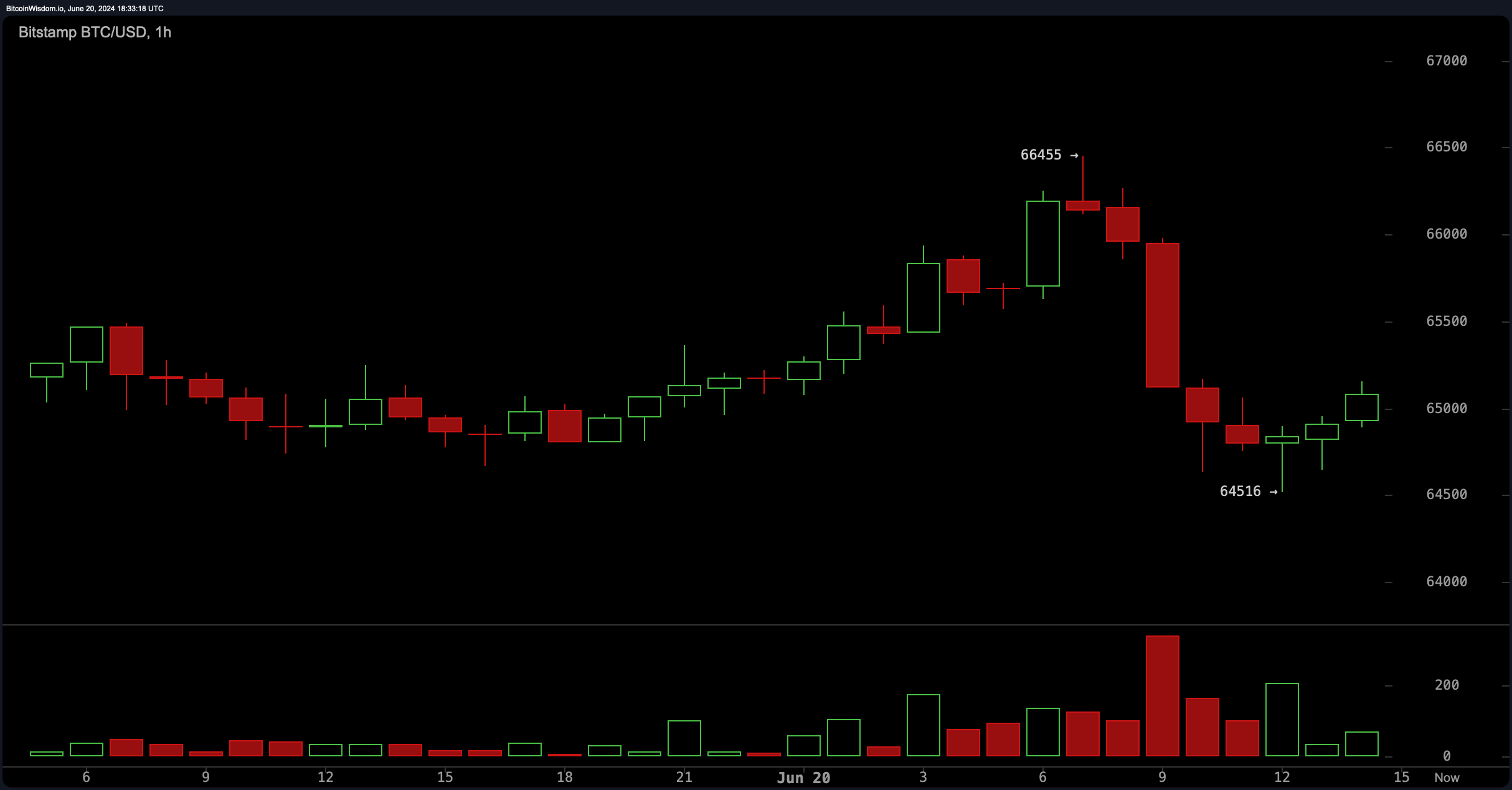

On Thursday, bitcoin (BTC) peaked at $66,455 per coin round 7 a.m. EDT however dropped to roughly $64,516 by midday. The risky actions resulted in $118.82 million in liquidations throughout the crypto financial system, with lengthy positions accounting for $61 million of that complete.

Bitcoin’s Speedy Rise and Fall Triggers Main Liquidations in Crypto Economic system

Bitcoin reclaimed the $66,000 stage on June 20 however couldn’t preserve its place attributable to promoting strain. As of two p.m. Thursday, the worth is fluctuating between $64,850 and $65,150. When BTC strikes, it typically influences the broader crypto market, inflicting altcoins to rise and fall in tandem. At the moment was no exception, with a number of cryptos experiencing comparable worth swings.

After BTC cruised up right this moment previous the $66K per unit zone, it misplaced momentum and hit a low of $64,516.

This market exercise led to $118.82 million in derivatives being liquidated throughout the ecosystem. Bitcoin noticed $33.10 million briefly positions liquidated, whereas ethereum’s (ETH) worth adjustments resulted in $22.21 million in lengthy positions being worn out. Solana (SOL) skilled $6.91 million in lengthy liquidations, and $4.23 million in pepe (PEPE) longs have been additionally liquidated.

In complete, lengthy positions confronted $65.13 million in liquidations on Thursday, whereas quick positions noticed $53.6 million erased. Over the previous day, 48,553 merchants have been liquidated. The Lengthy to Brief Ratio reveals a predominantly bearish sentiment amongst merchants, although there are barely extra lengthy positions piling up after the latest worth changes.

The ratio is almost balanced, with a small edge for longs. On Binance, merchants are predominantly lengthy, whereas Okx merchants are largely lengthy on BTC. Conversely, a majority of Deribit merchants are quick on BTC as of two p.m. EDT Thursday. Regardless of the latest liquidations, ongoing lengthy exercise, and bets towards BTC’s rise by hedge funds and merchants leveraging crypto derivatives exchanges, a ten% worth rebound might probably erase billions in shorts.

What do you concentrate on the risky crypto market on Thursday? Share your ideas and opinions about this topic within the feedback part under.