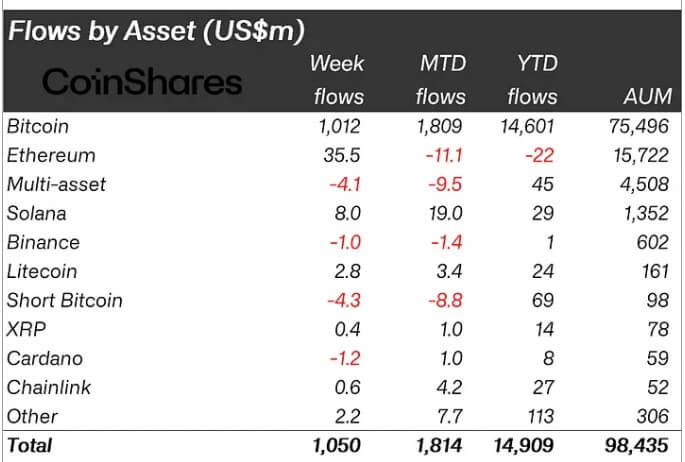

The cumulative year-to-date inflows into crypto-related funding merchandise have reached a report excessive of $14.9 billion, in response to in response to CoinShares’ weekly report.

This report was achieved following a 3rd straight week of inflows that totaled $1.05 billion final week. Notably, the ETPs’ buying and selling volumes rose by 28% to $13.6 billion in the course of the reporting interval, a major departure from the subdued actions seen in earlier weeks.

In the meantime, James Butterfill, CoinShares’ head of analysis, identified that current worth will increase available in the market have pushed the full worth of property below administration for digital asset ETPs to $98.5 billion.

Optimistic sentiments

A stream breakdown exhibits that Bitcoin-related ETPs accounted for 99% of the full inflows, recording $1.01 billion final week. Surprisingly, brief Bitcoin merchandise noticed one other week of outflows, totaling $4.3 million.

Butterfill defined that the substantial inflows into BTC ETPs confirmed constructive sentiments returning to the market. He wrote:

“[The inflows] recommend that sentiment is popping broadly constructive regardless of the current worth rises. That is doubtless on account of buyers deciphering the FOMC minutes and up to date macro knowledge as mildly dovish.”

These constructive sentiments additionally prolonged to Ethereum-related funding merchandise, which noticed their highest inflows at $36 million since March. Butterfill acknowledged that these inflows “had been doubtless an early response to the approval of ETH ETFs in the USA.”

Notably, different large-cap digital property, like Solana, Chainlink, and Litecoin, recorded cumulative inflows exceeding $10 million in the course of the reporting interval.

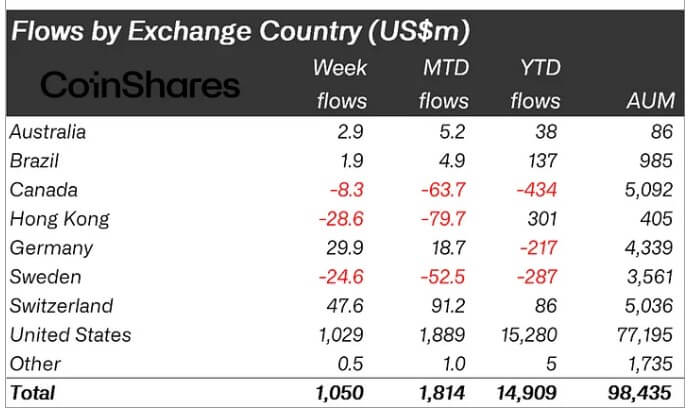

Whereas sentiments in the USA seem to impression buyers’ pursuits in crypto merchandise positively, the identical can’t be mentioned for ETFs in Hong Kong.

In response to CoinShares, for the reason that preliminary constructive launch of Bitcoin spot-based ETFs in Hong Kong (which noticed $300 million within the first week), there have been additional outflows of $29 million final week. This brings the full outflows within the city-state to roughly $80 million this month, the best amongst nations.

Talked about on this article