Because the Crypto Concern and Greed Index plunges to 35, market sentiment displays rising concern and uncertainty. Bitcoin struggles to seek out robust footing close to the $97,000 mark, battling towards a pullback of 1.08% over the previous 24 hours.

With a market valuation nonetheless below $2 trillion, Bitcoin’s momentum stays weak. Whereas a possible morning star sample hints at a bullish comeback, the sudden halt in institutional help warns of a deeper correction.

Will a turnaround in institutional demand propel BTC worth again to the $106,000 mark?

Bitcoin at $97k Goals For A Comeback

Within the each day chart, Bitcoin’s worth decline assessments a vital native help trendline. With a doji candlestick shaped yesterday, in the present day’s intraday restoration of 1.13% hints at a morning star reversal.

Bitcoin Value Chart

At the moment, the BTC worth consolidates between the 50-day and 100-day EMA strains, retaining merchants cautious. Nevertheless, the earlier pullback has triggered a bearish development within the MACD and sign strains.

Thus, the momentum indicator presents a promote sign, regardless of Bitcoin sitting at a key help stage. This usually contradicts the purchase at help, promote at resistance technique.

For now, the morning star sample strengthens the probabilities of a bullish reversal rally, which might drive a broader market restoration.

Ascending Triangle Formation: Bullish Breakout or Breakdown?

On a bigger scale, the native help trendline varieties an ascending triangle sample, with the overhead ceiling at $106,000. If the BTC worth maintains help inside this sample, it might see a short-term market restoration.

In such a case, Bitcoin might check the overhead resistance, projecting an upside potential of practically 10%. Nevertheless, if bulls fail to maintain dominance at this help stage, the BTC worth might witness a serious crash.

The quick help for Bitcoin stands at $91,000, and a closing under this stage would considerably improve draw back dangers.

Institutional Exercise: ETF Flows Reveal Combined Sentiment

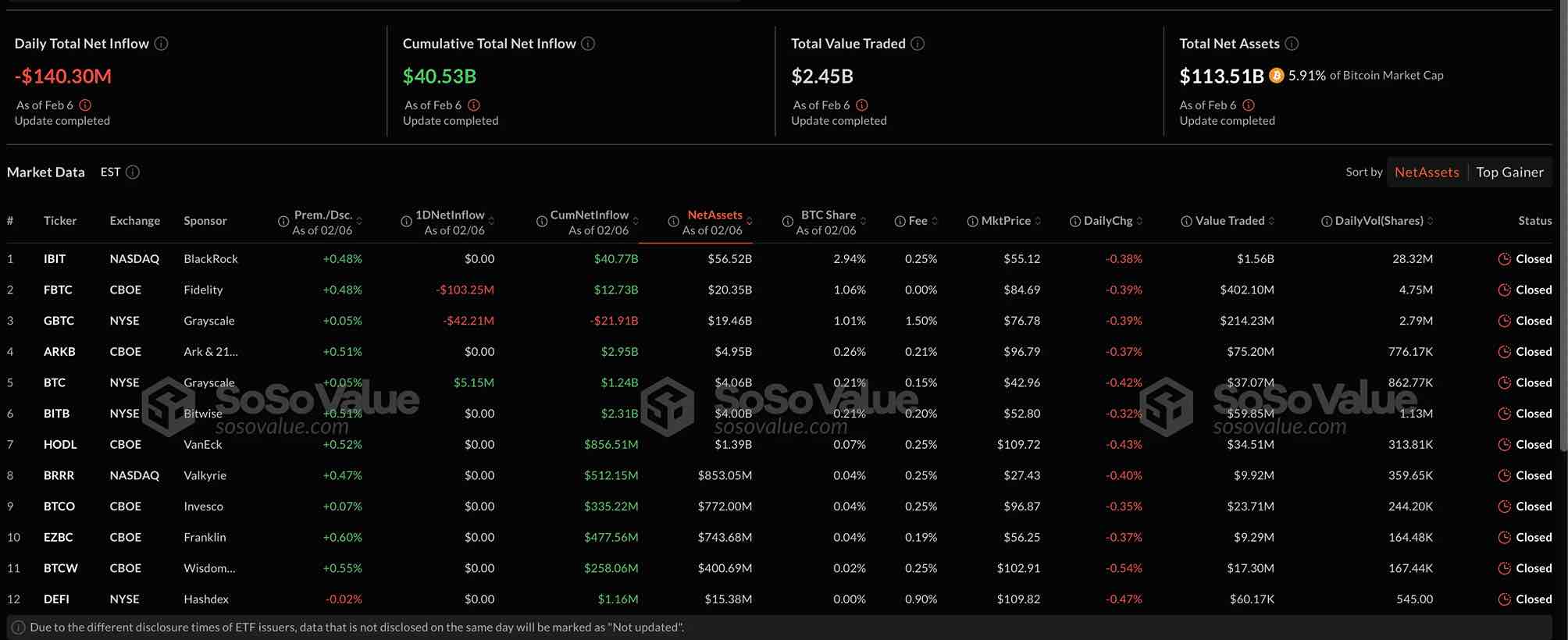

On February 6, the each day whole internet influx of U.S. Bitcoin spot ETFs remained adverse. Grayscale BTC Mini Belief was the one purchaser, with an influx of $5.15 million.

BTC ETF

Nevertheless, the most important promoting got here from Constancy, offloading $103.25 million, whereas Grayscale BTC Belief bought $42.21 million. This reveals a diverging viewpoint between Grayscale Mini BTC Belief and Grayscale BTC Belief.

At the moment, Grayscale BTC Belief has a cumulative internet outflow of $21.91 billion, reflecting continued promoting strain. In the meantime, the most important Bitcoin ETF, BlackRock, with a complete internet asset worth of $56.252 billion, maintained a impartial stance with zero internet stream.