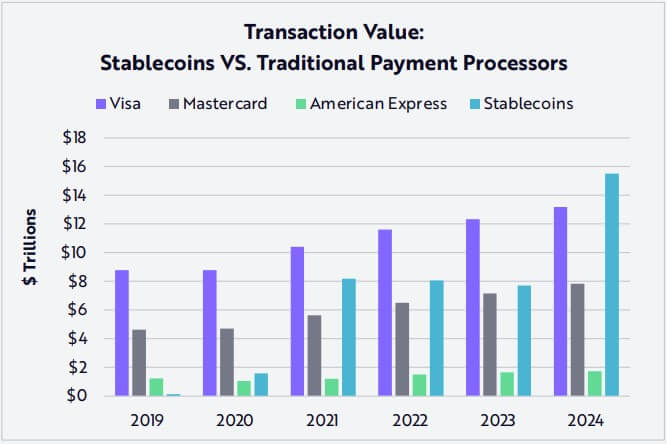

- Stablecoin transaction worth surpassed Mastercard and Visa by 200% and 119%

- The variety of month-to-month stablecoin transactions reached 100 million in 2024

- Stablecoin transaction worth roughly doubled year-on-year from $7 trillion in 2023

The transaction worth of stablecoins hit $15.6 trillion in 2024 overtaking conventional funds made with Mastercard and Visa.

The info, revealed in Ark Make investments Huge Concepts Report 2024, confirmed that stablecoins surpassed Mastercard and Visa by 200% and 119%, respectively. Regardless of a two-year bear market that witnessed a greater than 70% decline in market capitalization, stablecoin progress remained uninterrupted, reaching a five-year excessive.

The variety of stablecoin transactions hit 100 million month-to-month, roughly 72% and 41% of which had been processed by Mastercard and Visa.

In comparison with earlier years, the variety of folks utilizing stablecoins to switch funds has steadily elevated. As an illustration, in 2023, the worth of stablecoin transactions was roughly $7 trillion with Visa taking the lead at round $13 trillion.

Prime stablecoin issuers

Of the stablecoins available on the market, Tether (USDT) continues to dominate the market adopted by Circle (USDC). Collectively, they account for 90% of the whole provide.

Tether additionally reported $5.2 billion in earnings throughout the first half of 2024. Tether and Circle account for 60% of the income generated by the highest 5 networks and purposes.

“Collectively, stablecoins USDT, USDC, DAI/USDS, and USDE generated revenues of $3.35 billion, or $6.7 billion at an annual price, throughout the second half of 2024,” mentioned Ark Make investments.

Information of stablecoin progress comes as David Sacks, President Donald Trump’s AI and crypto czar, indicated that one of many priorities throughout the White Home is creating stablecoin laws.

Republican Senator Invoice Hagerty launched a invoice yesterday to create a framework for stablecoins.

The invoice is proposing to implement a “clear, regulatory framework” for his or her use. With stablecoin use gaining reputation abroad, the US is hoping that the invoice will reinforce the greenback’s dominance whereas aiding Trump’s mission to make America the crypto capital of the world.