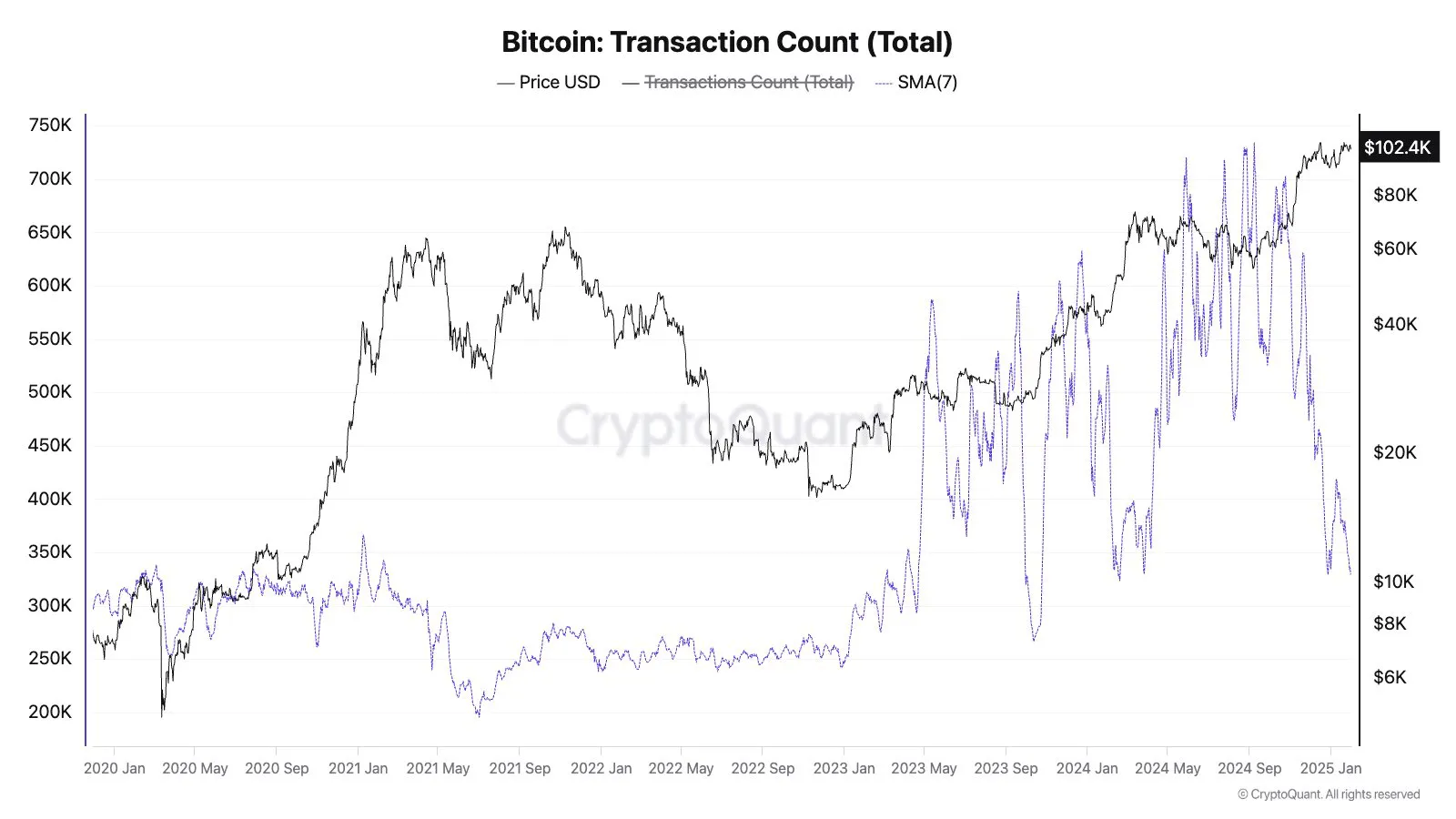

Transactions on the Bitcoin community have dropped to an 11-month low, in accordance with knowledge from CryptoQuant. This continues the decline in community exercise that started final 12 months when the each day transaction quantity peaked at 810,850 transactions on November 19.

CryptoQuant head of analysis Julian Moreno noticed the drop, noting that Bitcoin exercise is at its lowest since March 2024. Common each day transactions on the Bitcoin community have fallen to round 400,000 over the previous two months.

Bitcoin community exercise is at its lowest since March 2024. (Supply: Julio Moreno)

The decline in Bitcoin transaction quantity has led to a corresponding drastic drop in community mempool utilization. A Bitcoin mempool is the space for storing for unprocessed Bitcoin transactions earlier than miners embrace them in a block.

The variety of unconfirmed transactions on the Bitcoin community has additionally fallen to round 10,000, a large drop from over 250,000 unconfirmed transactions in December 2024.

Apparently, the decline in community exercise additionally signifies that many mined Bitcoin blocks have gone with out being absolutely stuffed. In a single excessive case, Block 881931, mined by Antpool, had solely 31 transactions and a dimension of 25.35 kilobytes (kB). That is far under the typical variety of transactions inside a Bitcoin block, which normally exceeds 2,000.

Transaction charges drop under $1 on the Bitcoin community; Miners undergo

The decline in community exercise signifies that charges on the Bitcoin community have additionally fallen, making it extraordinarily low cost for customers to finish transactions.

Based on knowledge from mempool area, common charges fell as little as 1 sat/vB ($0.14). Though they’ve elevated to three sat/vB ($0.42), it stays comparatively low cost. This can be a optimistic change in tune after earlier community congestions and excessive charges that customers have complained about on the community.

Nonetheless, a draw back is that Bitcoin miners are actually making far much less from transaction charges, with a mean of round $2,000 per block. This provides to the strain miners have confronted because the 2024 Bitcoin halving, which lowered mining rewards to three.125 BTC.

On the time of the halving, which coincided with the launch of the Runes protocol, Bitcoin miners earned document income from transaction charges. This led stakeholders to foretell that transaction charges may exchange the mining rewards misplaced to halving.

Nonetheless, declining community exercise, which Moreno claims outcomes from the drop in hype surrounding RUNES and BRC20 tokens, signifies that miners are caught with solely mining rewards whilst they face near-record mining problem.

Bitcoin drops under $100k as Trump imposes tariffs on commerce companions

In the meantime, Bitcoin was meant to compensate for the halving via a worth improve, however it has struggled in that space just lately too. The flagship asset fell 2% within the final 24 hours after President Donald Trump introduced tariffs in opposition to Mexico, Canada, and China.

The president imposed a 25% extra tariff on imports from Mexico and Canada and elevated tariffs on Chinese language imports by 10%. This transfer triggered retaliation from the nations, with Canada imposing 25% tariffs on some US items and Mexico and China promising to take their measures. Chinese language authorities additionally plan to file a grievance with the World Commerce Group.

Issues about how these tariffs may result in inflation precipitated Bitcoin to drop to $99,000 for the primary time in six days. With that, the hash worth additionally fell $58.46, additional impacting miners’ profitability.

Cryptopolitan Academy: The right way to Write a Web3 Resume That Lands Interviews – FREE Cheat Sheet