Ethereum (ETH) stays a pivotal participant within the blockchain ecosystem, and up to date bulletins from the Ethereum Basis and co-founder Vitalik Buterin recommend a transformative interval forward. Key developments, together with staking plans, management modifications, and strategic strikes in decentralized finance (DeFi), point out Ethereum’s evolving technique to solidify its place as a frontrunner in Web3 innovation. And with this main replace on EF’s treasury administration, the AAVE token surged as one of the vital trending tokens as we speak, and among the many few ones displaying a 24-hour enhance. Listed here are the Ethereum information and their impression on AAVE token:

1- Management Transitions and Strategic Course

The appointment of Aya Miyaguchi as the brand new Govt Director of the Ethereum Basis is one other essential improvement. Her intensive expertise, together with her management position at Kraken Trade, positions her to drive innovation and international adoption initiatives.

- Management Imaginative and prescient: Miyaguchi is predicted to deal with scaling options, increasing the Ethereum ecosystem, and constructing partnerships that improve Ethereum’s usability and accessibility.

2- Ethereum Basis’s Staking Plans: Proof-of-Stake (PoS) community and DeFi

Ethereum’s Proof-of-Stake (PoS) networ

One of the impactful bulletins was the Ethereum Basis’s consideration of staking a good portion of its ETH holdings, estimated at practically $1 billion. This marks a shift from its earlier cautious strategy to a extra lively position in supporting Ethereum’s Proof-of-Stake (PoS) community.

- Why Staking Issues: By staking its holdings, the Basis would contribute on to the community’s safety and stability, whereas additionally incomes staking rewards. This transfer aligns with Ethereum’s objectives of decentralization and self-sustainability.

50,000 ETH in DeFi

The Ethereum Basis has additionally allotted 50,000 ETH into numerous decentralized finance (DeFi) initiatives. This choice displays the Basis’s confidence within the DeFi sector as a driver of Ethereum’s development and utility.

- DeFi as a Progress Engine: This allocation is not only about funding; it serves as a strategic enhance to liquidity swimming pools, lending platforms, and DeFi innovation. The injection of fifty,000 ETH is predicted to strengthen Ethereum’s place because the spine of decentralized finance.

3- Ethereum Basis Treasury Replace

The Ethereum Basis has initiated a strategic shift in managing its treasury by organising a brand new Gnosis Protected 3-of-5 multi-sig pockets. This transfer goals to boost safety and operational flexibility whereas supporting the DeFi ecosystem.

- New Pockets Particulars: The brand new pockets is designed for safe, multi-signature transactions.

- Treasury Deployment: An ongoing operation is underway to switch 50,000 ETH (price over $160 million at present market charges) into the pockets. This switch course of is delayed barely as a result of signing necessities however highlights EF’s dedication to DeFi engagement.

- DeFi Participation: The EF has confirmed its plans to actively take part in DeFi through the use of this treasury. A check transaction has already been executed on AAVE, signaling EF’s confidence within the platform’s reliability and consumer expertise.

This treasury replace marks a major milestone for Ethereum’s broader technique. By deploying its sources in DeFi, the Ethereum Basis is setting an instance of how institutional individuals can drive innovation whereas supporting the ecosystem.

-

Key Implications:

- DeFi Adoption: The EF’s lively participation may entice extra establishments to DeFi platforms like Aave.

- Treasury Diversification: Using the treasury in DeFi not solely provides utility to Ethereum’s holdings but in addition generates potential yields.

- Strengthened Ecosystem: Participating instantly with DeFi protocols reinforces Ethereum’s place because the spine of decentralized finance.

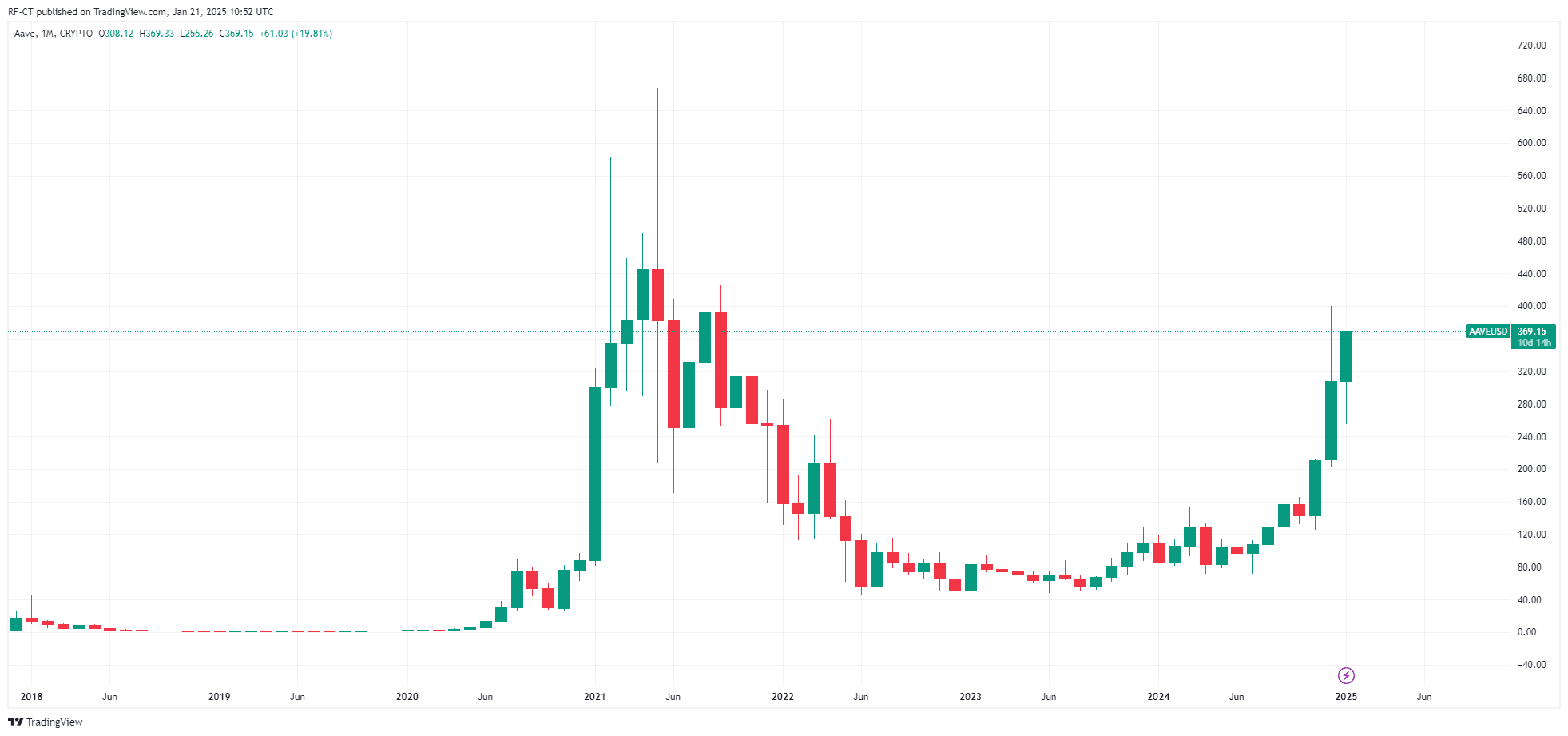

4- Why AAVE is Trending

Amid this treasury replace, AAVE, the native token of the Aave lending protocol, has emerged as one of many few cryptocurrencies to indicate optimistic efficiency within the final 24 hours. Right here’s why:

- Ethereum Basis’s Involvement: The EF’s choice to check its 50,000 ETH switch on Aave has drawn important consideration to the protocol. This transfer demonstrates Aave’s credibility as a go-to DeFi platform for institutional participation.

- Enhance in Liquidity: The potential addition of EF’s funds to Aave’s ecosystem is predicted to boost liquidity and lending capabilities, making it extra enticing to customers and buyers alike.

- Market Sentiment: EF’s lively involvement in DeFi has sparked optimism, as establishments collaborating in DeFi typically result in elevated adoption and development.

- Safety and Belief: The Ethereum Basis’s endorsement of Aave displays the platform’s strong safety and usefulness, additional solidifying its place within the DeFi area.

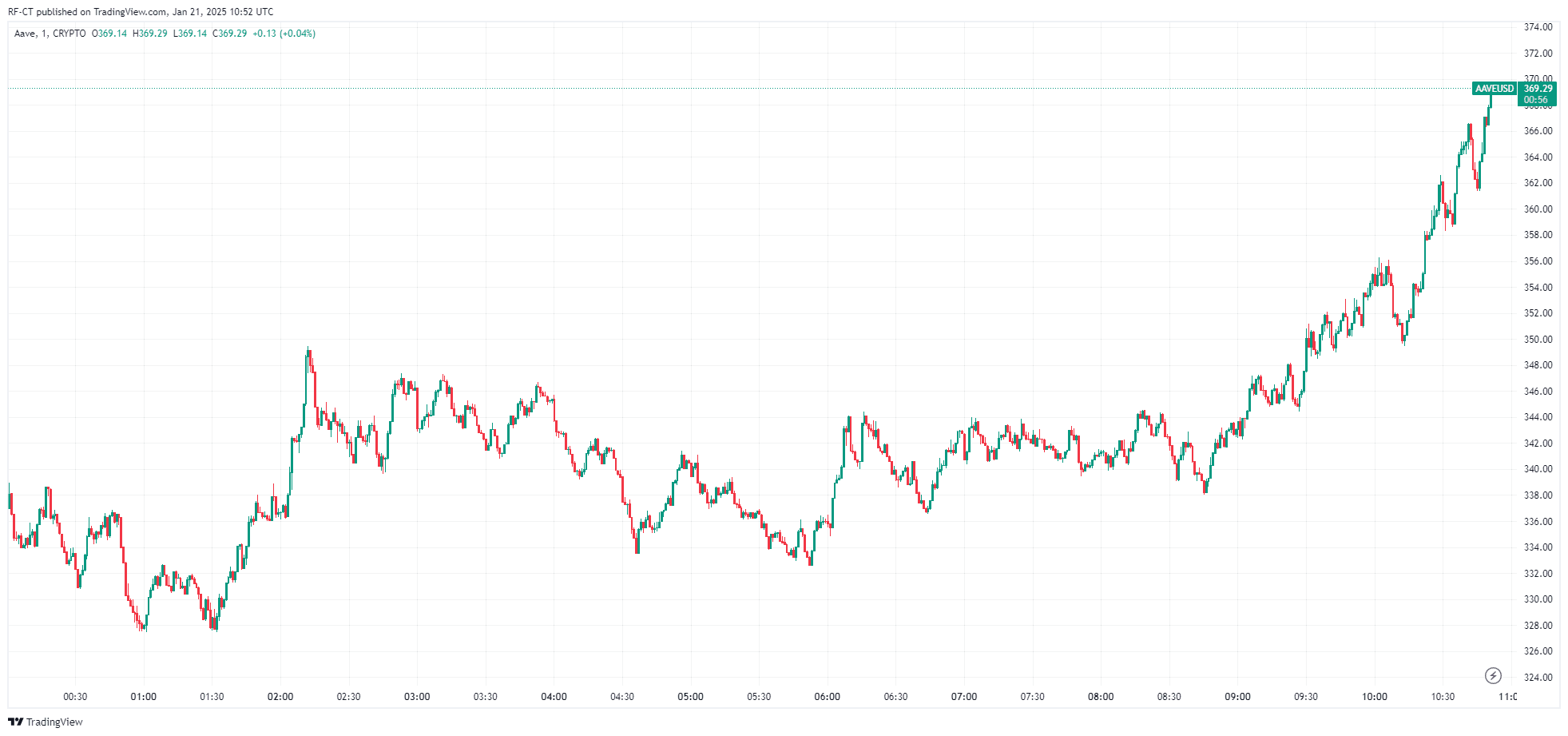

By TradingView – AAVEUSD_2025-01-21 (1D)

Ethereum Market and AAVE Efficiency

As of January 21, 2025:

- Ethereum (ETH): Buying and selling at $3,289.20, ETH has proven resilience regardless of minor fluctuations. The 50,000 ETH DeFi transfer is predicted to create long-term optimistic sentiment.

- AAVE: The token is up 3.8% up to now 24 hours, fueled by the Ethereum Basis’s involvement and elevated buying and selling volumes.

By TradingView – AAVEUSD_2025-01-21 (All)

5- Implications for the Ethereum Ecosystem

These initiatives level towards a number of key implications for Ethereum’s future:

- Enhanced Community Resilience: Staking the Basis’s ETH ensures better community participation and stability.

- DeFi Growth: The allocation of ETH to DeFi initiatives is a vote of confidence within the sector and a catalyst for additional innovation.

- Sustainable Income Streams: Each staking rewards and DeFi engagement current alternatives for long-term monetary sustainability.

- Adaptive Governance: Management modifications sign a dedication to evolving governance buildings that may hold tempo with trade calls for.

The Ethereum Basis’s latest strikes — staking plans, DeFi involvement, and management restructuring — underscore a daring, forward-looking technique. These actions not solely improve Ethereum’s technical and monetary robustness but in addition place it as a catalyst for innovation within the Web3 and DeFi landscapes.

With these developments, Ethereum is poised to keep up its management position in blockchain know-how, providing buyers, builders, and customers an ecosystem constructed for sustained development and innovation.

In the meantime, AAVE’s surge demonstrates the rising affect of institutional actions on DeFi markets. As Ethereum continues to broaden its ecosystem, initiatives like Aave are poised to learn, signaling a shiny future for each ETH and DeFi tokens.