Bitcoin’s value fluctuates between $93,607 and $94,026 over the previous hour, reflecting a market capitalization of $1.86 trillion. With a 24-hour buying and selling quantity of $63.28 billion and an intraday vary spanning $91,215 to $95,098, bitcoin finds itself at a pivotal juncture.

Bitcoin

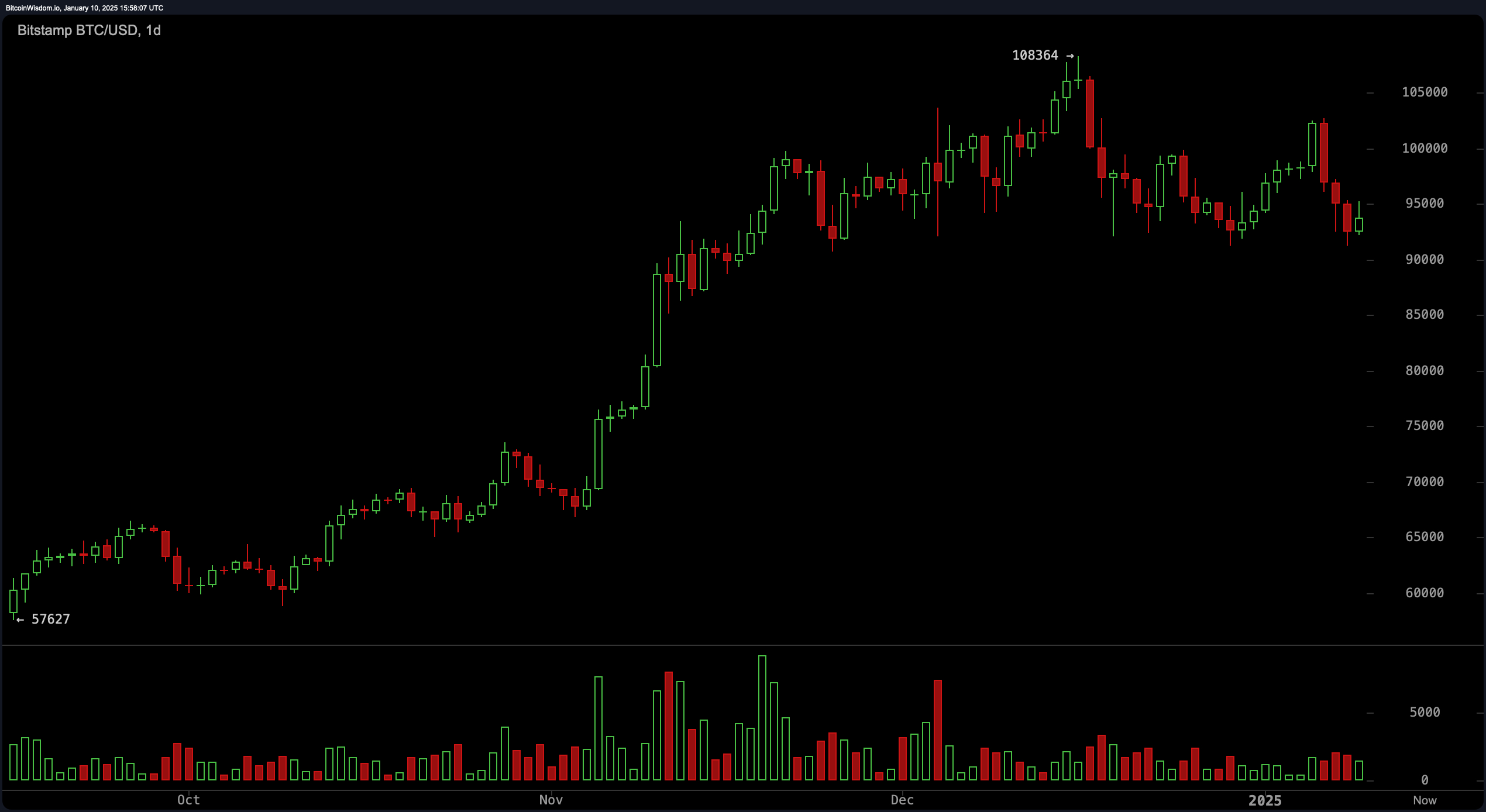

The every day chart illustrates bitcoin consolidating close to its assist band of $91,000 to $93,000 after retreating sharply from its latest excessive of $108,364. Elevated volumes noticed on the peak counsel a distribution section, whereas the following stagnation hints at waning bullish energy. Quick-term shifting averages—10-day and 20-day exponential (EMA) and easy shifting averages (SMA)—point out bearish tendencies, making use of downward strain. Nonetheless, the 100-day and 200-day shifting averages stay in alignment with a broader bullish narrative, suggesting resilience in bitcoin’s overarching trajectory.

BTC/USD 1H chart on Jan. 10, 2025.

The four-hour chart reveals indicators of a corrective rebound following the dip to $91,215. Nonetheless, muted buying and selling volumes throughout this restoration forged doubts on its sturdiness. Resistance ranges between $95,000 and $96,000 align with decrease highs fashioned after the retreat from $102,760, echoing the persistent bearish sentiment. A decisive breach above $96,000, supported by heightened quantity, may alter the outlook, inserting $102,760 as the subsequent key goal.

BTC/USD 4H chart on Jan. 10, 2025.

On an hourly scale, bitcoin’s volatility intensifies because it strives to recuperate from latest troughs. Resistance solidifies close to $95,000, whereas assist holds regular within the $91,000 to $92,000 vary. Momentum indicators just like the relative energy index (RSI) and Stochastic oscillator stay impartial, whereas the shifting common convergence divergence (MACD) suggests bearish situations. Nonetheless, a modest uptick in constructive momentum on shorter timeframes hints at potential shopping for alternatives.

BTC/USD 1D chart on Jan. 10, 2025.

Oscillators paint a blended image. Impartial alerts dominate indicators comparable to RSI, stochastic, and the commodity channel index (CCI), although momentum leans towards a shopping for bias. The superior oscillator stays balanced, reflecting market indecision. Merchants ought to stay vigilant, awaiting quantity confirmations earlier than making directional strikes.

The interaction of those technical alerts suggests a cautious method, as draw back dangers dominate until bitcoin decisively reclaims the $95,000 to $96,000 vary. Important value actions may emerge with quantity surges, both propelling bitcoin towards $102,000 or testing the important $91,000 assist degree.

Bull Verdict:

If bitcoin efficiently reclaims the $95,000 to $96,000 resistance zone with robust buying and selling quantity, it may set the stage for a rally towards $102,760 and past, reaffirming bullish dominance within the broader pattern. Merchants eyeing lengthy positions ought to look ahead to a sustained breakout supported by elevated momentum.

Bear Verdict:

Failure to interrupt above $96,000, coupled with an absence of quantity, may see bitcoin revisiting its assist ranges close to $91,000. A breach of this important assist might open the door to additional declines, solidifying the bearish outlook within the close to time period.