Bitcoin has skilled vital value actions up to now few days, largely influenced by macroeconomic developments and market fundamentals.

Following the Federal Open Market Committee (FOMC) assembly and a speech by Federal Reserve Chair Jerome Powell, Bitcoin’s value dropped sharply beneath $99,000.

Nonetheless, the main crypto shortly rebounded, climbing again to $104,000 earlier right this moment earlier than settling at $100,573 on the time of writing. This represents a 3.4% lower over the previous day and a roughly $67 billion discount in its market cap valuation.

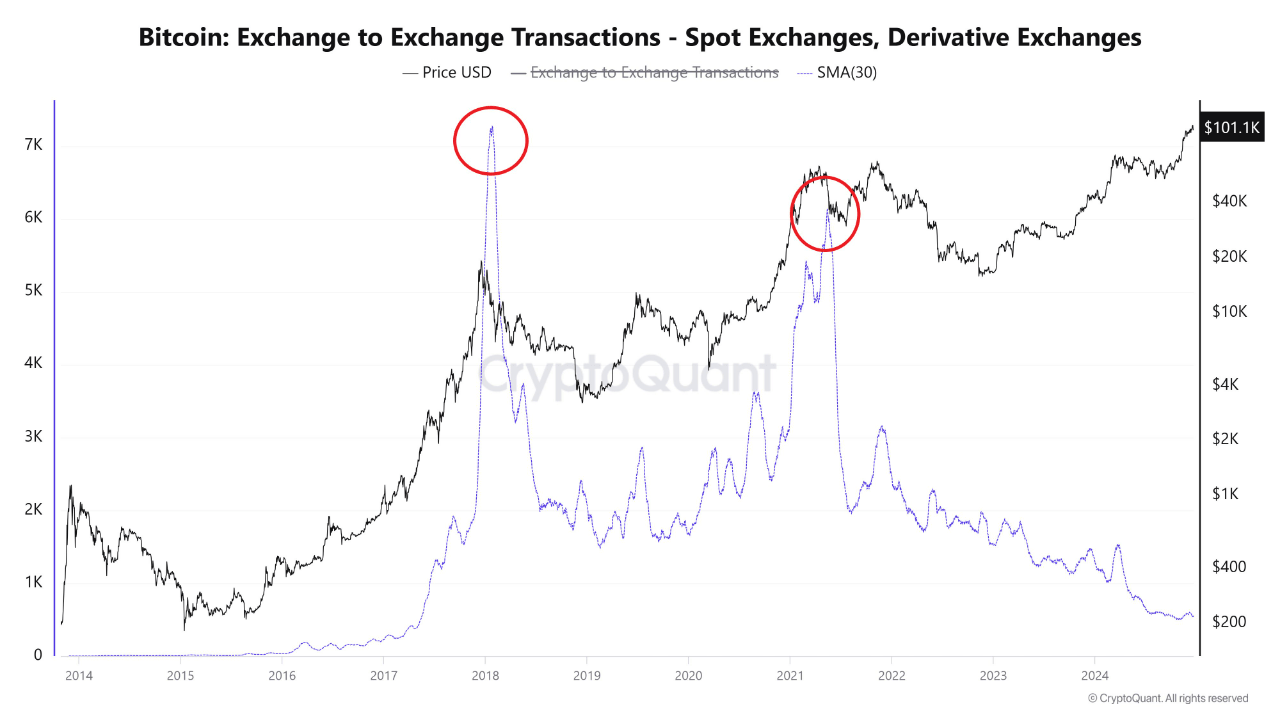

Alternate Transactions Hit File Lows

Amid this value efficiency, CryptoQuant analyst often known as Woominkyu offered insights into Bitcoin’s market exercise, highlighting declining change transaction volumes.

In line with Woominkyu, historic knowledge suggests a correlation between transaction quantity spikes and vital value actions. For instance, peaks in change transactions coincided with Bitcoin’s dramatic value surges in 2017 and 2021.

Nonetheless, current knowledge reveals a marked decline in transaction volumes on each spot and spinoff exchanges, reflecting diminished buying and selling exercise in comparison with earlier years.

This lower, in response to the CryptoQuant analyst might point out “waning market participation,” suggesting a “interval of consolidation or diminished volatility” within the close to time period.

Bitcoin Key Help Ranges and Technical Insights

Market intelligence platform IntoTheBlock has make clear an essential help zone forming just under the $100,000 mark. The info shared by the platform reveals that over 1.45 million BTC have been collected at a mean value of $97,500.

This accumulation has established a major demand zone, probably serving as a “buffer” towards additional value declines. The significance of this stage lies in its skill to offer a basis for value stability, significantly as Bitcoin navigates its present part of market correction.

It’s recommended {that a} breach beneath this zone may set off additional downward stress, whereas holding above it’d increase restoration efforts.

In the meantime, from a technical perspective, insights shared by market analyst Satoshi Wolf spotlight the vital nature of Bitcoin’s present value ranges. The cryptocurrency not too long ago examined the $100,000 help, aligning with the 100-day Exponential Shifting Common (EMA).

This stage is pivotal because it combines technical indicators with psychological significance. The Shifting Common Convergence Divergence (MACD) indicator reveals bearish momentum, whereas the Relative Power Index (RSI) nears oversold territory, signalling the potential for a value reversal.

Wolf means that merchants monitor for a confirmed breakout above $104,000 or a breakdown beneath $100,000, with quantity affirmation being key to validating both.

📊 $BTC Evaluation: The chart reveals a current pullback after a powerful uptrend, suggesting potential profit-taking. Worth is testing the 100,000 help, aligning with the 100 EMA, a vital stage to look at.

If it holds, a bounce again in direction of 104,000 resistance is feasible. MACD… pic.twitter.com/smLaqsr2Tz

— Satoshi Wolf (@SatoshiWolf) December 18, 2024

Featured picture created with DALL-E, Chart from TradingView