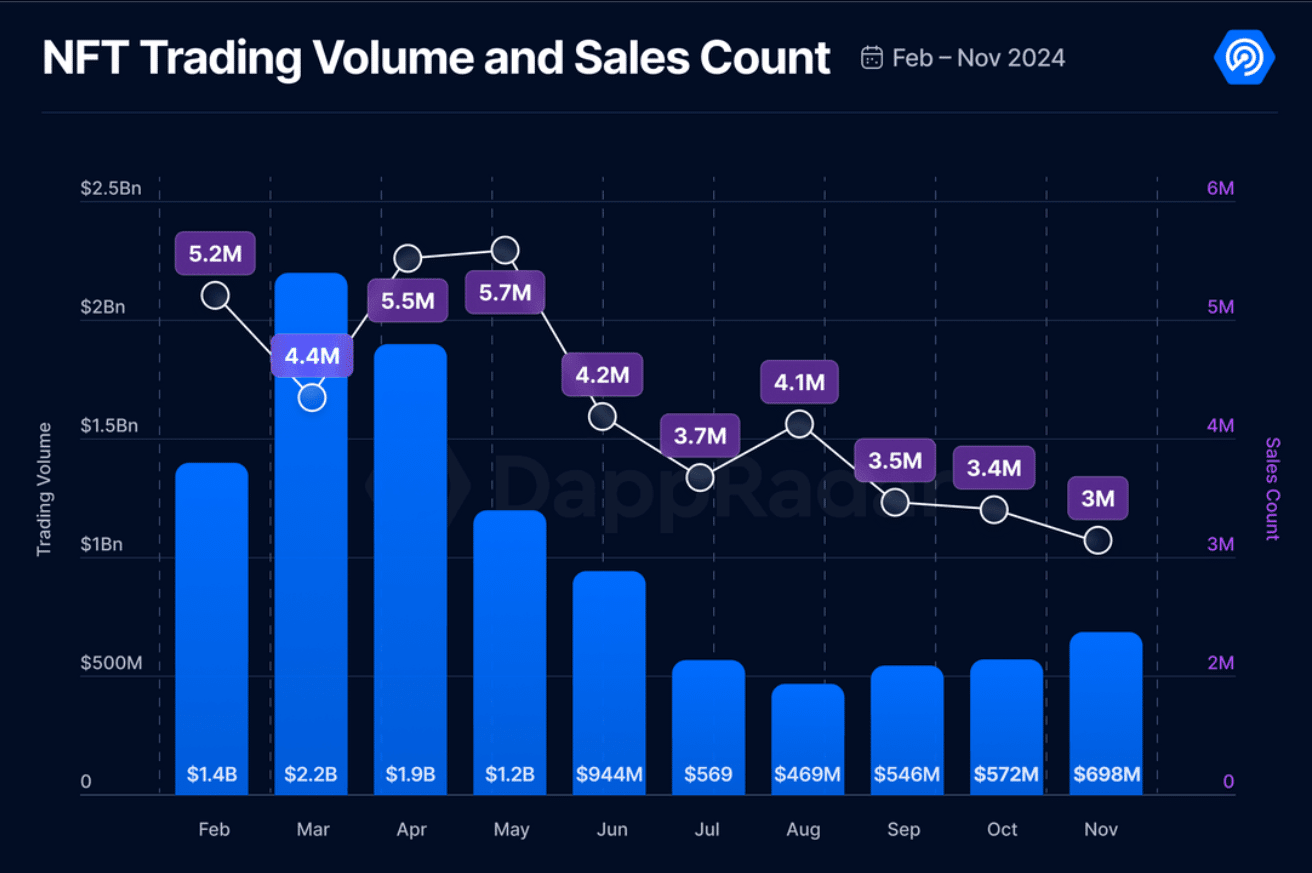

After months of slowdown, the NFT market now exhibits indicators of restoration with a 22% enhance in buying and selling quantity as of November, boosted by costs and excessive exercise in blue-chip collections.

The market of non-fungible tokens appears to be exhibiting indicators of restoration, with an over 20% surge in buying and selling quantity in November, per a report by DappRadar. In accordance with the information, NFT buying and selling quantity reached $698 million, marking a 22% enhance from October.

NFT buying and selling quantity and gross sales rely in 2024 | Supply: DappRadar

DappRadar’s analyst Sara Gherghelas attributes the expansion to “elevated engagement with blue-chip collections” like these from Yuga Labs and rising token costs, alongside elevated liquidity and confidence amongst buyers.

“Improved liquidity and elevated engagement with blue-chip collections are fostering confidence amongst collectors and buyers, who at the moment are viewing NFTs not solely as speculative property but additionally as cultural commodities.”

Sara Gherghelas

Regardless of the expansion in buying and selling quantity, gross sales quantity declined by 11% to three million models, which is perhaps signaling a shift towards extra beneficial transactions.

You may additionally like: Nike’s NFT arm RTFKT to close down after launching closing assortment

The restoration additionally comes amid broader market traits. As reported by NFTevening, November additionally noticed an increase within the general NFT market worth, which grew to $8.8 billion. On the similar time, every day buying and selling quantity throughout all chains rose by virtually 50%.

The info exhibits that blue-chip NFT collections like CryptoPunks and Bored Ape Yacht Membership have been essential to the market’s rebound. Whereas CryptoPunks noticed a 392% enhance in buying and selling quantity, BAYC noticed robust demand, with its flooring worth rising 75.79% week-on-week to $79,727.

Ethereum (ETH) stays the chief in buying and selling quantity, whereas Polygon (POL) holds the “high place for the variety of NFT gross sales,” Gherghelas says, including that the rise of marketplaces like Blur, which surpassed OpenSea in buying and selling quantity, highlights the quickly evolving NFT panorama.

Learn extra: Way of life app STEPN GO expands Adidas partnership with bodily NFT sneakers