Bitcoin’s astronomical value rise reveals the coin is now coasting alongside at $97,227 per coin on Sunday, Dec. 1, 2024, at 11:57 a.m. With a $100,000 milestone in sight, it’s been sparking questions on its enchantment—or lack thereof—amongst retail traders.

The Gold Commonplace Lure: Bitcoin’s Wrestle With Retail Attraction

Bitcoin (BTC) has reached unprecedented heights, at present priced at $97,227 per coin, edging nearer to a psychological $100,000 barrier. But, this bull market in 2024 contrasts sharply with earlier rallies in 2017 and 2021, which had been characterised by plenty of retail enthusiasm. The present surge is pushed predominantly by institutional traders, with retail curiosity notably subdued. Google Tendencies knowledge highlights fluctuating curiosity over the previous month, peaking at 65 out of 100 on a five-year scale, however plummeting since mid-November.

This stagnation in retail participation raises an vital query: Is BTC’s rising notion as an costly, affluent-only asset dampening its broader enchantment?

For a number of years now, bitcoin has been hailed as “digital gold,” a story that underscores its shortage, sturdiness, and utility as a hedge in opposition to inflation. Nonetheless, this positioning dangers pushing BTC into the identical psychological class as gold: perceived as a high-value asset accessible solely to the rich. Gold has typically been criticized for its exclusivity, resulting in silver’s status because the “poor man’s gold.”

Bitcoin’s rise in value exacerbates this notion. Retail traders, who had been the lifeblood of earlier adoption waves, now might even see a single bitcoin as unattainable. Not like altcoins, which stay accessible on account of cheaper price factors, bitcoin’s excessive value might inadvertently alienate the very demographic it must foster broader adoption. Some altcoins could also be perceived because the “poor man’s bitcoin.”

Fractional Bitcoin: Breaking the Costly Coin False impression

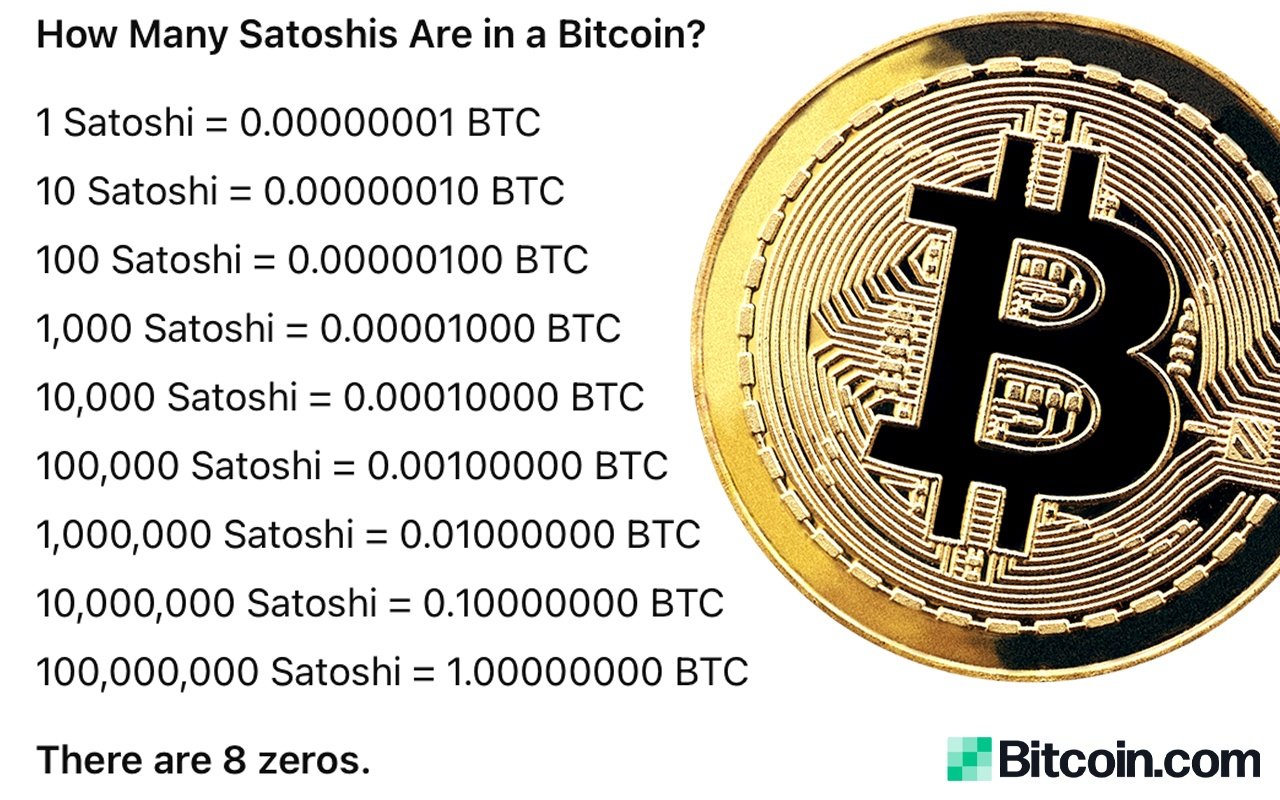

One among bitcoin’s biggest strengths is its divisibility. Every bitcoin may be break up into 100 million satoshis, enabling fractional purchases. For instance, a $100 funding in the present day would nonetheless yield roughly 0.00103 BTC at present costs—an idea akin to purchasing gold in grams reasonably than ounces. Sadly, this elementary facet of bitcoin typically goes unrecognized by the common retail investor, a lot of whom assume the excessive unit value excludes partial possession.

This misunderstanding underscores a broader academic hole throughout the cryptocurrency house. Platforms and advocates should higher talk bitcoin’s accessibility by way of fractional shopping for, highlighting that anybody can make investments no matter bitcoin’s total value.

Institutional dominance within the 2024 rally has shifted bitcoin’s narrative. Huge buy-ins from companies, hedge funds, and sovereign wealth entities spotlight its rising acceptance as a retailer of worth. Nonetheless, this institutionalization might additionally solidify the notion of bitcoin as an asset for the rich. With vital obstacles to entry—each monetary and technical—bitcoin very nicely might threat dropping the grassroots enchantment that drove its early success.

Bitcoin’s retail enchantment would possibly reignite as soon as the $100,000 milestone is breached. Psychologically, this quantity might draw retail traders who equate spherical figures with security and development potential. The identical phenomenon occurred when bitcoin crossed $10,000 in 2017 and $50,000 in 2021.

The difficult half is preserving retail traders from feeling like they’re being left behind. Bitcoin isn’t simply up in opposition to the clock; it’s additionally dealing with stress from altcoins and decentralized finance (defi) platforms that lure traders with guarantees of larger returns for smaller buy-ins. To remain within the recreation, bitcoin must shine a highlight on its fractional accessibility, maintain its floor in defi, and preserve highlighting its potential as a long-term wealth builder.