Ethereum (ETH) worth has climbed 46.11%, marking spectacular development however nonetheless making it the second-worst performer among the many prime 10 largest cryptocurrencies. Its current rally is supported by rising whale accumulation and a 7-day MVRV signaling impartial to barely bullish sentiment.

Nonetheless, key resistance at $3,600 may decide whether or not ETH continues its upward trajectory towards $4,000 for the primary time since December 2021. On the draw back, a reversal may result in a major correction, with sturdy assist at $3,000 and a possible drop to $2,359 if bearish strain intensifies.

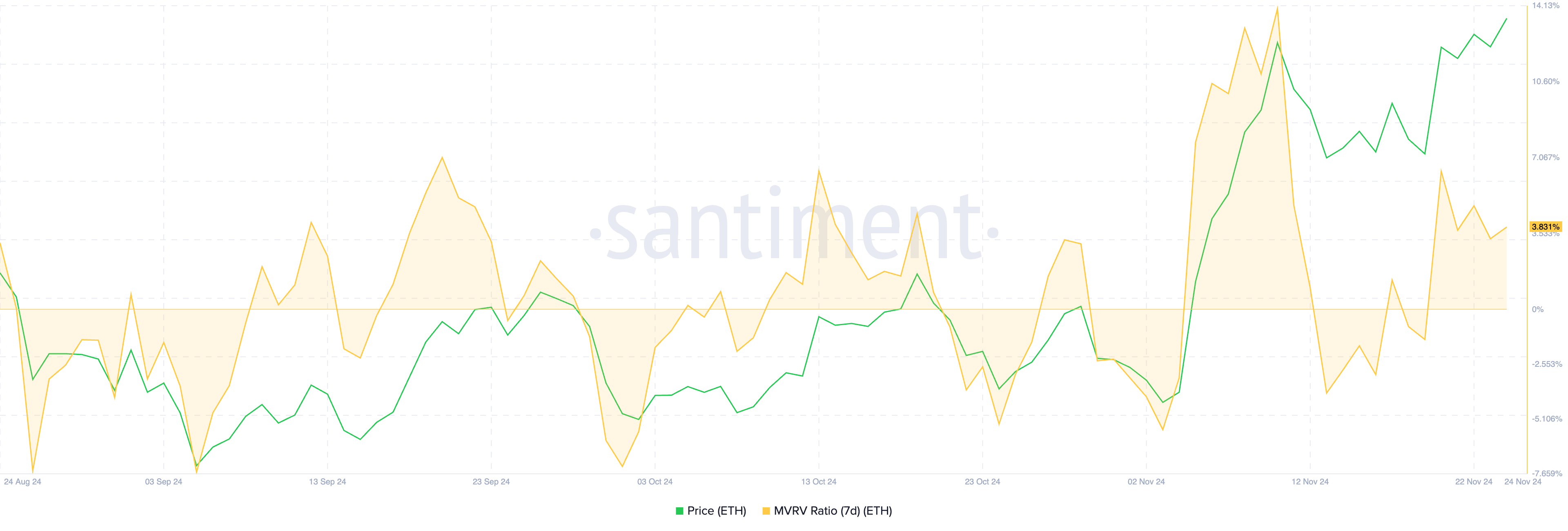

ETH 7D MVRV Reveals An Necessary Threshold To Be Surpassed

Ethereum MVRV 7D is at present at 3.8%, signaling a impartial to barely bullish place by way of short-term profit-taking conduct. The MVRV 7D metric compares the market worth to the realized worth for cash moved prior to now seven days, offering insights into the profitability of current merchants.

When MVRV 7D is low, it signifies that merchants are holding at a loss or minimal revenue, decreasing promoting strain, whereas increased values counsel rising profit-taking dangers.

ETH 7D MVRV. Supply: Santiment

Traditionally, ETH worth has struggled to take care of upward momentum when its MVRV 7D enters the 5–7% vary, usually triggering corrections. Nonetheless, its current rise to 13% earlier than a ten% correction exhibits that breaking this zone may gas sustained bullish momentum.

If MVRV 7D exceeds the 7% threshold once more, ETH worth could expertise important positive aspects, doubtlessly surpassing 10%, as bullish sentiment builds and merchants resist taking earnings in anticipation of additional upside.

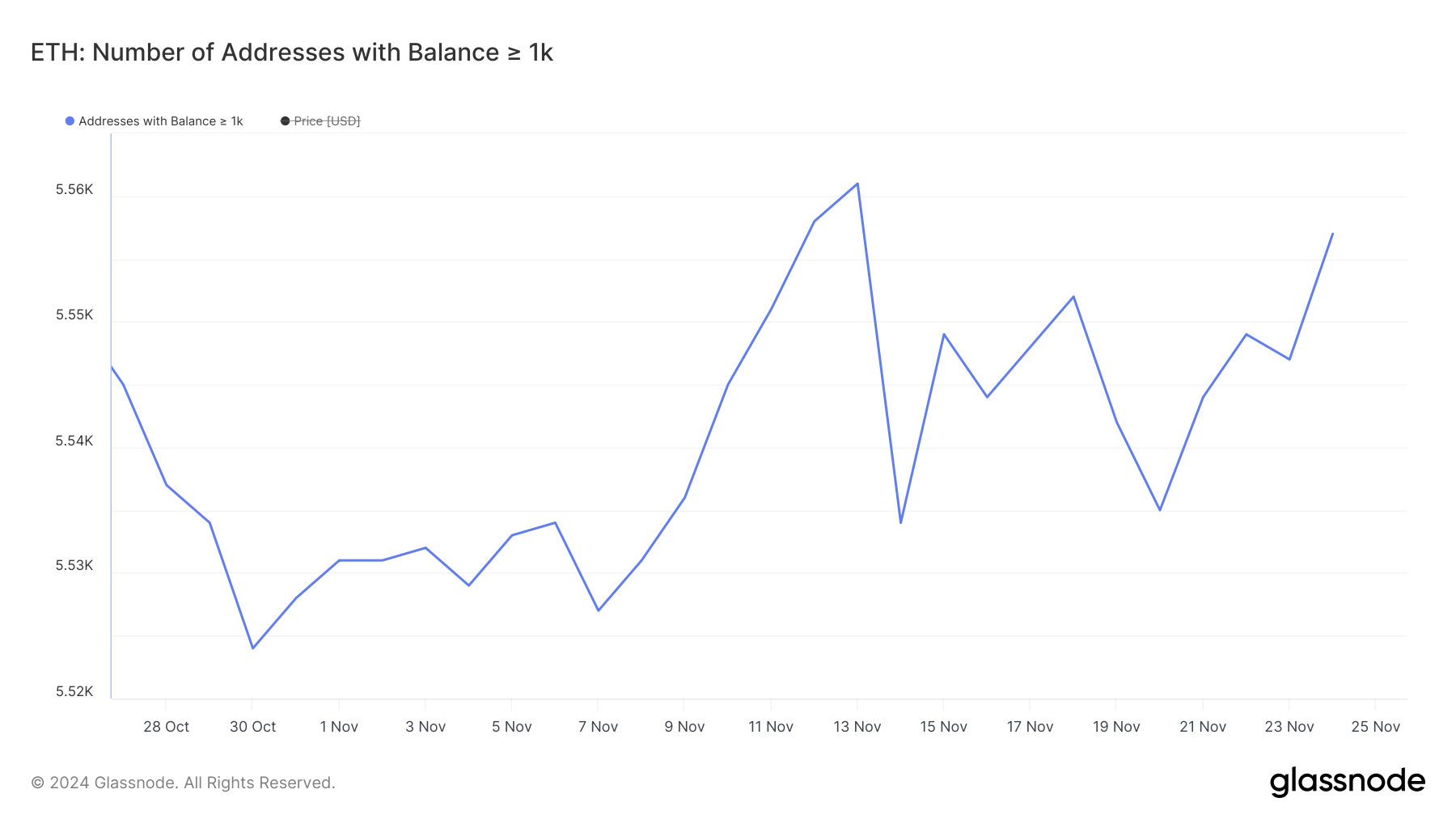

Ethereum Whales Are Again

The variety of Ethereum whales holding not less than 1,000 ETH is nearing its month-to-month excessive of 5,561, at present sitting at 5,557. Monitoring whale exercise is crucial as a result of these massive holders considerably affect market tendencies by way of their shopping for and promoting conduct.

Will increase in whale numbers usually sign rising confidence within the asset, supporting worth stability or upward momentum, whereas declines can point out lowered curiosity and potential promoting strain.

Addresses with Stability >= 1,000 ETH. Supply: Glassnode

After rising from 5,527 to five,561 over six days, the variety of whales dropped to five,535 on November 20, suggesting a quick interval of profit-taking or lowered accumulation. Nonetheless, the current restoration to five,557 inside every week displays renewed curiosity and accumulation amongst massive holders.

This rebound suggests rising optimism available in the market, which may assist Ethereum worth stability and pave the way in which for additional upward motion if the development continues.

ETH Worth Prediction: Can It Get Again To $4,000?

If Ethereum maintains its present uptrend, it may quickly take a look at resistance at $3,600, a crucial stage for sustaining bullish momentum.

Breaking above this resistance would place Ethereum worth simply 11% away from reclaiming the $4,000 mark, a worth it hasn’t reached since December 2021. Such a transfer would probably gas additional optimism and entice extra shopping for curiosity, reinforcing the upward development.

ETH Worth Evaluation. Supply: TradingView

Nonetheless, if the uptrend slows and reverses, ETH worth can have sturdy assist at $3,000, a key stage to forestall important declines.

If this assist fails, the value may drop as little as $2,359, marking a possible 31% correction from present ranges.