Ethereum (ETH) value has lagged behind different main belongings this 12 months, with a 30% year-to-date enhance in comparison with Bitcoin’s 102% and Solana’s 118% positive factors. Nevertheless, latest metrics recommend that ETH could also be gearing up for a stronger efficiency.

Whale accumulation is selecting up once more, and key indicators just like the 7-day MVRV ratio and EMA alignments are signaling a possible bullish section.

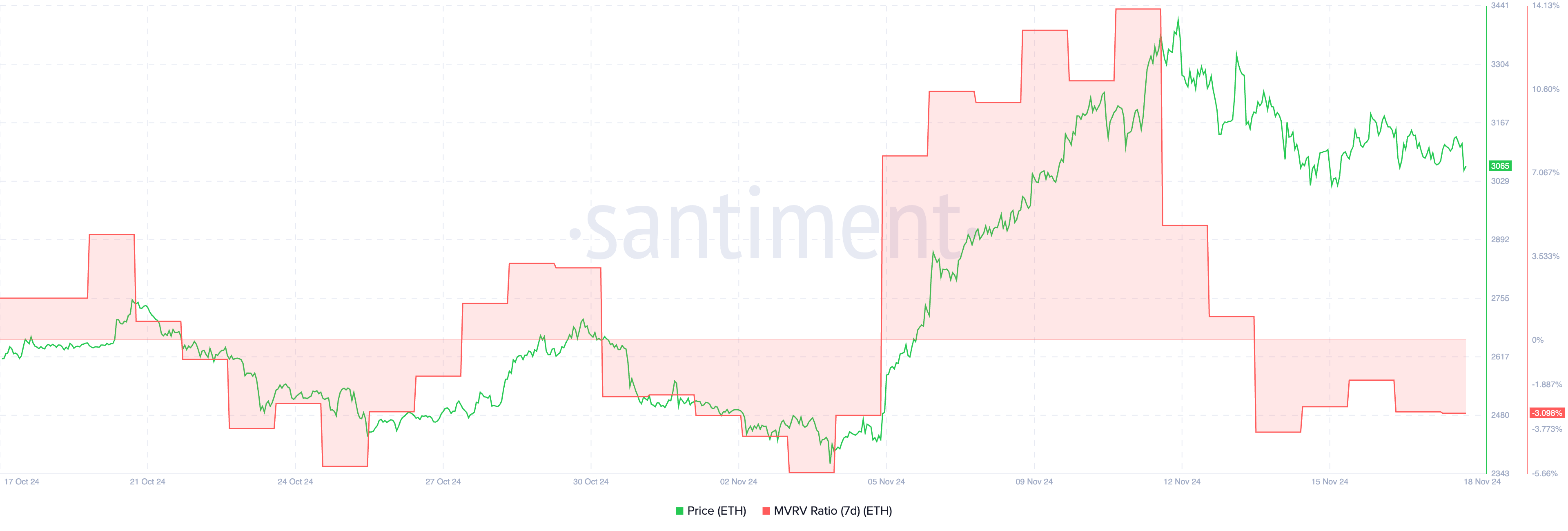

ETH 7D MVRV Is at An Necessary Threshold

Ethereum’s 7-day MVRV ratio at present sits at -3%, suggesting that short-term holders are at a slight unrealized loss on common. This metric usually signifies whether or not an asset is undervalued or overvalued relative to latest market exercise.

A adverse MVRV ratio like this could sign a possible accumulation zone, because it displays that holders could also be much less inclined to promote, creating room for upward value motion if demand will increase.

ETH 7D MVRV. Supply: Santiment

The MVRV 7-day ratio measures the common revenue or lack of addresses which have acquired Ethereum over the previous seven days.

Curiously, on November 5, MVRV 7D ratio hovered round related ranges earlier than a pointy value rally took ETH from $2,400 to $3,400 in only a week, highlighting how this might occur once more quickly.

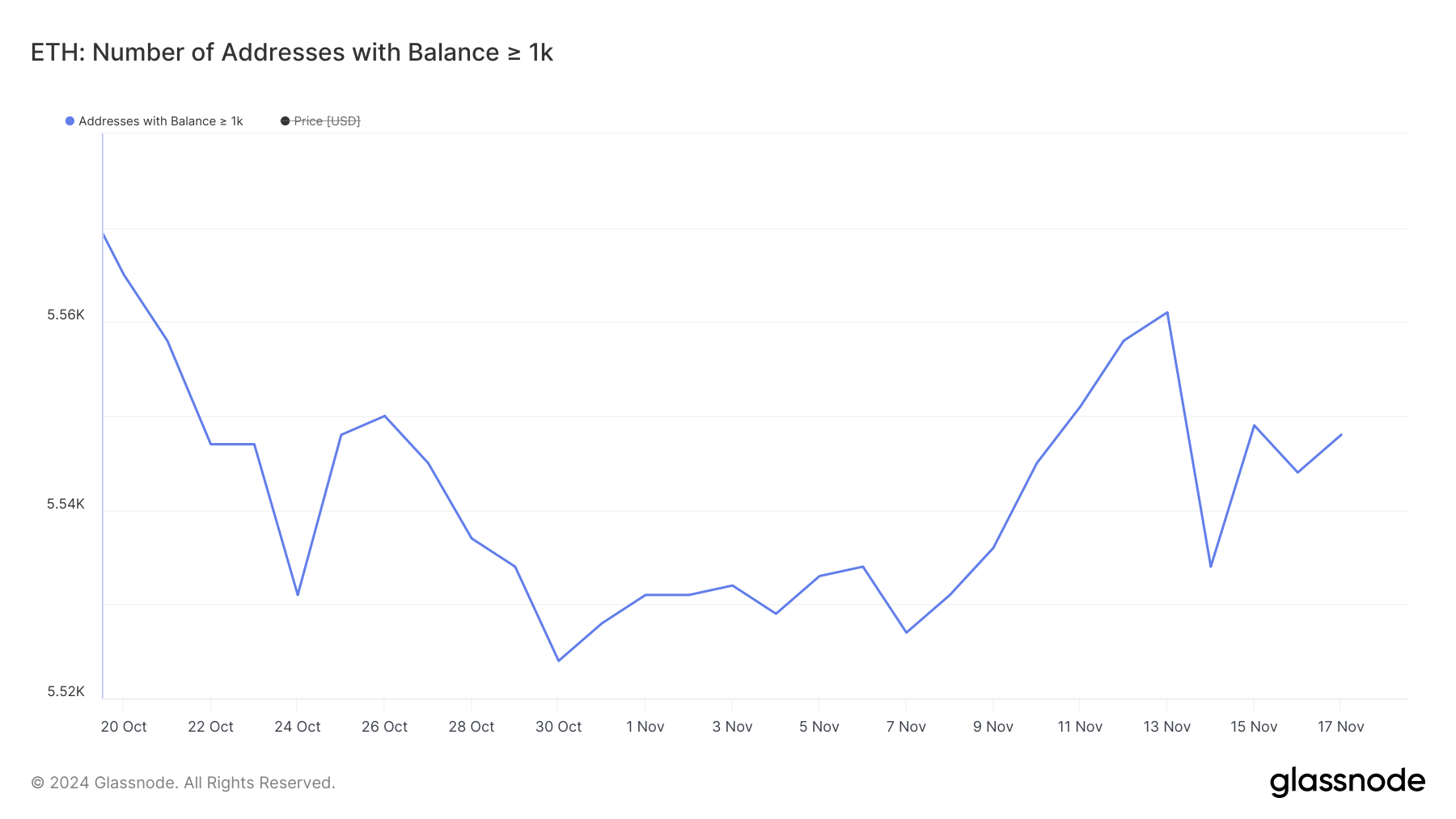

Ethereum Whales Are Accumulating Once more

From November 7 to November 13, the variety of whales holding at the very least 1,000 ETH elevated considerably from 5,527 to five,561. This marked one of many largest progress spurts on this metric for 2024, signaling sturdy accumulation by massive holders.

Such exercise usually displays elevated confidence in ETH’s, as whale accumulation tends to precede durations of upward value motion resulting from decreased promoting strain and concentrated possession.

Addresses with Stability >= 1,000 ETH. Supply: Glassnode

Following this surge, the metric noticed a pointy drop to five,534 in simply at some point, reflecting profit-taking. Nevertheless, it has began climbing once more, reaching 5,548 in latest days.

This renewed progress means that whales are as soon as once more positioning themselves, which may bolster ETH value stability and even gasoline a possible rally.

ETH Worth Prediction: Potential 15% Upside

With the MVRV 7D ratio at -3% and whales resuming accumulation, ETH value seems to be positioning itself for a bullish section. This outlook is additional supported by its EMA alignment, the place the worth is above all strains, and the short-term strains are crossing above the long-term ones, forming a golden cross.

This technical setup usually alerts the beginning of a robust uptrend, reflecting rising momentum available in the market.

ETH Worth Evaluation. Supply: TradingView

If the bullish momentum holds, ETH may problem its resistance at $3,560, which represents a possible 15% upside from present ranges.

Nevertheless, if the uptrend weakens, ETH could take a look at assist round $2,822, and failure to carry that zone may result in a deeper correction towards $2,360. These ranges can be essential in figuring out whether or not ETH can maintain its restoration or face additional consolidation.