This can be a phase from the Empire publication. To learn full editions, subscribe.

Trump’s win might have you ever cooking up all types of worthwhile buying and selling methods.

It’s solely pure, contemplating it seems like we’re on the cusp of a brand new paradigm: for arguably the primary time ever, US regulators may take it straightforward on crypto and let innovation flourish.

And so the subject of danger urge for food got here up on immediately’s Empire podcast episode.

Yano requested Eric Peters, CEO and CIO of each Coinbase Asset Administration and One River, what he’d prescribe for a 30-40-year-old first-time crypto investor who has 1,000,000 {dollars} to allocate and a robust urge for food for danger.

“I’d advocate for them to be overweighted to bitcoin and ether however have some publicity to solana. Possibly 50/35/15 [percent], one thing like that,” Peters stated. “[But] I believe for those who’re proper on that commerce, you’re gonna, at the least for a time frame, want you’d had 1,000,000 bucks in solana.”

The query was actually posed inside the speedy context. Nonetheless, we are able to backtest Peters’ suggestion.

And even higher, plot it alongside Coinbase’s new benchmark crypto index COIN50, which is presently weighted 51.5% BTC, 23.4% ETH, 7% SOL with the remaining 18% or so unfold throughout 47 different altcoins together with DOGE, XRP, BCH and BONK.

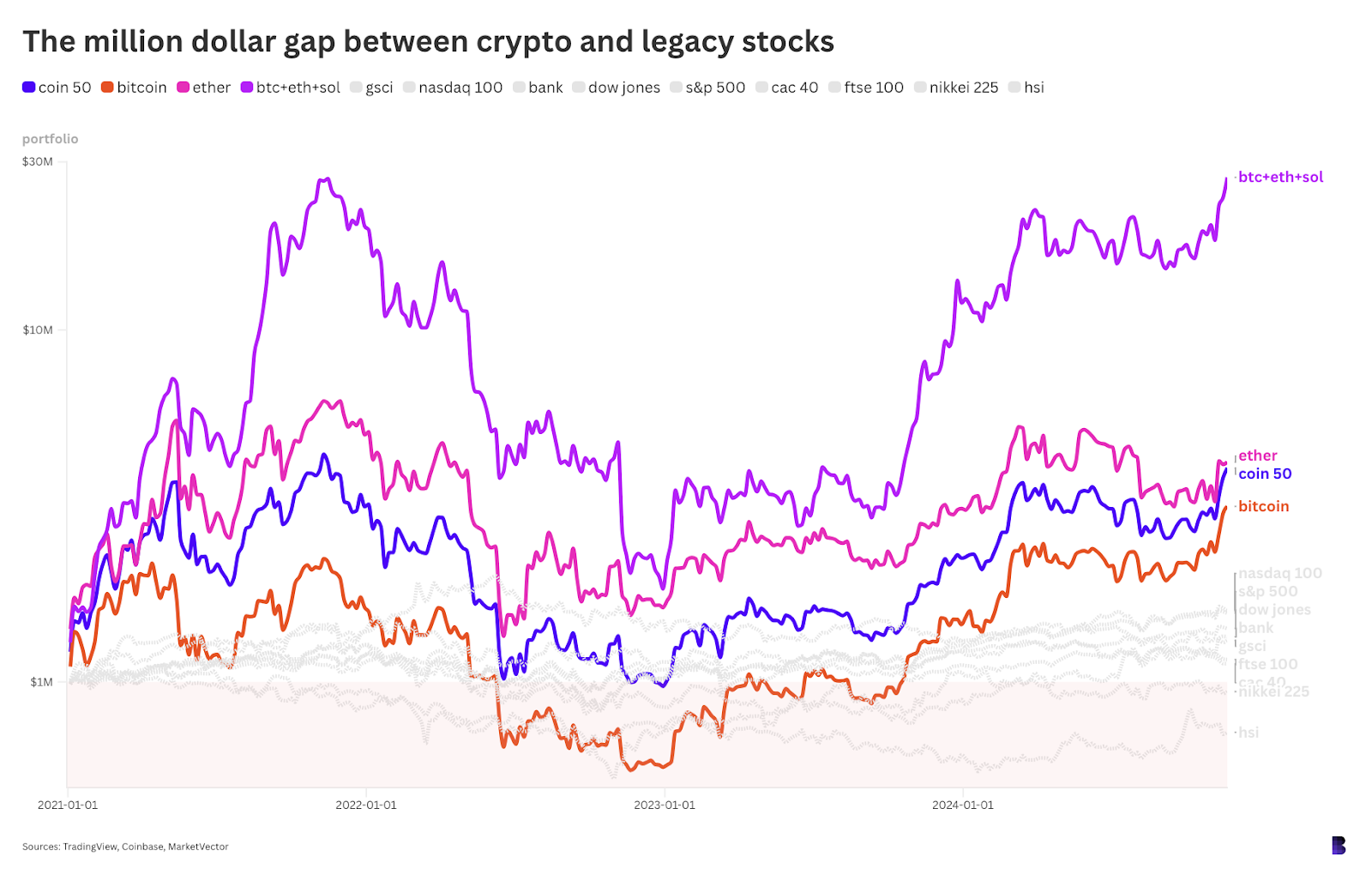

The above, in log view, plots the worth of that $1 million allocation from the top of 2020, which is when COIN50’s efficiency knowledge begins.

There’s certainly a component of time bias. The interval begins within the leadup to the epic 2021 bull run when SOL’s market cap was beneath $100 million (now $117 billion).

So, again then, it might be questionable simply how doubtless it might be to separate a million-dollar allocation between BTC, ETH, and a token so small in relative phrases.

In any case, the purple reveals the break up highlighted by Peters, which turned $1 million into $27 million and would now be at all-time highs for greenback worth.

ETH maxis had been second greatest with $4.2 million. And whereas there are presently no ETPs monitoring COIN50, if there have been, that car would’ve transformed to a $3.8 million portfolio.

Somebody who aped 1,000,000 {dollars} in BTC in the meantime could be holding $3.15 million proper now.

For scale: Anybody who purchased an index fund monitoring any main benchmark from legacy finance would, at greatest, be sitting on $1.64 million, through the Nasdaq 100.

That’s a minimal $1.5 million distinction between shares and crypto. It’s onerous to place an actual worth on danger urge for food, however that’s as strong a quantity as any.